Cardano founder addresses concerns about contingent staking

Charles Hoskinson is certainly not new to controversy and criticism when it comes to matters related to the Cardano blockchain. The latest instance of criticism involves contingent staking, an idea that Charles recently talked about.

Is your portfolio green? Check out the Cardano Profit Calculator

Charles addressed the issue in a recent post through which he expressed disbelief in criticism stemming from the lack of understanding.

The Cardano CEO reintroduced the idea of contingent staking two days ago. One of the reasons for the criticism is that the idea touched on improving contractual agreements within the blockchain. More importantly, it addresses operations within a regulatory environment.

I'm still at a loss reading some of the comments on contingent staking. It's incredible how polarized some people have become to the extent that they can not understand a basic concept and continue to misrepresent it. (1/10)

— Charles Hoskinson (@IOHK_Charles) February 16, 2023

Among the concerns brought forth by KYC is that Cardano will push for KYC especially when staking. Hoskinson addressed this by stating that Cardano will not implement a KYC regime. He also noted that it will not be a replacement for normal staking.

So what is contingent staking?

Hoskinson explained that contingent staking is a safety mechanism that can offset some of the risks associated with ISPOs in a contractual setting.

It is still in the conceptual stage. However, one can wonder what it would be like if such a mechanism was implemented. Having extra checks or security measures would likely introduce a higher level of trust for the Cardano network as well as its participants.

In an ideal setting characterized by heavy demand, additional demand for ADA from contingent stakers may contribute to prevailing market demand.

Speaking of ADA, it has delivered a bullish performance so far this week. It managed to achieve a new 2023 high at $0.42 during Wednesday’s (15 February) rally.

ADA’s price did tank slightly in the last 24 hours, confirming that there was some profit-taking after this week’s rally.

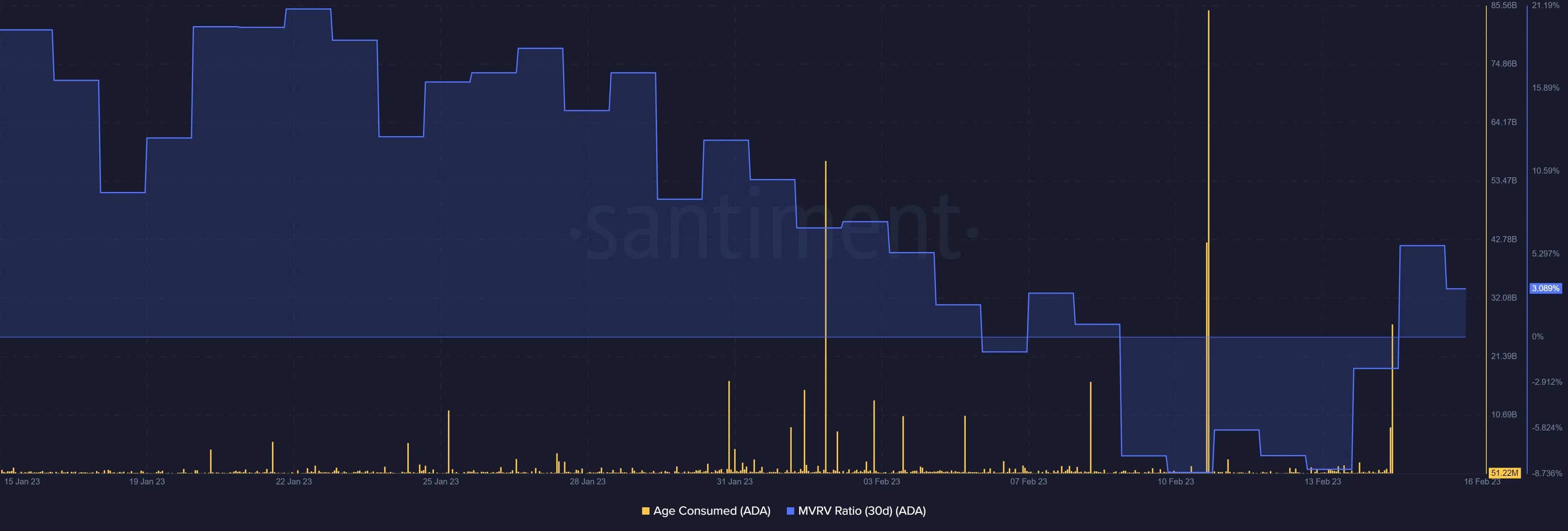

But should ADA investors expect a deeper bearish retracement? So far the prevailing sell pressure has manifested as a slight dip in the MVRV ratio, confirming that investors who bought at recent highs are not in profit.

Realistic or not, here’s Cardano’s market cap in BTC’s terms

The last time that the age-consumed metric registered a large spike was on 14 February. This is around the same time that the price embarked on the rally, hence confirming bullish volumes.

However, no spike has been observed so far, meaning whales are still holding on to their coins.

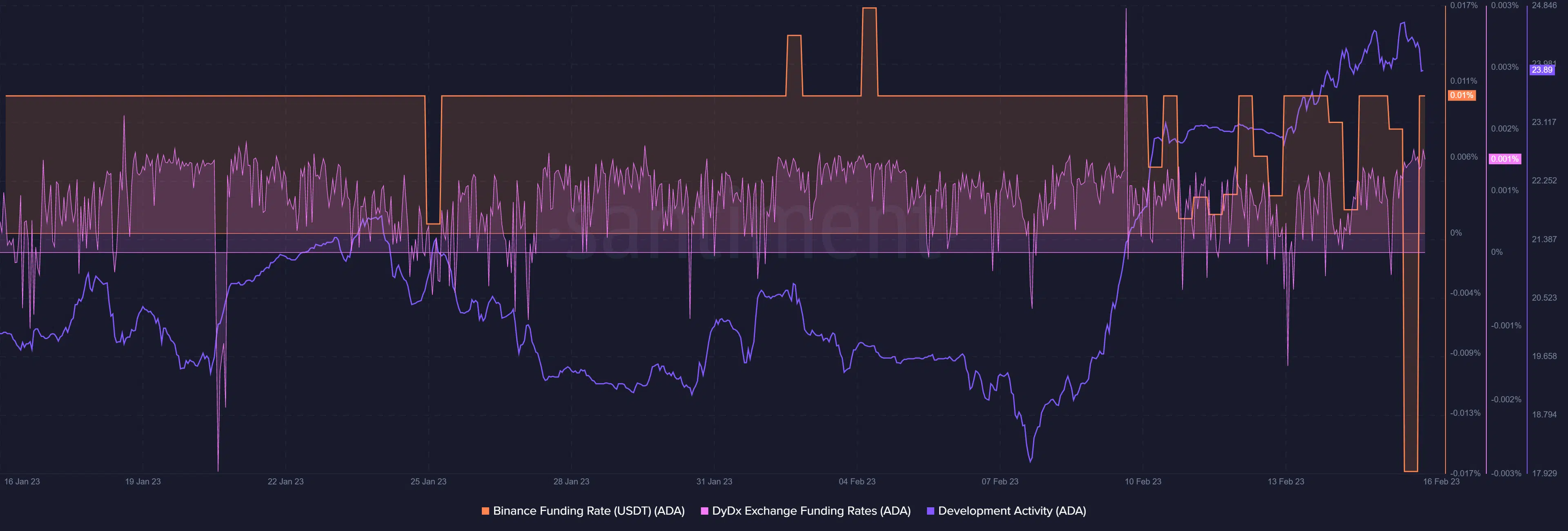

We did see a strong dip in the Binance funding rate, before a comeback. This may reflect the bearish outcome while the recovery suggests that there is still some demand at its current level.

Meanwhile, the DYDX funding rate continues to rally, while development activity remains within healthy levels.