The ‘but’ to ADA after Cardano outshines all

![Cardano [ADA] is outshining the rest in this regard; here is why](https://ambcrypto.com/wp-content/uploads/2023/06/ADA-1.png.webp)

- Cardano’s weekly development report highlighted the efforts made by developers to improve the blockchain

- ADA’s price declined in the last 24 hours, and open interest increased

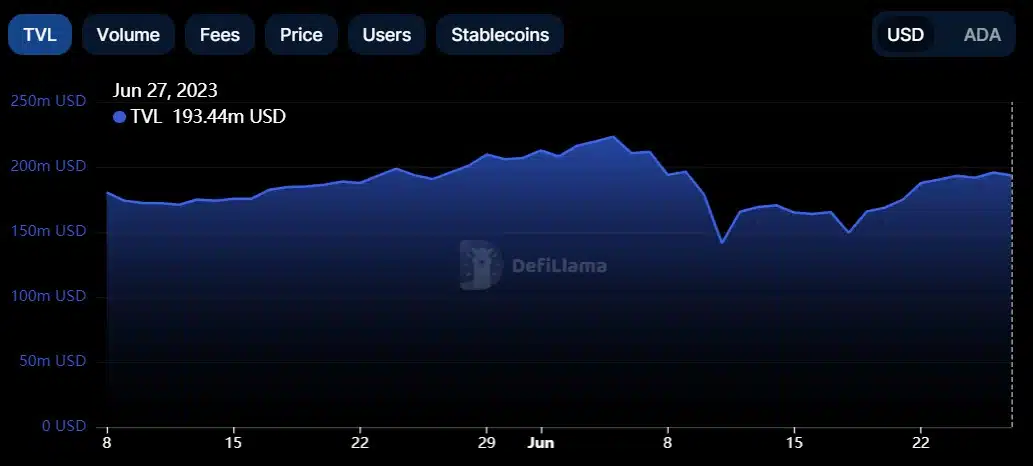

Cardano [ADA] witnessed a promising uptick in its network value while the rest of the market moved the other way. While most blockchains such as Ethereum [ETH], Solana [SOL], and Polygon [MATIC] suffered losses, ADA’s TVL went up.

This could be taken as an encouraging development for the token. A possible reason behind this surge could be the efforts of the developers to improve the blockchain’s capabilities. Amidst this, ADA’s price fell victim to a correction, causing a decline in the token’s value in the last 24 hours.

Realistic or not, here’s ADA market cap in BTC‘s terms

Overachiever ADA!!

Cardano Feed’s latest tweet revealed that ADA was outperforming the rest of the cryptocurrencies in terms of TVL. As per the tweet, while the rest registered a decline in their network value, Cardano TVL gained upward momentum.

DeFiLlama’s data revealed that after a slight decline on 11 June, the blockchain’s TVL once again started to move northward, which looked promising.

Decoding Cardano’s TVL surge…

A possible reason for the uptick could be the blockchain’s development activity, which has been relatively high. In fact, Cardano recently posted its weekly development report, highlighting the efforts made by developers last week to improve the blockchain.

For instance, scalability is something that Cardano is working towards. This week, the Hydra team focused on investigating and experimenting with how to operate a head on the mainnet. They addressed several bugs and issues. In order for SPOs to operate Mithril on their Cardano mainnet infrastructure, the Mithril team worked on the signer deployment mechanism.

Apart from that, this week in Voltaire, conversations continued on CIP-1694 to establish an initial Minimum Viable Governance (MVG) framework. The report also mentioned updated statistics for the network.

Cardano’s total number of transactions exceeded 69 million. The number of native tokens reached 8.44 million, while the number of projects launched on Cardano touched 130.

ADA is witnessing a price correction

Though the blockchain’s TVL went up, its price chose to follow the other way, as it declined by more than 1% in the last 24 hours. At the time of writing, it was trading at $0.2828 with a market capitalization of over $9.8 billion.

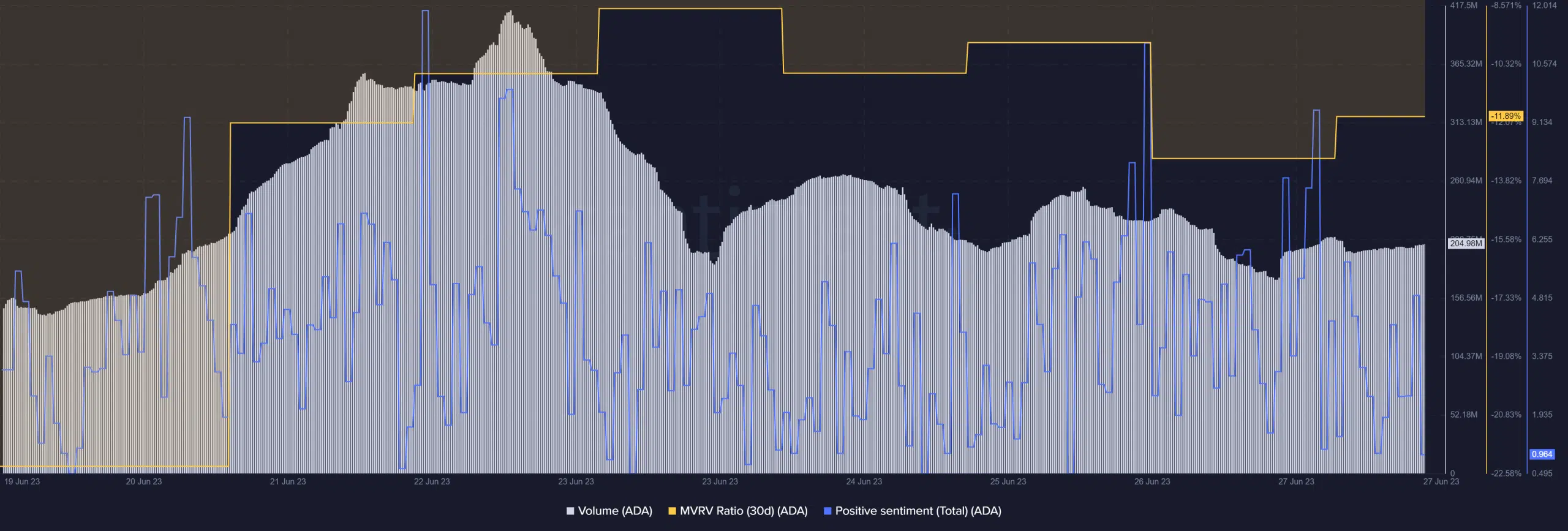

As per Coinglass, ADA’s open interest registered an increase of late. An increase in the metric generally means that the current price trend can continue longer.

Read Cardano’s [ADA] Price Prediction 2023-24

Fruthermore, ADA’s price decline was accompanied by a slight decline in volume, which looked optimistic for the token’s value. Additionally, positive sentiment around Cardano also spiked, reflecting investors’ confidence in the token.

Despite the recent price drop, the token’s MVRV was relatively high, which could be taken as a bullish signal.