Cardano slides near August lows – When will the plunge ease?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

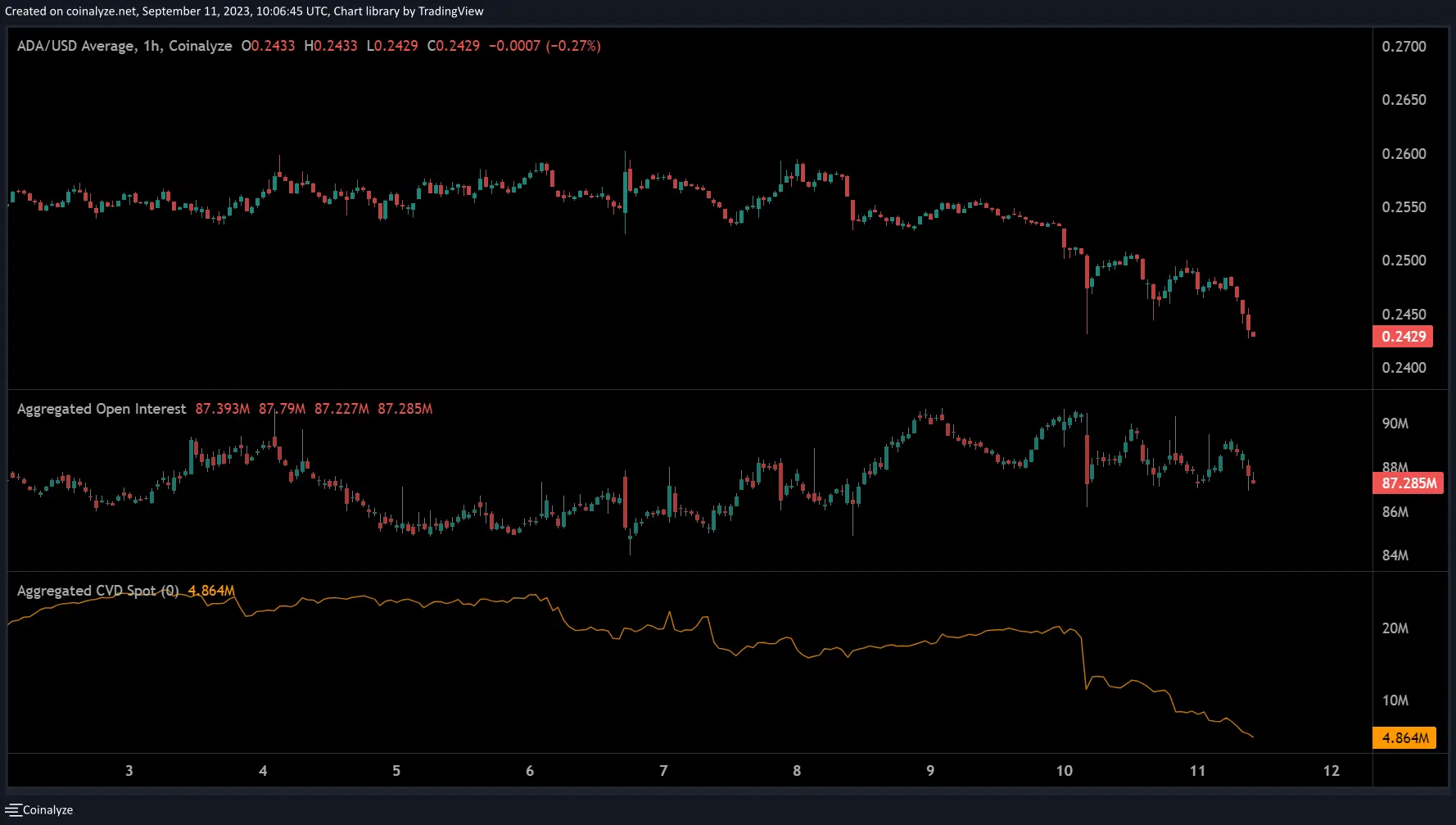

- ADA failed to flip $0.26 to support, giving sellers an opening.

- Longs discouraged as sellers extended market control.

Cardano [ADA] eventually slumped after consolidating below $0.26 since mid-August. Sellers who shorted the altcoin at $0.26 last week (8 September) were on track to cash in 8% gains if the drop hits December lows.

Is your portfolio green? Check out the ADA Profit Calculator

In the meantime, Bitcoin [BTC] was being shelled at the range-low of $25.8k at press time. But only a daily candlestick close below the range-low could confirm further weakening.

Which way for ADA?

The daily chart’s market structure was bearish at press time and could only flip bullish if price action crossed above the recent high of $0.26. That meant sellers still had the upper hand. So, ADA could retest the December low of $0.2392 or edge lower to June lows of $0.2200.

An extended drop to the latter would offer about 16% gains to sellers who shorted the asset at $0.26.

On the other hand, buyers must clear the $0.26 roadblock to show willingness to recover more lost ground. If successful, $0.28 and $0.29 could be the next targets for bulls, especially if BTC fronts a wild upswing.

Meanwhile, the RSI and CMF moved in opposite directions. The RSI retreated to the oversold territory while the CMF eased but was above the zero mark. It underscores ADA’s elevated sell pressure but improved capital inflows since August.

Sellers extended market control

Over $350k worth of long positions were liquidated within 24 hours before press time compared to less than $20k shorts. It shows longs were highly discouraged, a bearish bias.

How much are 1,10,100 ADAs worth today?

Besides, the CVD (Cumulative Volume Delta) dropped lower from 10 September, indicating sellers extended market control over the same period.

However, bulls could see a reprieve at $0.2392 or $0.2200 if BTC doesn’t lose the range-low. So, tracking BTC movement is crucial for risk mitigation.