Cardano’s transactions surge: Impact on key metrics and ADA

- Cardano transactions increased by 1.8 million in May.

- Active addresses and daily active addresses increased, but ADA price declined by 8%.

Cardano [ADA] recently unveiled its monthly roundup, showcasing a remarkable transaction surge within its network. But let’s explore whether this growth resonated with other crucial metrics and ADA.

Transactions on Cardano increases by 1.8 million

In a recent update on May 31, Cardano provided insights into the activities on its network. One of the most significant highlights was the substantial surge in the number of transactions.

According to the report, Cardano witnessed a remarkable increase of 1.8 million transactions, pushing the overall count to 67.2 million transactions. This surge in transaction volume was not the only noteworthy event during the month.

In addition to the transaction spike, there was a significant rise in the creation of native tokens on the Cardano network, with an increase of 150,000 tokens.

Moreover, the launch of Marlowe, a collection of open-source tools designed to simplify the development, testing, and deployment of secure smart contracts on the blockchain, took place on the network’s mainnet.

Considering all these developments, it is worth exploring whether these advancements significantly impacted the on-chain activity within the network.

Cardano active addresses see a slight uptrend

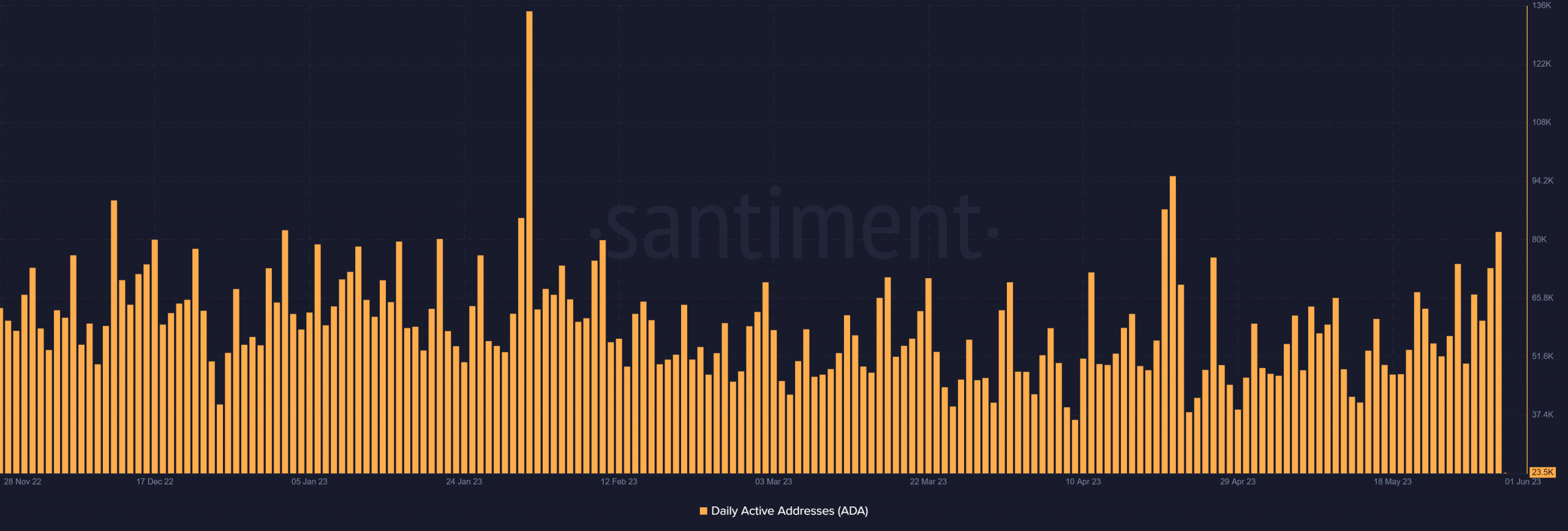

Santiment’s analysis of Cardano‘s 30-day active addresses metric revealed an interesting pattern, particularly towards the end of May.

The accompanying chart depicted a mixed response in the number of active addresses during this period. Around May 20, there was a notable decline from approximately 1 million active addresses to around 945,000.

However, a positive trend emerged around May 28. As of this writing, the active addresses have reached the 1 million mark again.

Furthermore, comparing the beginning and end of May, there was a clear increase in the number of daily active addresses. On May 1, the daily active addresses were approximately 60,000, but by May 31, they had risen to around 82,000.

As of this writing, the active addresses stood at over 21,000. This indicated ongoing engagement within the Cardano network.

TVL and price show divergence

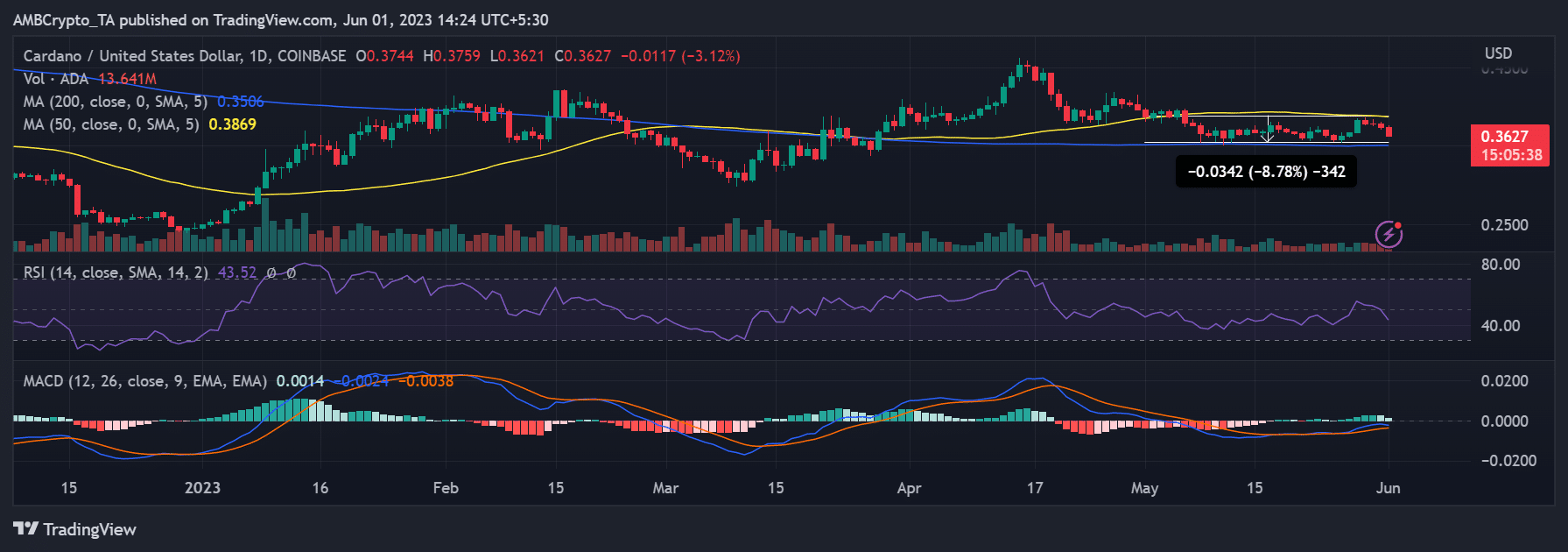

Examining Cardano’s price trajectory revealed a less positive picture than its transactional growth. According to the price trend tool, ADA experienced a decrease in value of over 8% throughout May.

As of this writing, it was trading at approximately $0.36, indicating a loss of over 3%. The Relative Strength Index (RSI) confirmed a bearish trend, as it remained below the neutral line and showed a continuous downward movement.

How much are 1,10,100 ADAs worth today

On the other hand, Cardano’s Total Value Locked (TVL) on DefiLlama presented a different perspective, displaying an upward trend. The TVL stood at around $172 million at press time, suggesting a positive trajectory on the chart.

Cardano has witnessed significant positive trends in key metrics, including increased transactions and TVL. However, the movement in price was yet to align with these metrics and may potentially converge in the forthcoming months.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-5-1-400x240.webp)