SHIB’s sideway structure persists, what should traders expect?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Shiba Inu [SHIB] continued to face muted price performance in early June. Besides fierce competition from Dogecoin [DOGE], Floki Inu [FLOKI], and Pepe [PEPE], SHIB’s TVL dipped from over $1 billion in 2021 to less than $30 million in recent times.

The meme coin’s price action chalked a short-term range formation since mid-May as Bitcoin’s [BTC] price gyrations persisted.

Will SHIB bypass the mid-range level?

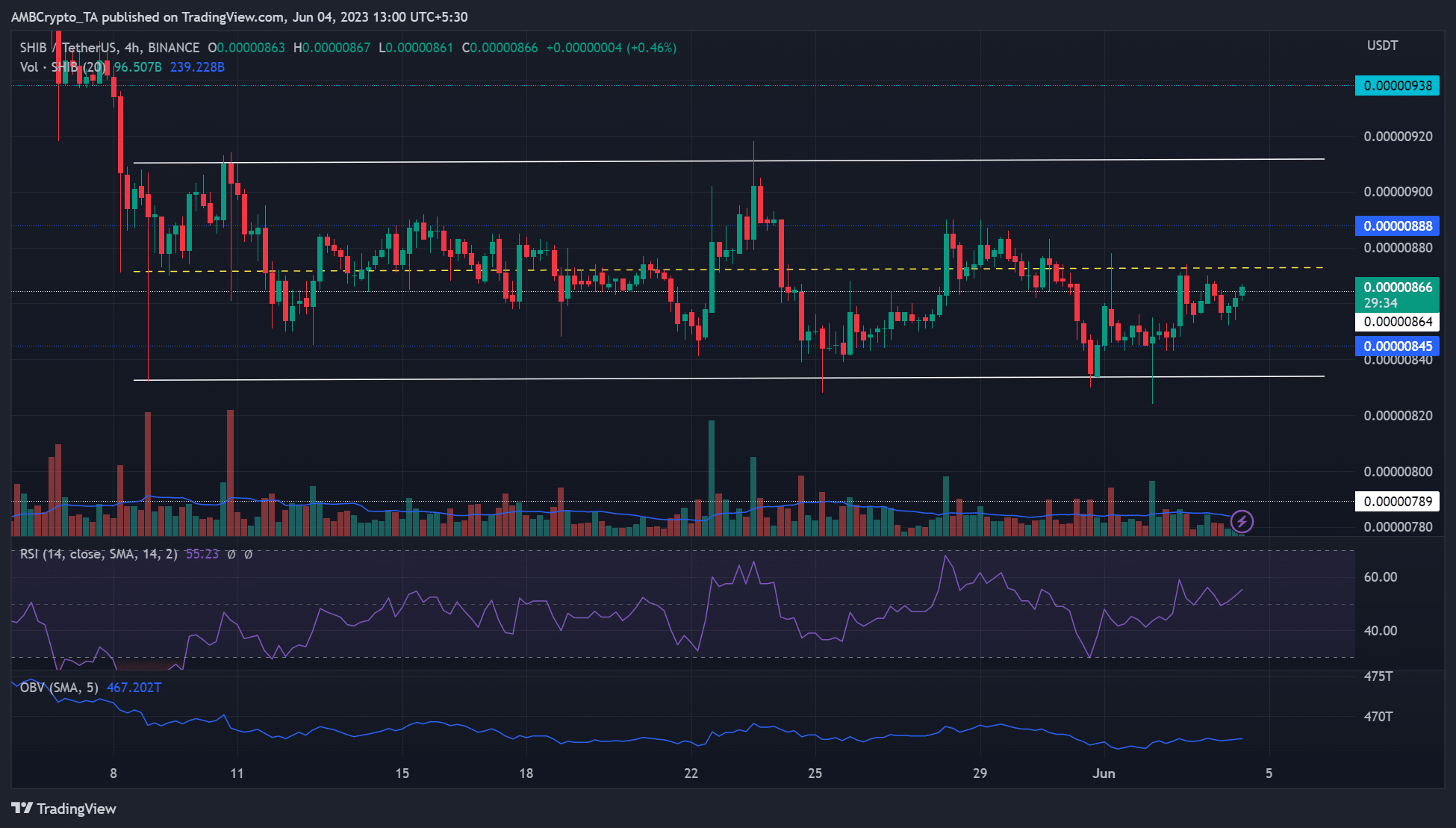

Since 8 May, SHIB has been stuck in a range trading pattern, with extremes at $0.00000912 and $0.00000834. Like the 4-hour chart, the 12-hour chart was neutral at press time, meaning the price could go in either direction at the mid-range level of $0.00000873.

If BTC maintains hold of $27k and surges, SHIB could smash the mid-range level and aim at the range high of $0.00000912. But near-term bulls must clear the $0.00000888 roadblock to gain the upper hand.

Conversely, bulls could falter at the mid-range, allowing sellers to enter the market if BTC falls below $27k again. Such a move could set SHIB to depreciate to $0.00000845 or the range low of $0.00000834.

Meanwhile, the RSI was near the neutral position after rising from the oversold zone, denoting increased buying pressure in the past few days. Similarly, the OBV registered an uptick, highlighting a surge in volume in the same period.

Traders bearish on the short-term

How much are 1,10,100 SHIBs worth today?

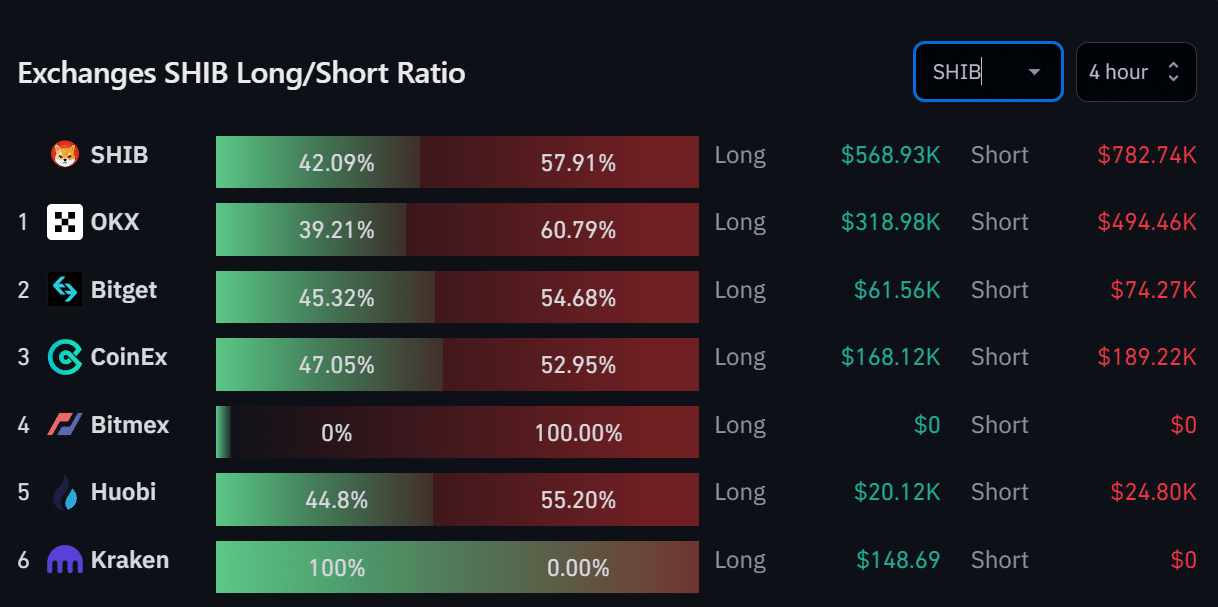

At press time, more traders were shorting the meme-coin, with shorts positions dominating at over 57%. This reiterates a conviction that SHIB could face price rejection at mid or high range.

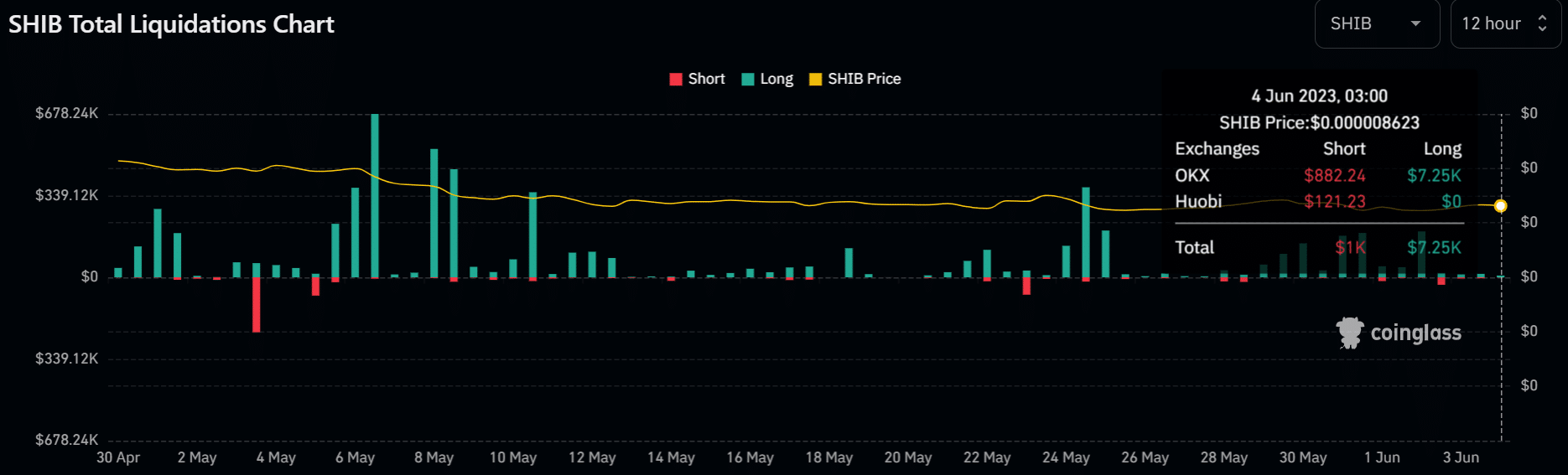

In addition, liquidation data in the past 12 hours showed that more long positions worth $7k had been wrecked than short positions. This reiterates the bearish short-term outlook. However, the negative sentiment could change if BTC retests $28k.