Cardano TVL crosses $700 mln – Will this help ADA cross $3?

- Cardano’s TVL crossed $700M, with $1B as the next target.

- Will the strong network growth push ADA’s value higher?

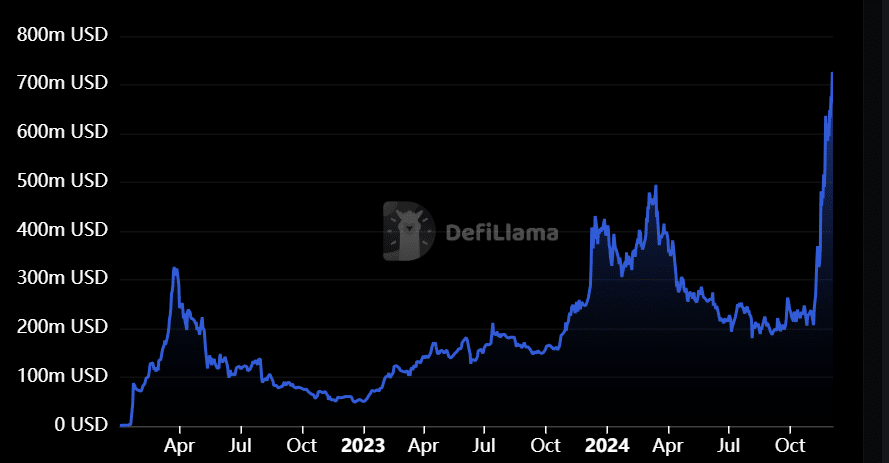

Cardano’s [ADA] impressive November rally was backed by strong fundamentals and trust, as TVL (total value locked) soared to record highs of $713 million.

This was a massive recovery from the nearly $500M hit in the last cycle.

Cardano TVL soars

For the unfamiliar, TVL tracks the amount of funds locked in a chain, especially the DeFi protocols on the Cardano network. By extension, a surge in TVL indicates improved investor trust.

According to DeFiLlama, the top protocols driving Cardano TVL were two lending platforms-Liqwid, Indigo, and decentralized exchange (DEX), Minswap. They controlled over 50% of TVL ($430M) at press time.

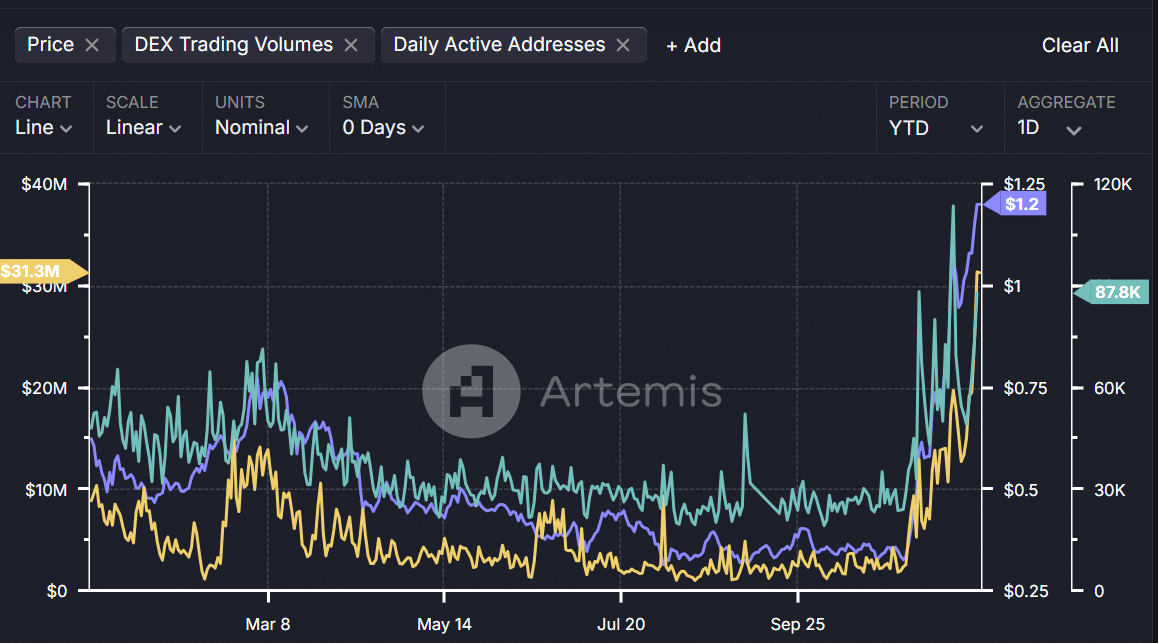

The network growth was also evident as DEX (decentralized exchange) volume jumped to yearly highs.

Cardano DEX trading volume (orange) was a mere $1.9M in early November, but this surged to $31.5M as of this writing. That’s a whopping 17X growth in a month.

The increased DEX trading volume meant more user activity, which positively correlated to strong price action in ADA in the past month.

Notably, users rose from 30K in early November to nearly 90K as of this writing, a 100% increase. On the price front, ADA surged 272% over the same period, hitting a yearly high of $1.3.

ADA price action

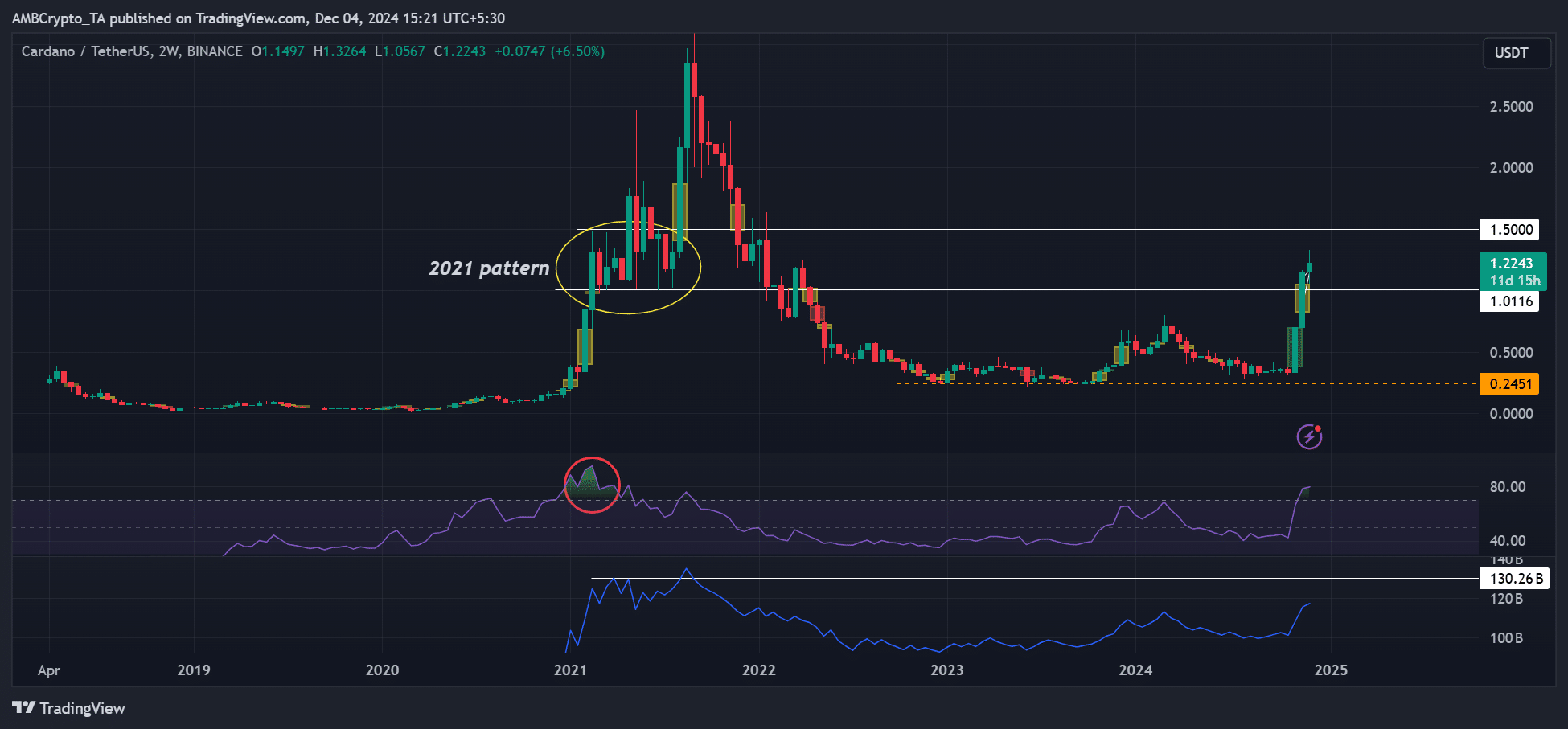

So, the rising DEX volume and overall network growth could fuel ADA’s attempt to eye its 2021 cycle high of $3 if the trend continues into the next few weeks or months.

ADA’s prospects of hitting 2021 highs on the price charts could only be validated if it holds above $1 and a clear $1.5 range-high formed in the last cycle.

The recent price pump pushed the altcoin into a price range of $1-$1.5 formed in 2021. ADA consolidated for three months in the range before a breakout that hit $3.

Read Cardano [ADA] Price Prediction 2024-2025

If the pattern repeats, ADA price could fluctuate between $1 and $1.5 for the next few weeks.

In conclusion, ADA’s recent price rally wasn’t a market FOMO affair; strong fundamentals also played a role.