What to expect as Cardano awaits a new breakout

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

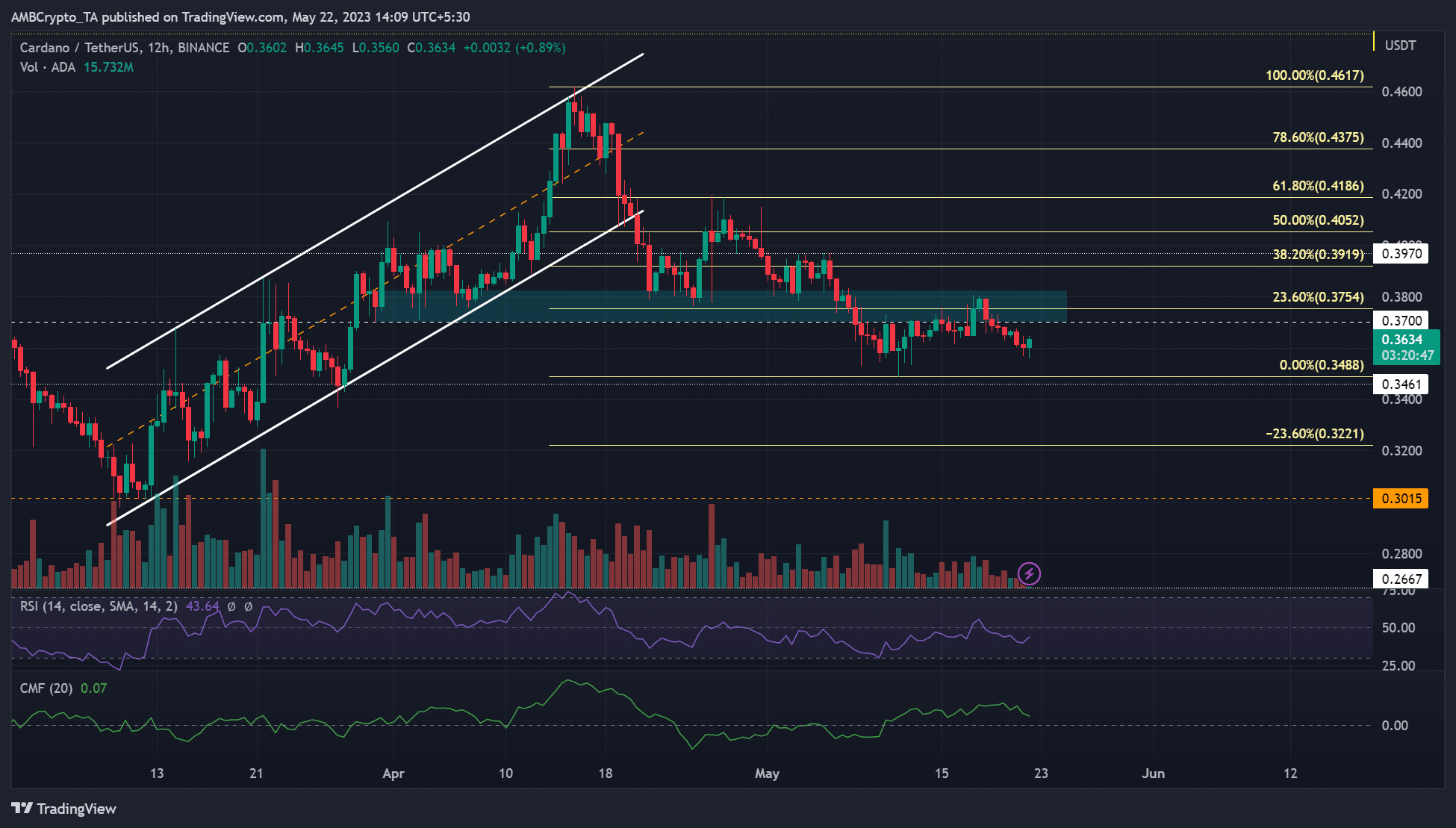

- The 23% Fib level ($0.3754) was a key hurdle in the past few days.

- A mild bullish sentiment was present on lower timeframe charts.

Cardano’s [ADA] price remained below $0.3800 in the past two weeks, confirming the sellers’ upper hand. ADA’s selling pressure intensified since mid-April, cracking a key demand and support zone of $0.37 – $0.38 on 8 May.

Is your portfolio green? Check out the ADA Profit Calculator

Although there was a strong rally at press time, on lower timeframe charts, the uptrend could stall with Bitcoin [BTC] still stuck within the $26k zone.

Can bulls mount above this bullish OB?

The bullish order block (OB) formed on 30 March served as a crucial demand and support zone (cyan) in April. However, sellers overwhelmed the support in early May, cracked it, and sank ADA.

Cardano’s price action has remained below the 23% Fib level ($0.3754), and the bullish OB in the past two weeks could thwart the bullish momentum seen in lower timeframe charts at press time. This is true especially if BTC remains within the $26k price zone.

ADA could face rejection at the above resistance area in such a case, forcing it to retest the immediate lower support level at $0.3488.

Alternatively, bulls could have little leverage if they push ADA above $0.38, especially with a bullish BTC. The next obstacle will be the 38.2% Fib level ($0.3919). Moving above this hurdle could make a retest of $0.42 feasible.

Meanwhile, CMF nosedived as RSI rose, indicating capital inflows dropped as buying pressure improved.

Liquidation variance across timeframes

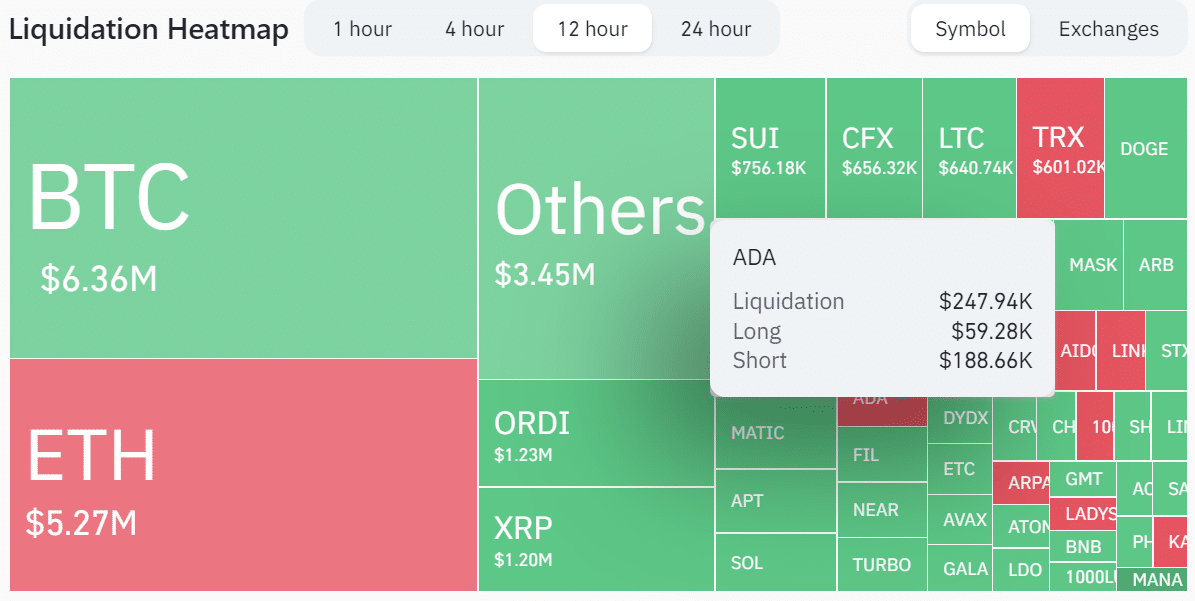

On the 12-hour timeframe, Coinglass’ data revealed that ADA’s total liquidations were $248k, with short positions suffering more wreckage than longs. It shows mild bullish sentiment in the past 12 hours in the futures market.

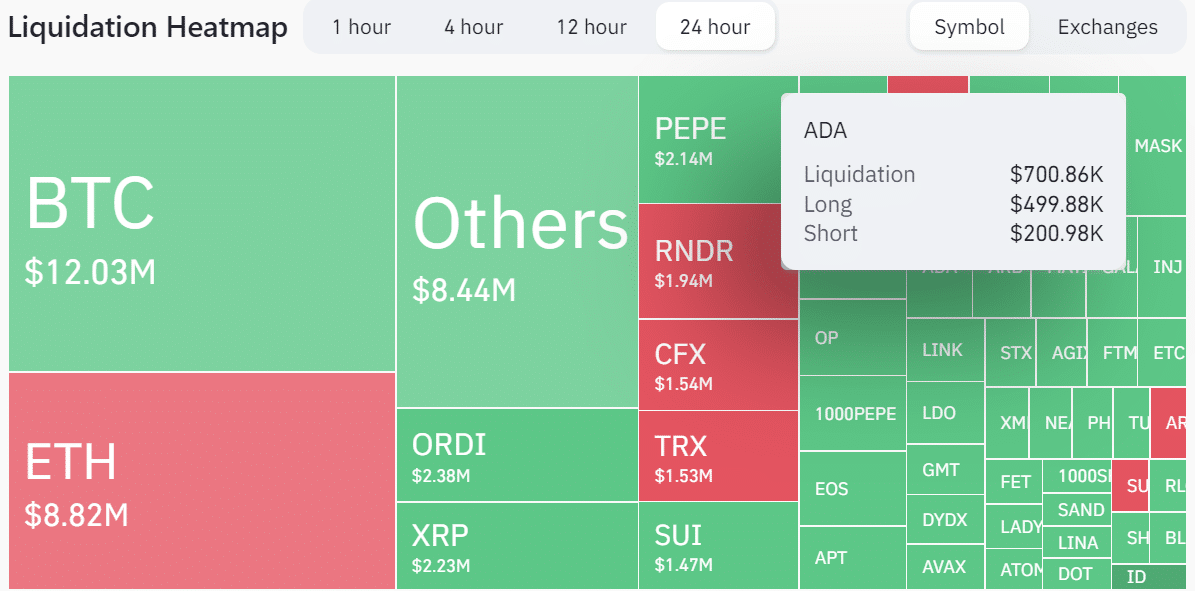

However, extrapolating the same data to a 24-hour timeframe shows a different picture. Notably, longs suffered more than shorts, painting a bearish bias on a 24-hour basis.

How much are 1,10,100 ADAs worth today?

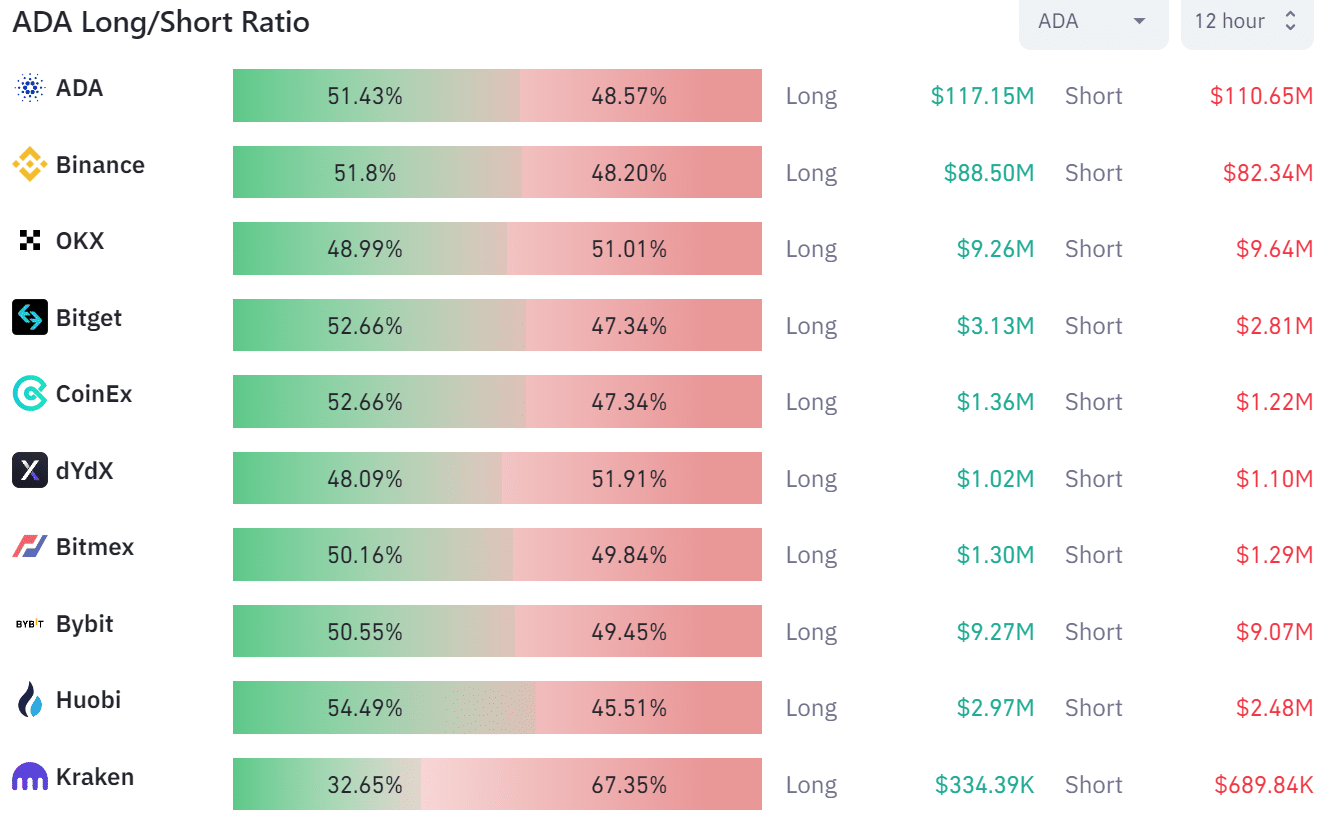

Since we are stepping from the weekend, the former could help gauge the direction for the week rather than the latter. Despite buyers gaining ground by press time, Cardano’s long/short ratio indicates a small spread on the 12-hour, hence a neutral sentiment.

Therefore, higher timeframe charts remained almost neutral, and tracking BTC could help offer clear trends and direction.