Tron can sustain its upside for the rest of May, but only if…

- TRX might become legal tender, according to a Tron community update.

- Assessing the likelihood of sell pressure now that TRX is deeply overbought.

Tron [TRX] delivered an impressive overall bullish performance since the start of May, but it crossed the oversold territory at press time. Despite this, there is one scenario that may support more potential upside.

Read Tron’s [TRX] Price Prediction 2023-24

It is no surprise that the Tron network has been looking to be in good books with China. This is because the country may open up opportunities for mass adoption and fast-paced growth.

A 21 May update from the Tron community claimed that Hong Kong will allow retail traders to start trading cryptocurrencies in June. It also affirmed that TRX may gain legal tender status.

It is expected that on June 1st retail investors will be allowed to trade in cryptocurrencies in Hong Kong ?? Will this be the day when it will be announced that #TRON will be made legal tender? ? pic.twitter.com/iySgIvdWC3

— TRON Community (@TronixTrx) May 21, 2023

Although there is no official confirmation, such an outcome would likely favor TRX and usher in a new wave of demand. In addition, this would also favor its performance in the long term.

Meanwhile, TRX could likely experience a resurgence of sell pressure, especially as it was deeply overbought at press time.

Can TRX bulls defend their dominant position?

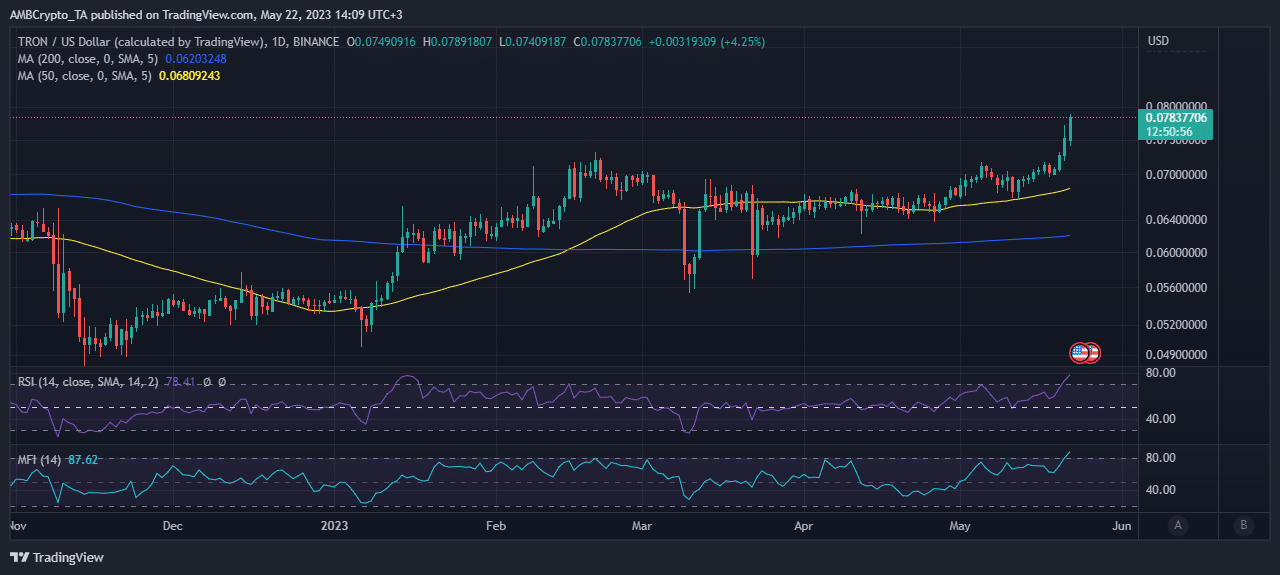

TRX has clearly decoupled from the rest of the market, which has mostly been correlated with BTC. It delivered an impressive performance in the last three days, during which it surged past its $0.072 short-term resistance. TRX traded at $0.078 at press time, representing a 17% upside on a month-to-date basis.

TRX’s MFI and RSI are currently flashing overbought signals, which means a higher probability of sell pressure resurgence.

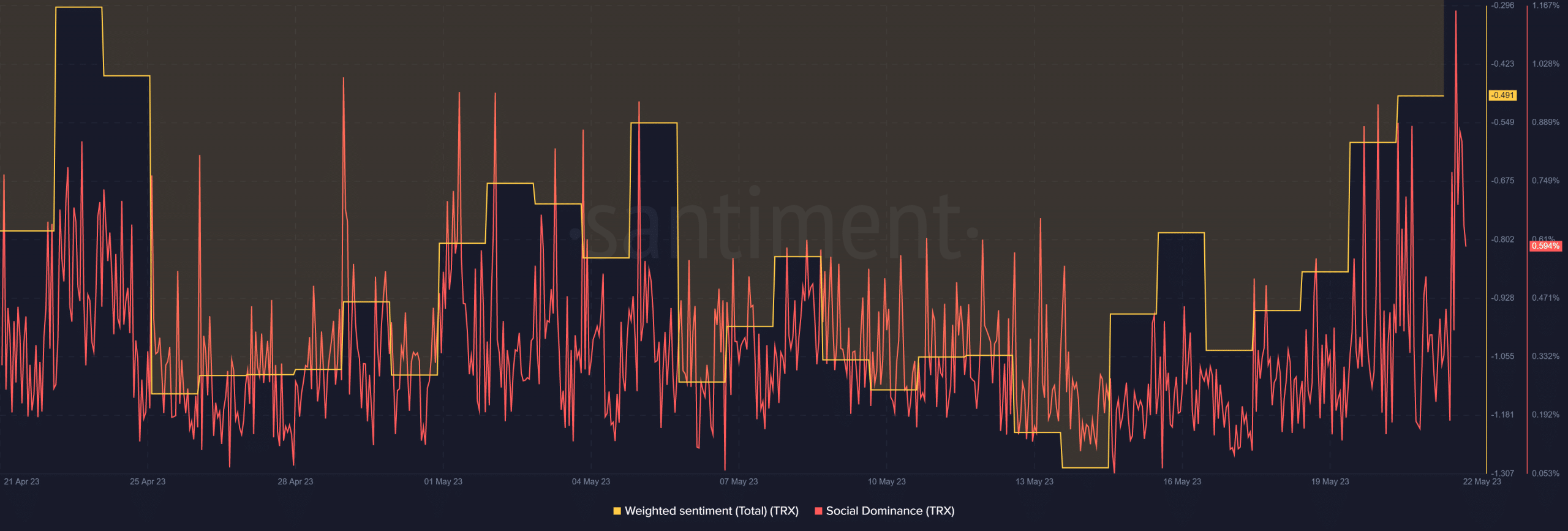

Tron’s social dominance metric jumped to its highest monthly level in the last 24 hours. This means it was experiencing a higher level of visibility at press time, which may, in turn, attract more liquidity, especially from retail buyers.

The higher the level of retail participation, the more likely it is for whales to start cashing in on short-term profits. Nevertheless, investor confidence was high, judging by the weighted sentiment’s position.

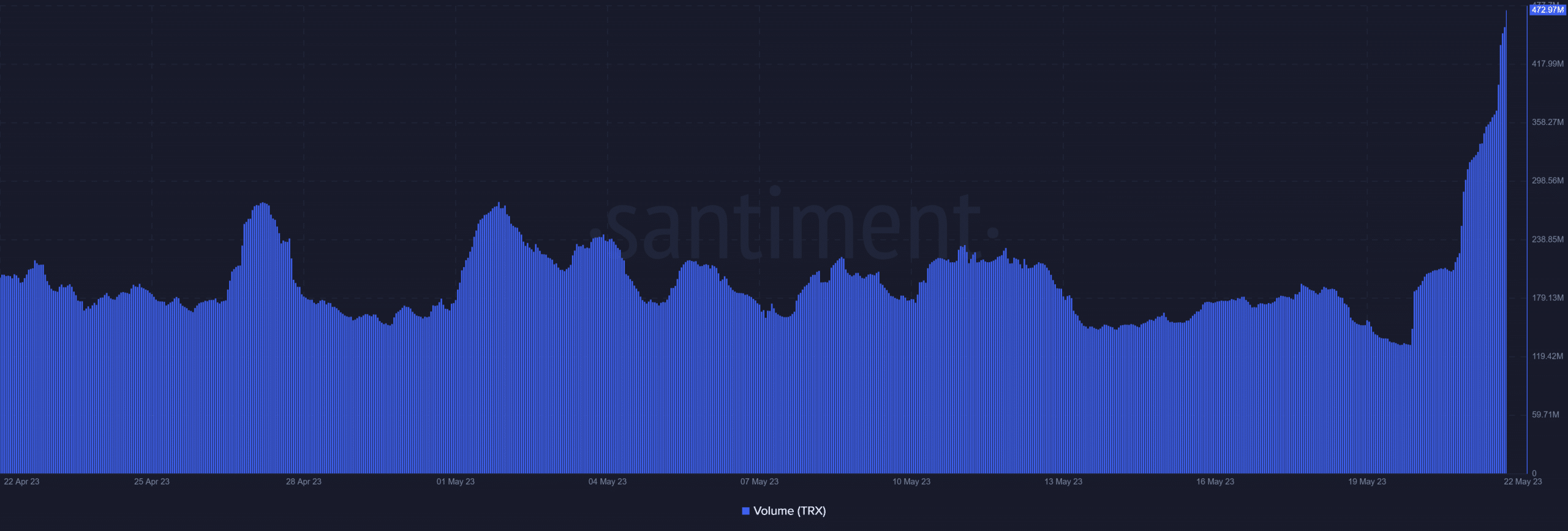

This retail participation was evident in the recent surge in TRX’s on-chain volume, which soared to its highest level in the last four weeks.

Is your portfolio green? Check out the Tron Profit Calculator

Interestingly, TRX previously demonstrated bullish resilience, being one of those cryptos that has held on to its YTD gains. Despite that, volumes previously remained within a normal range until the last 24 hours, during which it registered a large spike. Will this latest volume upside mark the end of the recent rally?

Well, June is still more than a week away, hence there is room for some sell pressure. However, the prospects of TRX being legal tender in Hong Kong might be enough to support a bullish outlook.