Cardano’s governance gets questioned; Charles Hoskinson responds with…

- Cardano gets criticized for its governance proposal.

- Charles Hoskinson responds, ADA gets impacted by FUD.

Vanessa Hariss, a Senator at Team Kujira (a decentralized ecosystem for protocols), on 5 March claimed that the Cardano governance was centralized.

In a Twitter thread, she stated that IOG (Input Output Global), the company behind Cardano’s formation, has been dominating a large part of Cardano’s governance.

Read Cardano’s [ADA] Price Prediction 2023-24

Questions arise

As per Vanessa, the CIP-1694 proposal will be giving away a lot of power to Cardano’s Constitutional Committee. The Constitutional Committee, which comprises of insiders from IOG, would be able to veto any governance action, except motions of no confidence and calls for a new committee.

Vanessa stated that replacing the committee would be a difficult task and that a no-confidence vote would require a large majority of representatives.

Due to these factors, she asserted that under the CIP-1694 proposal, IOG would always retain control of Cardano, except in rare situations.

She also mentioned that ADA stakers will not be afforded a platform to participate in the governance affairs of Cardano.

The stakers would have to pay a fee to a Delegated Representative or become a Delegated Representative themselves to participate in Cardano’s governance.

Well, much to the surprise, Charles Hoskinson responded quickly to these claims. He dismissed these statements saying, “This is categorically false and a great example of how FUD spreads.”

In a response to Charles’ tweet, many users have requested for a Twitter space to be held where all these doubts about the Cardano governance can be clarified.

Fear, Uncertainty, and Clout

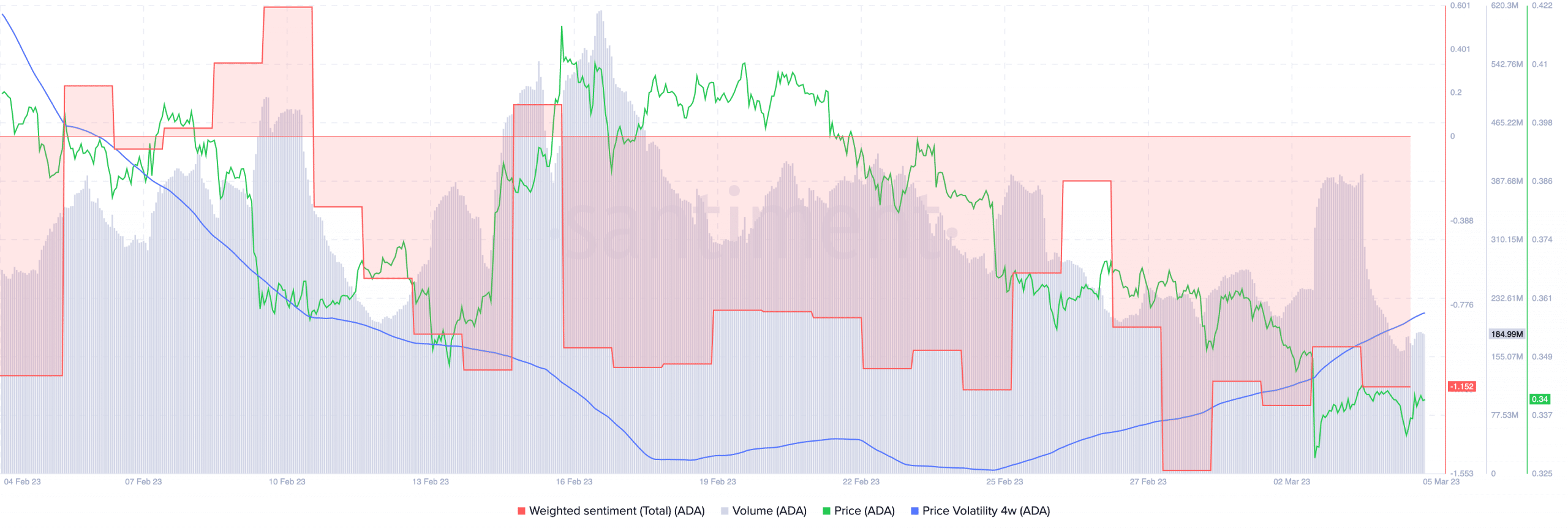

Meanwhile, all the talk about the Cardano governance affected the sentiment around ADA. According to Santiment’s data, the weighted sentiment metric declined over the past few days.

Furthermore, the volume of ADA also fell. Over the last month, it decreased from 258.69 million to 185.69 million, at press time.

During this period, ADA’s price showed a strong correlation with its volume, falling 16.61%. This led to ADA’s price volatility gradually increasing.

Realistic or not, here’s ADA’s market cap in BTC’s terms

Now, if the price volatility continues to rise, ADA could become an increasingly risky asset to buy.