CEL surges as Celsius settlement gets court approval, details inside

- The court has approved a settlement agreement between Celsius and its custody account holders.

- CEL sees increased trading volume in the last 24 hours.

On 21 March, cryptocurrency lending platform Celsius Network [CEL] received approval from the bankruptcy judge overseeing its bankruptcy case for a settlement agreement between the company, its debtors, the official committee of unsecured creditors, an ad hoc group of custodial account holders, and any non-withdrawal custody account holders.

Read Celsius’s [CEL] Price Prediction 2023-2024

Per the settlement agreement, custody account holders on the platform who decide to opt in may recover 72.5% of their cryptocurrency holdings. The settlement agreement will indemnify Celsius Network against any future claims by any custody account holder agreeing to recover 72.5% of their crypto holdings.

CEL leaps for joy

Following the court’s go-ahead for Celsius to make its custody account holders partly whole, CEL has seen increased trading in the past 24 hours. According to data from CoinMarketCap, the token’s value went up by 5% during that period, while trading volume surged by over 200%.

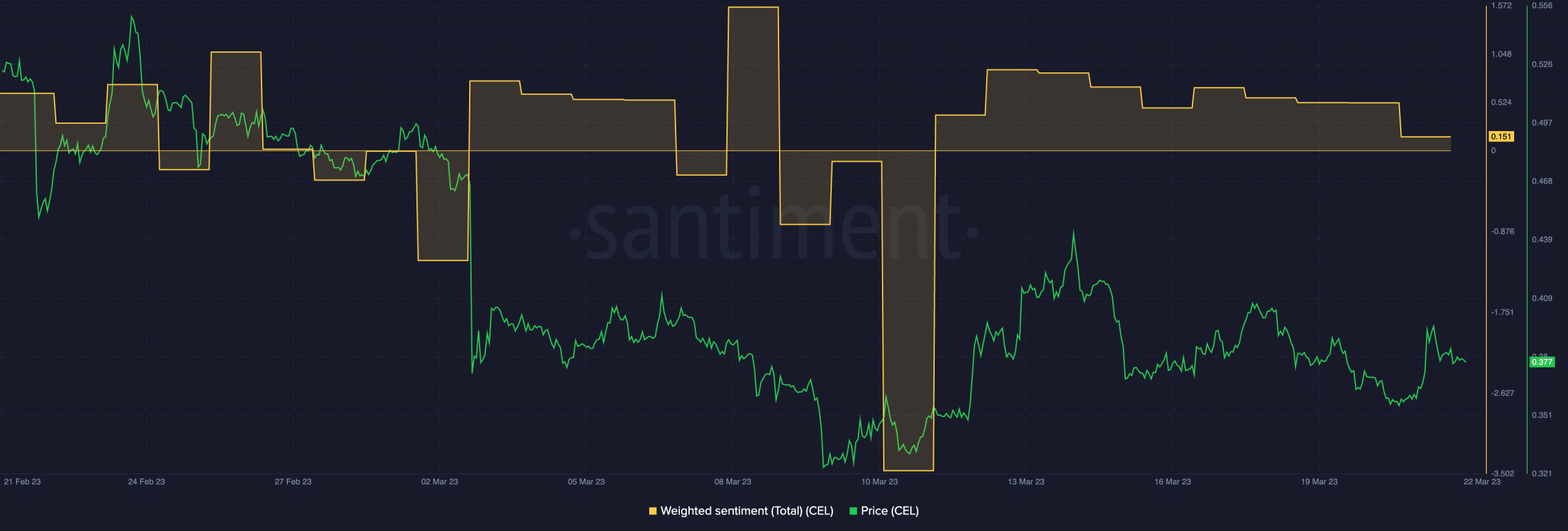

Growth in an asset’s trading volume with a corresponding rally in its price is a bullish sign, and it often indicates that the price may continue to grow. Per Santiment, CEL’s weighted sentiment was a positive 0.151, suggesting that investors remain convinced of a further price rally.

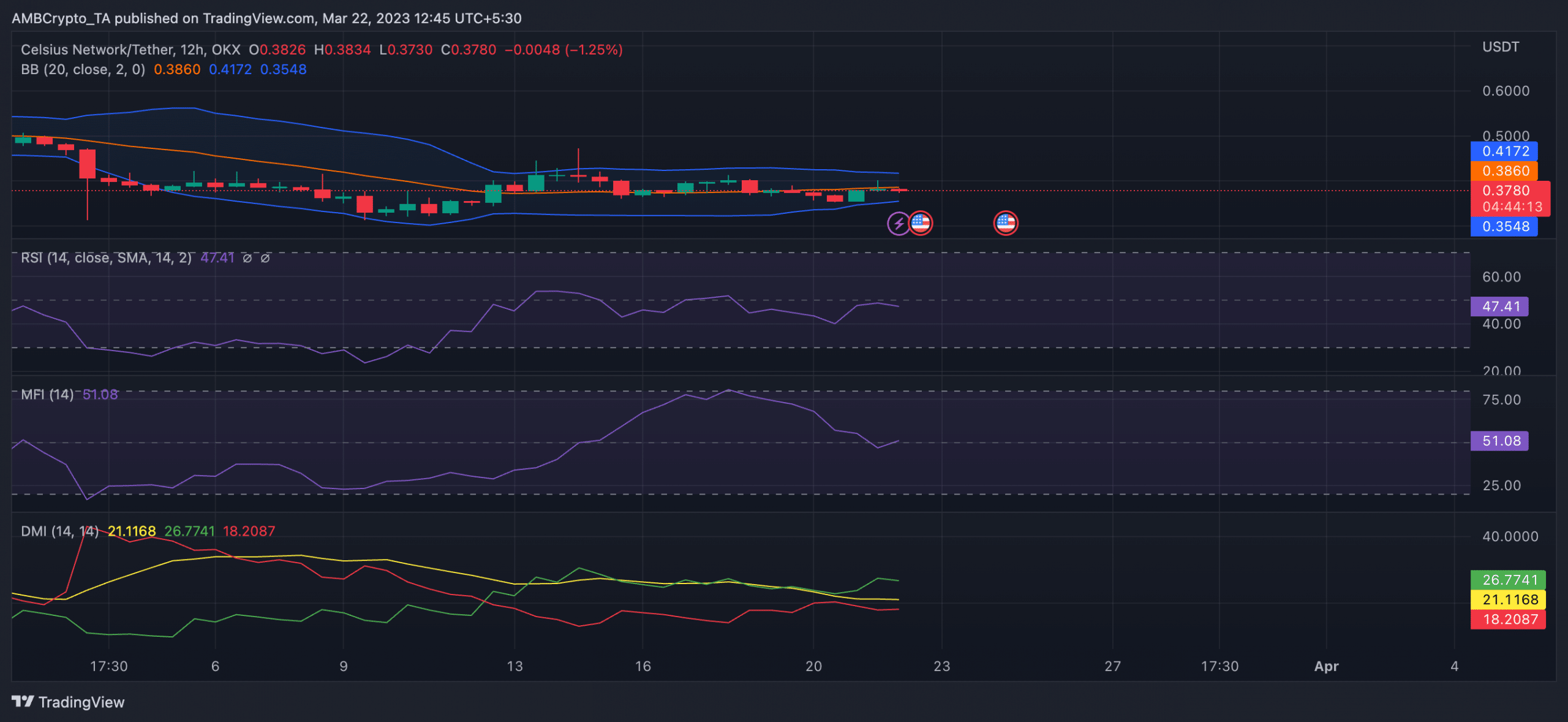

However, with many CEL day traders unsure of the exact breakout direction of the altcoin, the token’s price has traded sideways on a 12-hour window. At press time, CEL exchanged hands at $0.3784.

An assessment of the price relationship with the Bollinger Bands indicator showed CEL trading on the middle line. When the price of an asset is on the middle line, it suggests that the price is in a neutral position and it is neither overbought nor oversold. It is common in markets where traders decide to stay their hands due to uncertainty of what direction the asset’s price might go next.

What the metrics say

Likewise, CEL’s key momentum indicators, such as the Relative Strength Index (RSI) and its Money Flow Index (MFI), have moved sideways, with no major indication of any upward or downward breakout. When these two indicators move sideways, it typically means that there is little price momentum in the market.

Is your portfolio green? Check the Celsius Profit Calculator

This could indicate a period of consolidation or indecision among traders, with neither buyers nor sellers having a clear advantage. On the other hand, it may also suggest that the market is waiting for new information or a catalyst to drive the price in a certain direction.

While uncertainty plagued the day market, the silver lining was that buyers remained in control. A consideration of CEL’s Directional Movement Index (DMI) confirmed this. The buyers’ strength (green) at 26.77 was solidly above the sellers’ (red) at 18.20.