Celestia’s Ginger upgrade drives 5X throughput – Impact on TIA price?

- The recent Ginger upgrade increased Celestia’s throughput by 5X.

- Despite the update, TIA’s price remained muted — what’s next?

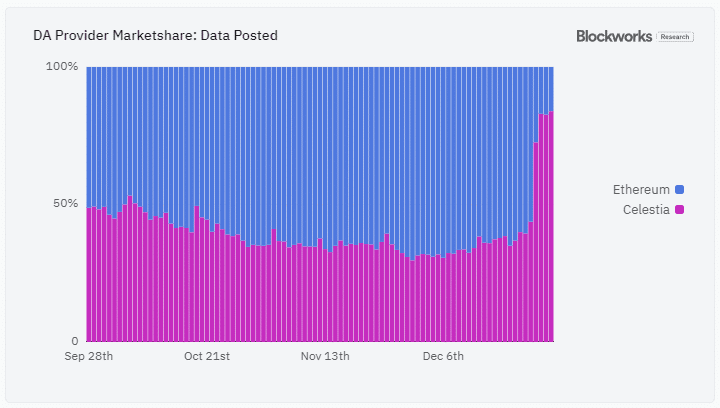

Celestia’s [TIA] recent Ginger upgrade, which doubled the data availability to ensure efficient handling of Ethereum [ETH] L2 transactions, is proving useful.

Blockworks research analyst Dan Smith stated that Celestia saw a 5x throughput increase after the upgrade. He said,

“Celestia hit a new all time high yesterday – 11.85 gb of data posted, almost entirely from EclipseFND. Celestia handled 5x the data posted to Ethereum blobs at a 99.6% lower fee per MB of data.”

Impact on TIA price

For the unfamiliar, Celestia’s data availability (DA) helps provide L2 transactions with a scalable way of storing and verifying transaction data off-chain.

Besides, Celestia is currently the cheapest DA provider for ETH L2 transactions.

Smith believes the low cost and high throughput could make Celestia the go-to DA platform for other L2 transactions.

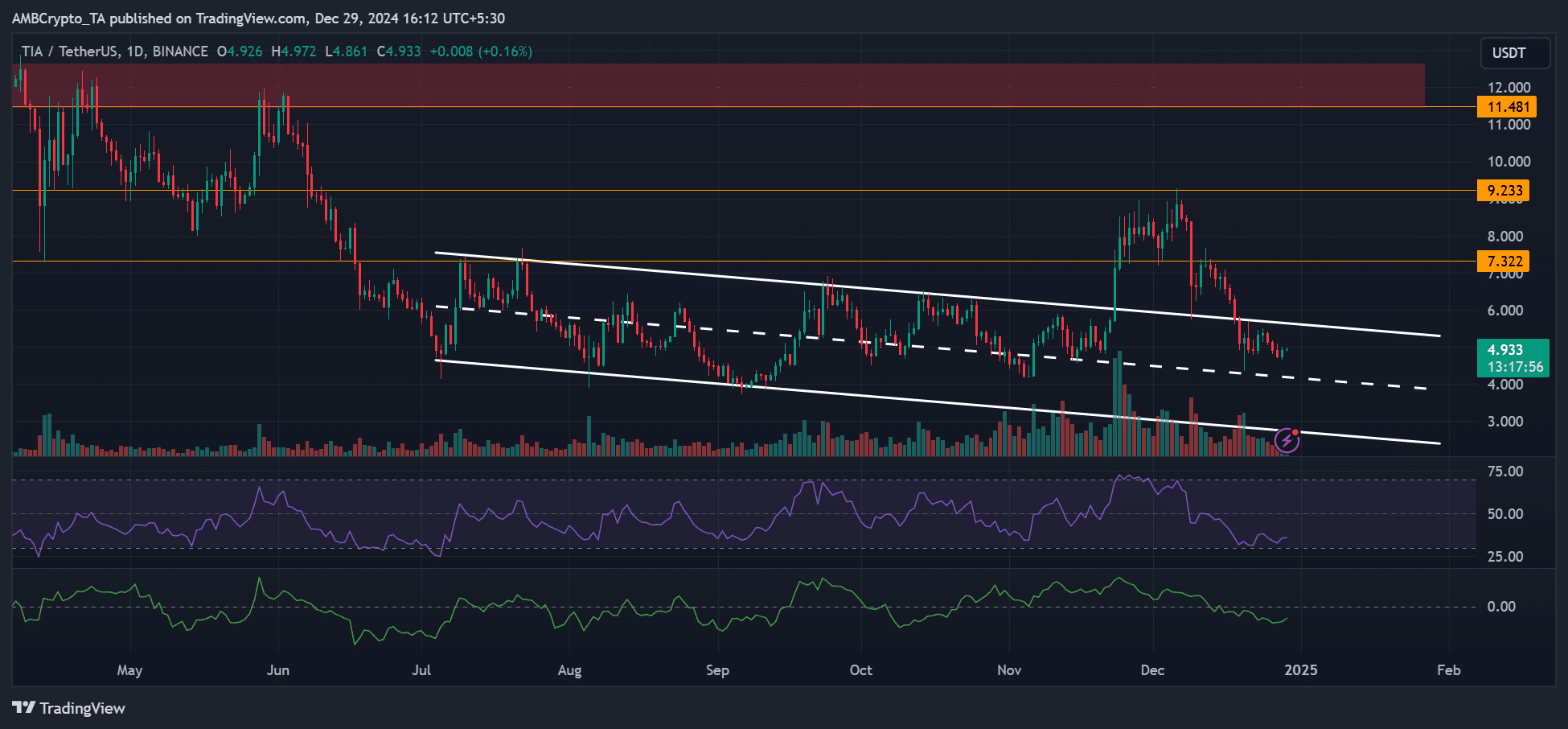

Despite the positive update, TIA, its native token, flashed bearish signals on-chain and price charts.

TIA’s social traction and Weighted Sentiment dropped to levels last seen before the November major rally. It underscored low market interest and bearish sentiment, which could delay a strong rebound in the short term.

But is the weak sentiment a great risk-reward buying opportunity?

On the price charts, TIA was down nearly 50% from its recent peak, reversing all November gains. It had plunged from $9.2 to a low of $4.3, briefly stabilized above the previous channel range.

However, the bearish readings of the daily RSI chart, and the south-bound movement of the CMF (Chaikin Money Flow), suggested that demand wasn’t there and capital outflows intensified in the past few days.

Read Celestia [TIA] Price Prediction 2025-2026

Unless the technical chart indicators reversed, TIA could crack the mid-range and drop further to the channel’s lows.

On the flip side, another bullish breakout from the range could make a $7.3 target within reach, triggering a potential 60% gain.