Chainlink: Assessing LINK’s behind-the-curtain scenario amid its recent rally

- Chainlink’s Proof of Reserve service garners attention after the FTX debacle

- Weighted sentiment and social mentions witness growth, however new addresses continue to decline

With the collapse of FTX, the mistrust in crypto exchanges continues to grow. This is why more and more exchanges are adopting Chainlink’s Proof of Reserve technology to establish trust with their users.

Read Chainlink’s Price Prediction 2022-2023

Silver lining

One of the recent events that took place in the crypto market was Chainlink’s integration of their proof of reserve services for StablR a DeFi liquidity protocol. This rise in demand for showing proof of reserves could prove to be beneficial for Chainlink in the long run.

.@StablREuro is integrating #Chainlink Proof of Reserve (PoR) on #Ethereum to help secure the minting of StablR Euro, its Euro-backed stablecoin.

Explore how PoR helps bring unparalleled transparency to stablecoins ⬇️https://t.co/mdSzbkOfkF

— Chainlink (@chainlink) November 24, 2022

In lieu of these developments, Chainlink’s social engagements witnessed an uptick. According to data provided by LunarCrush, a social media analytics platform, Chainlink’s social engagements appreciated by 6.24% over the last week.

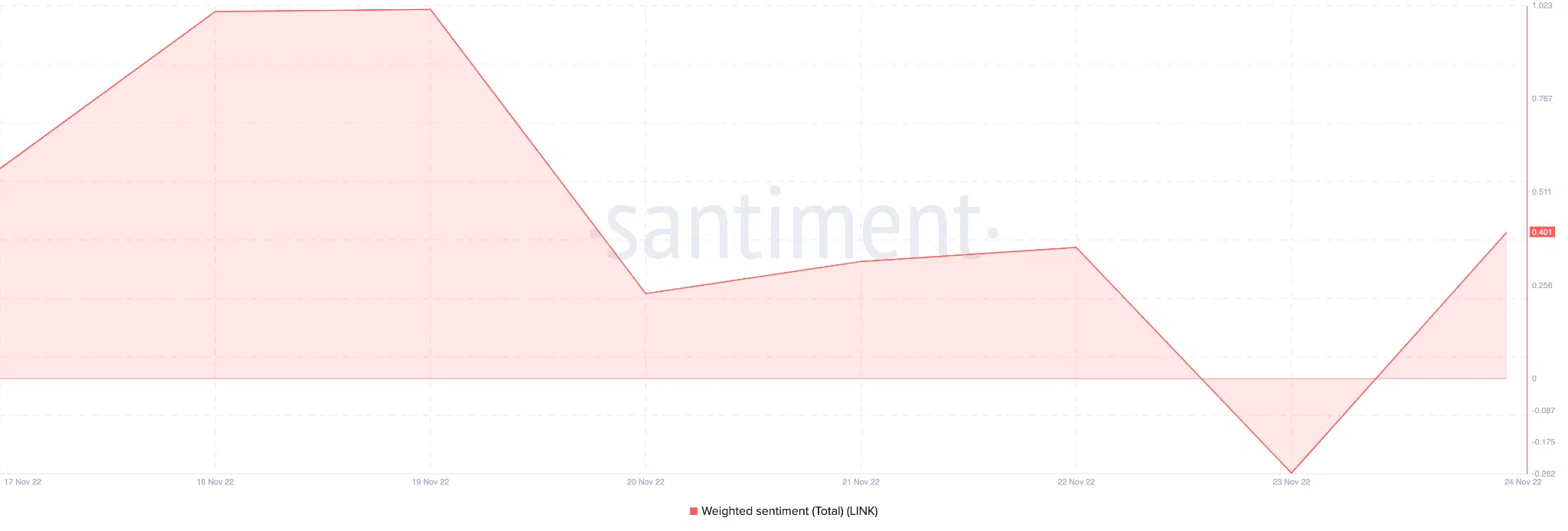

Its weighted sentiment also remained positive over the last week. This indicated that the crypto community had more positive than negative things to say about LINK in the last seven days.

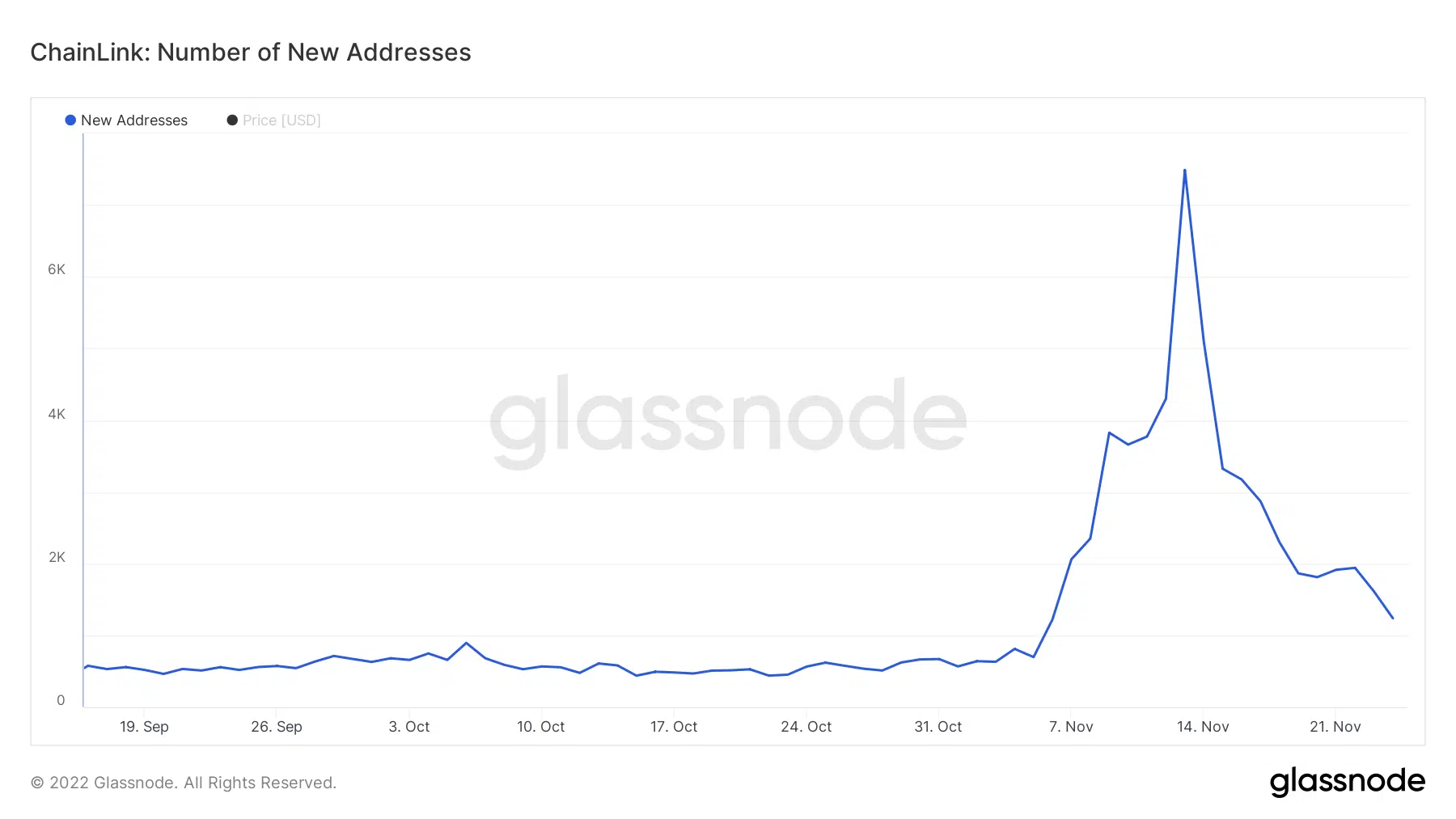

Despite the positive sentiment and growing social mentions, the number of new addresses on Chainlink continued to decline. As evidenced by the image below, the number of new addresses on Chainlink declined significantly in the last few days.

The number of active addresses on the network also declined during the same period according to data provided by crypto analytics firm glassnode.

Some ‘Whale’ing around…

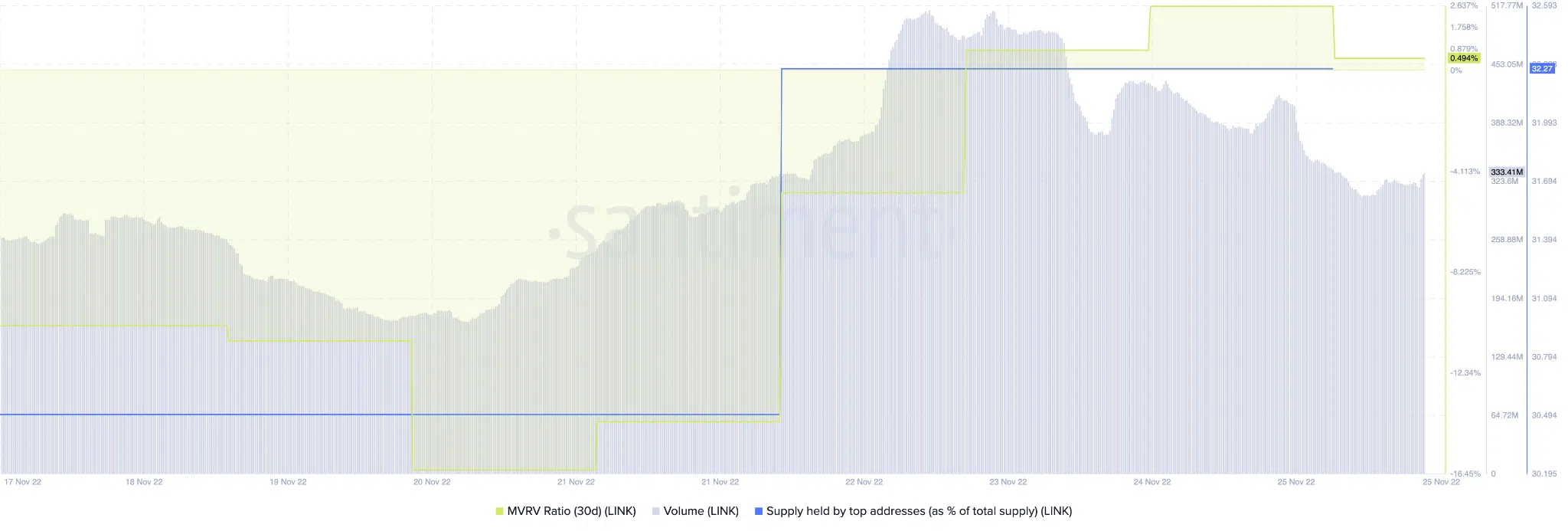

Despite the mixed signals sent out by LINK, whales continued to show interest in Chainlink. It can be observed that there was a spike in the supply of LINK held by top addresses. Furthermore, as of 25 November, the top 500 ETH whales were holding $26 million worth of LINK according to WhaleStats.

LINK’s Market Value to Realized Value (MVRV) ratio observed growth as well. This indicated that if most of the addresses holding LINK decided to sell, they would be doing so at a profit. Additionally, Chainlink’s volume observed growth as well. Over the last week, Chainlink’s volume also grew from 261 million to 331 million.

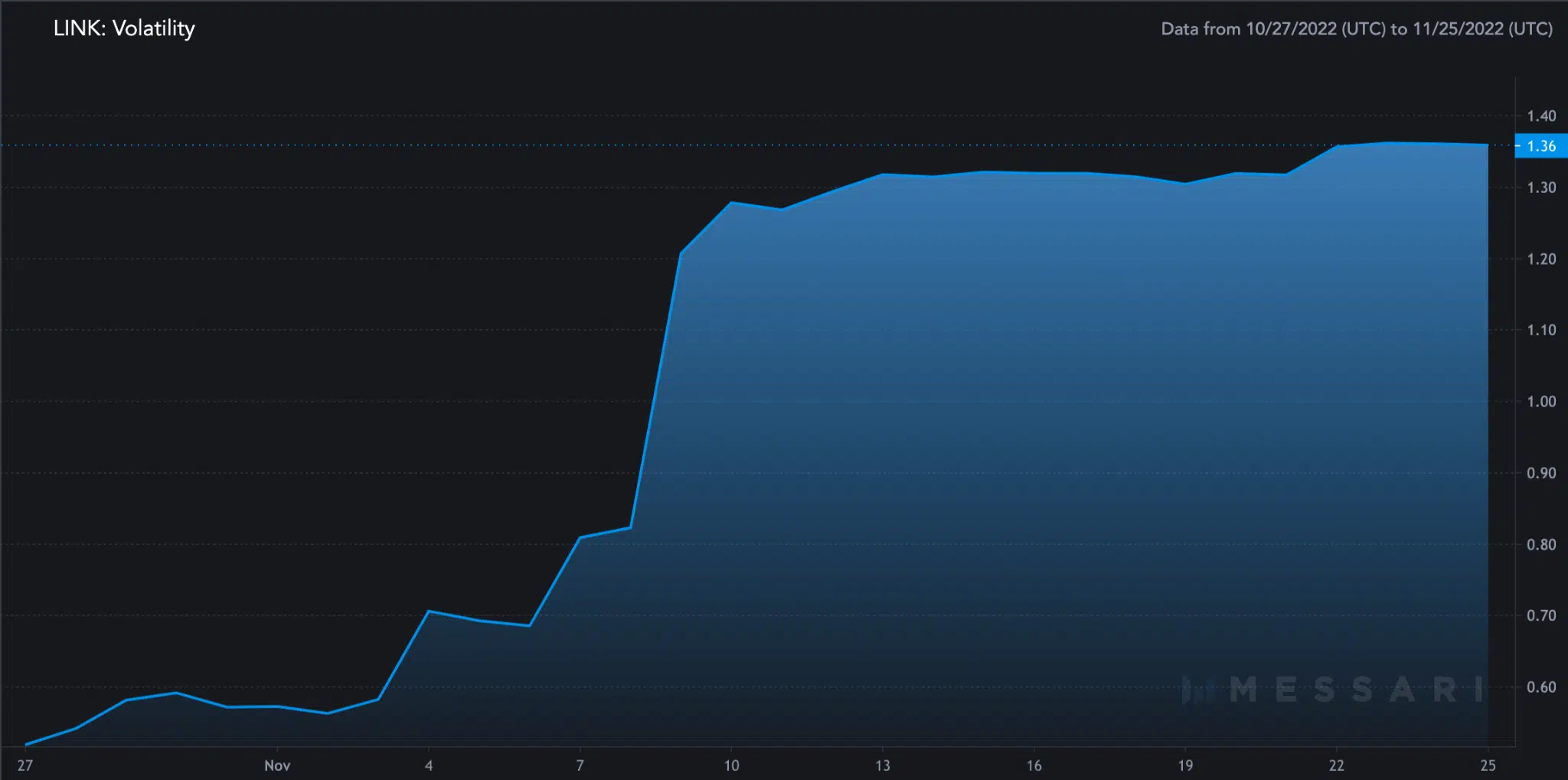

With the growth in volume, Chainlink also witnessed a growth in volatility. Chainlink’s volatility witnessed a massive spike over the last few weeks. This implied that it would be risky for investors to invest in LINK at the time of writing.

At press time, Chainlink was trading at $6.89 and its price had appreciated by 1.14% in the last 24 hours according to CoinMarketCap. Furthermore, its volume had depreciated by 14.7% during the same period as well.