Analysis

Chainlink: Bulls reclaim $7 level, what’s next?

Chainlink surged by 9% over the past 24 hours to take it above the $7 resistance with LINK’s on-chain activity registering critical growth.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Bulls claimed the $7 price level on the second retest.

- On-chain metrics highlighted the ongoing accumulation of LINK

Chainlink [LINK] surged another 9% over the past 24 hours to take it above the key $7 resistance level. LINK’s on-chain activity registered significant growth with a rise in new addresses. This led to increased liquidity for the token, thus fueling the current bullish trend.

Read Chainlink’s [LINK] Price Prediction 2023-24

Bulls will be looking to build on this bullish rally with a climb to a new high for 2023 looking likely in the long term.

Bulls link up to reclaim critical price level

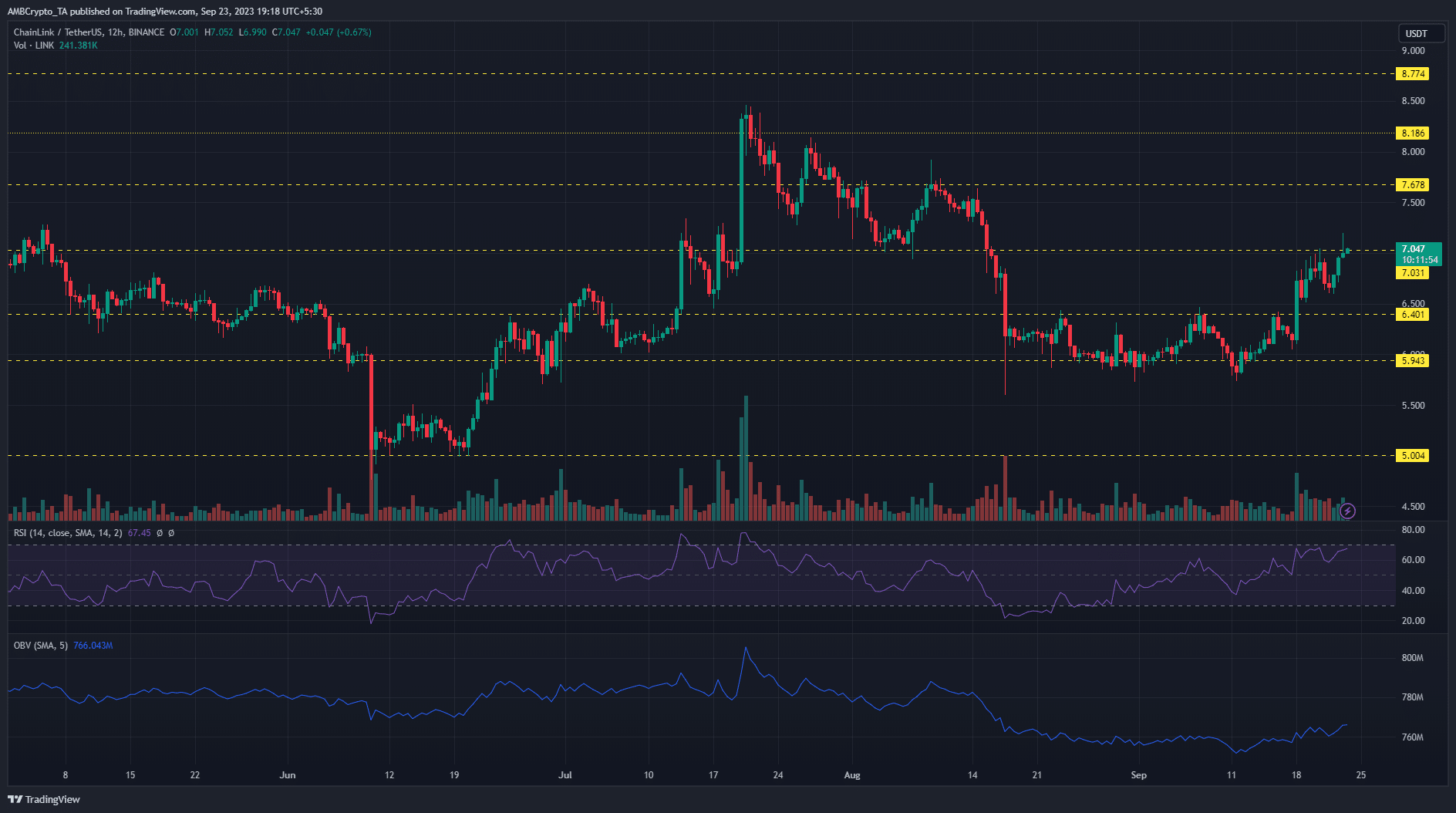

After breaking out of a compact price range with a strong rally, the next obstacle that lay ahead of bulls was the $7 resistance level. Bulls quickly advanced toward the resistance level but met a swift rejection on the first attempt on 20 September.

However, buyers regrouped and the second retest produced a positive outcome with bulls climbing above the $7 level.

The extended bullish momentum was supported by the on-chart indicators. The Relative Strength Index (RSI) continued to trend higher and stood at 67, as of press time. This highlighted the strong buying power backing the bullish rally.

Similarly, the On Balance Volume (OBV) recorded an uptick of over 6 million within the same time period.

A continuation of the bullish momentum could see buyers register further gains at $7.5 to $8. On the flip side, a drop below the $7 price level would invalidate the bullish thesis and could see LINK fall into another sideways price movement.

Is your portfolio green? Check out the LINK Profit Calculator

Buyers continue to accumulate LINK

The exchange data from Santiment showed a huge spike in the exchange outflows on 19 September and 21 September. This hinted at a significant accumulation of LINK, contributing to an increase in price.

Likewise, the 90d Mean Coin Age maintained its uptrend despite a slight drop. With market participants buying up LINK, this bullish rally could be sustained for the long term.