Chainlink investors should know this before getting into a trade

In a recent announcement made by Chainlink on 15 September, Chainlink claimed that it is the industry standard for on-chain climate data. With its price moving up by 2.64% in the last 24 hours, the question is- could LINK’s price rally ahead in the future?

Well, Chainlink has been proactive in enabling Web3 companies to reduce their negative impact on climate change by providing greenhouse gas emissions data on-chain through Chainlink’s decentralized oracle networks.

The company has also been helping other companies with carbon credit programs and information on reforestation through direct air capture.

Looking at the numbers

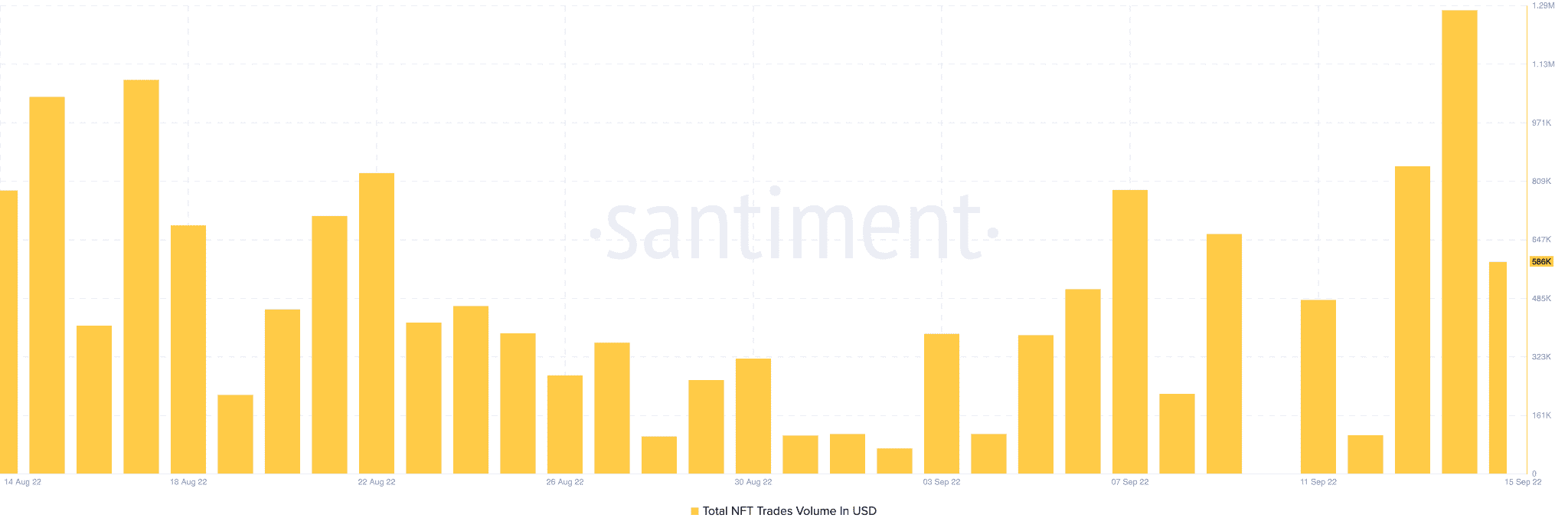

That being said, Chainlink’s circulating market cap has increased by 5.19% in a week. Meanwhile, it has been growing in the NFT market as well.

It can be seen in the image below. Over the past month, Chainlink’s NFT volume has been showing growth, with its NFT trade volume reaching $1.2 million on 15 September.

However, investors need to be cautious before jumping into any trades as there are some areas of concern for Chainlink.

Chainlink’s volume has depreciated by -46.25% over the past seven days, which could be perceived as a bearish sign.

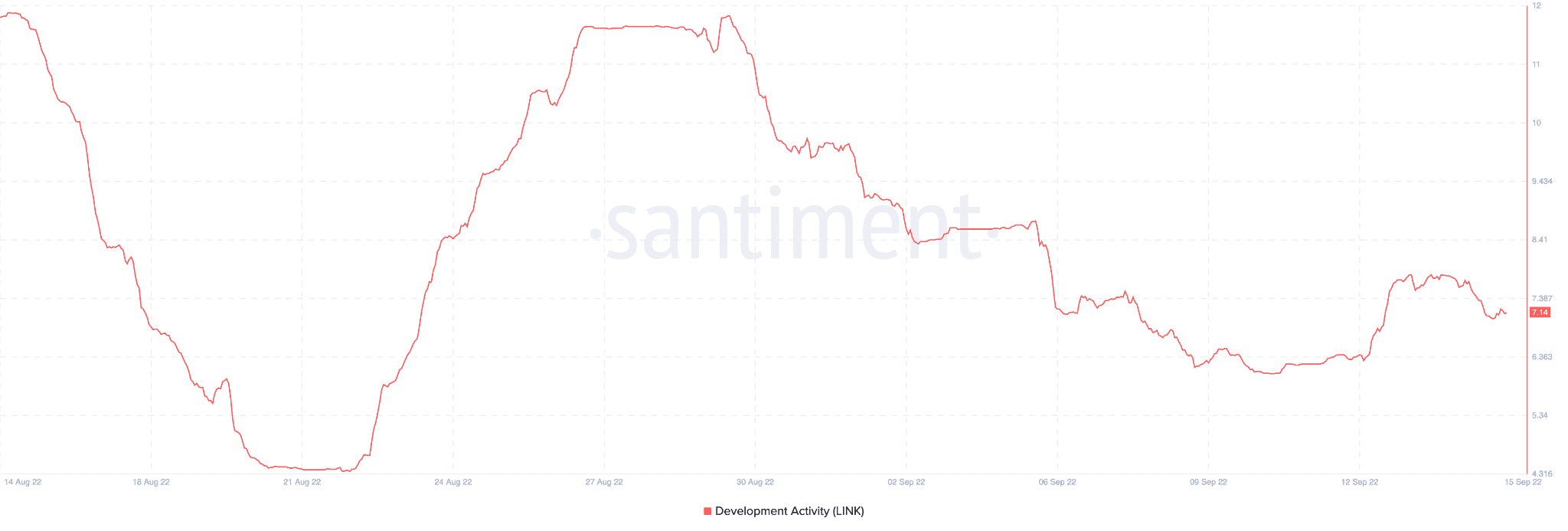

Another development that could alarm investors could be the decline in LINK’s development activity since the beginning of September. This clearly indicates that the developers haven’t been working on any new updates or upgrades.

Chainlink’s social media presence has similarly declined, with social media mentions decreasing by 30.21% and social engagement going down by 7.35%.

However, the drop in LINK’s strret cred has not slowed down the Chainlink team’s growth. They continue to partner with a variety of companies. Consider this- Chainlink stated on 15 September that they will be cooperating with freelancing site Lanceria labs to confirm transactions on-chain in order to lock and release user funds based on the progress of a job.

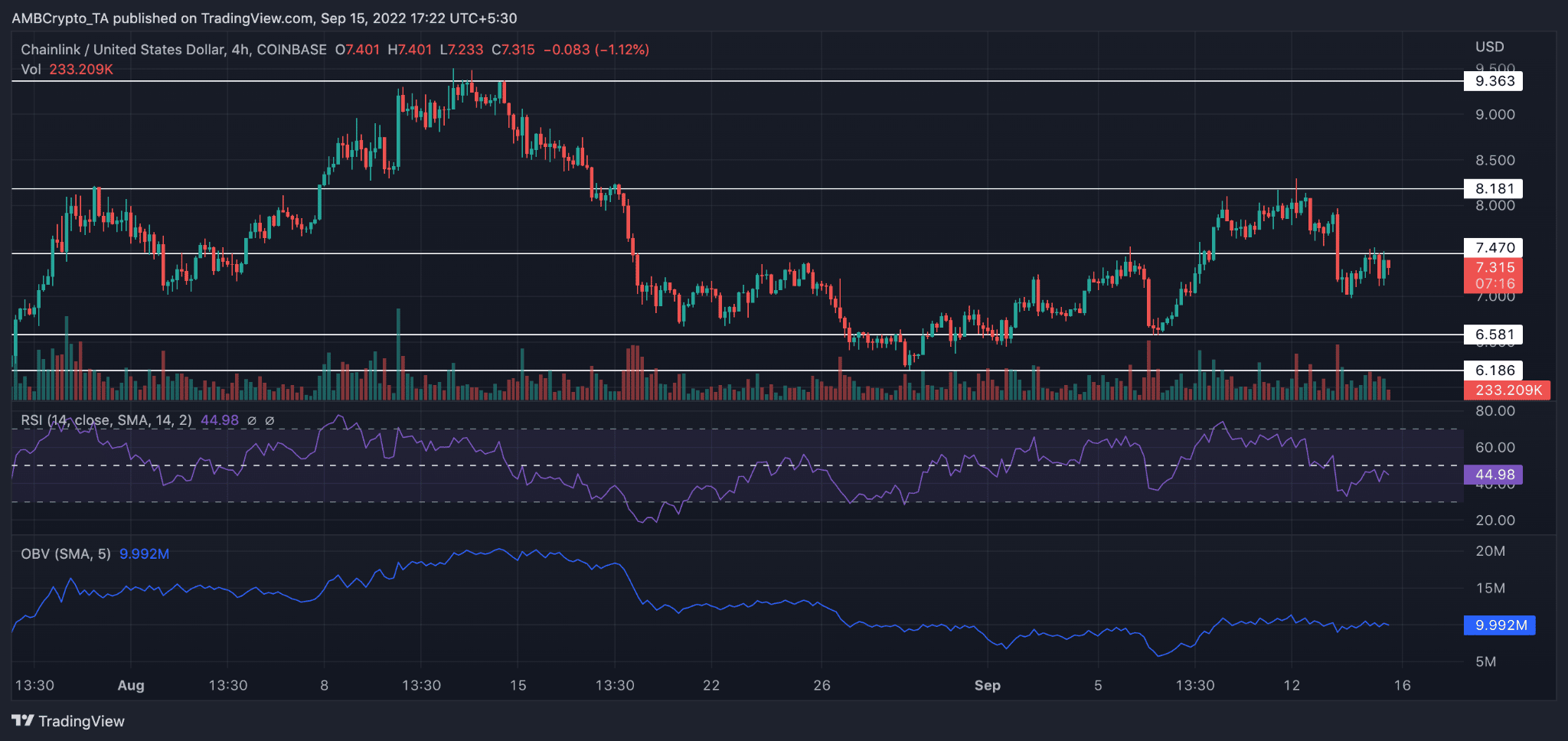

That said, Chainlink’s price has seen quite a lot of volatility in the past few weeks.

The price went as high as $9.36 on the 13 August and then came down to a low of $6.186 on 29 August.

The price at press time on 15 September was trading at $7.31. It seemed like the LINK’s price won’t be making any massive movements any time soon.

The RSI was at the 44.98 mark which indicates that the momentum was with the sellers. However, the OBV moved sideways.