Chainlink [LINK] investors should know this before taking a position

Chainlink has always been lauded for its services, even when it doesn’t perform as per expectations. Now, due to its popularity among Defi protocols, it was being expected that the token will recover on the price charts eventually.

However, with time this expectation has withered, and now investors are realizing what they’ve really got themselves into.

Chainlink loses value and investors’ support

Chainlink, trading at $11.3, is not only 380.33% away from its all-time high but is also at the lowest level in 17 months. The last time LINK visited these levels, the altcoin was just about to begin the bull run, which is far from happening this time around.

Chainlink price action | Source: TradingView – AMBCrypto

The single biggest concern right now is that since LINK is already facing bearish reactions from the community, it has become very vulnerable to investors exiting the Chainlink market.

This is supported by the fact that LINK traders are exhibiting the highest levels of negative sentiment witnessed in almost three months.

Chainlink investor sentiment | Source: Santiment

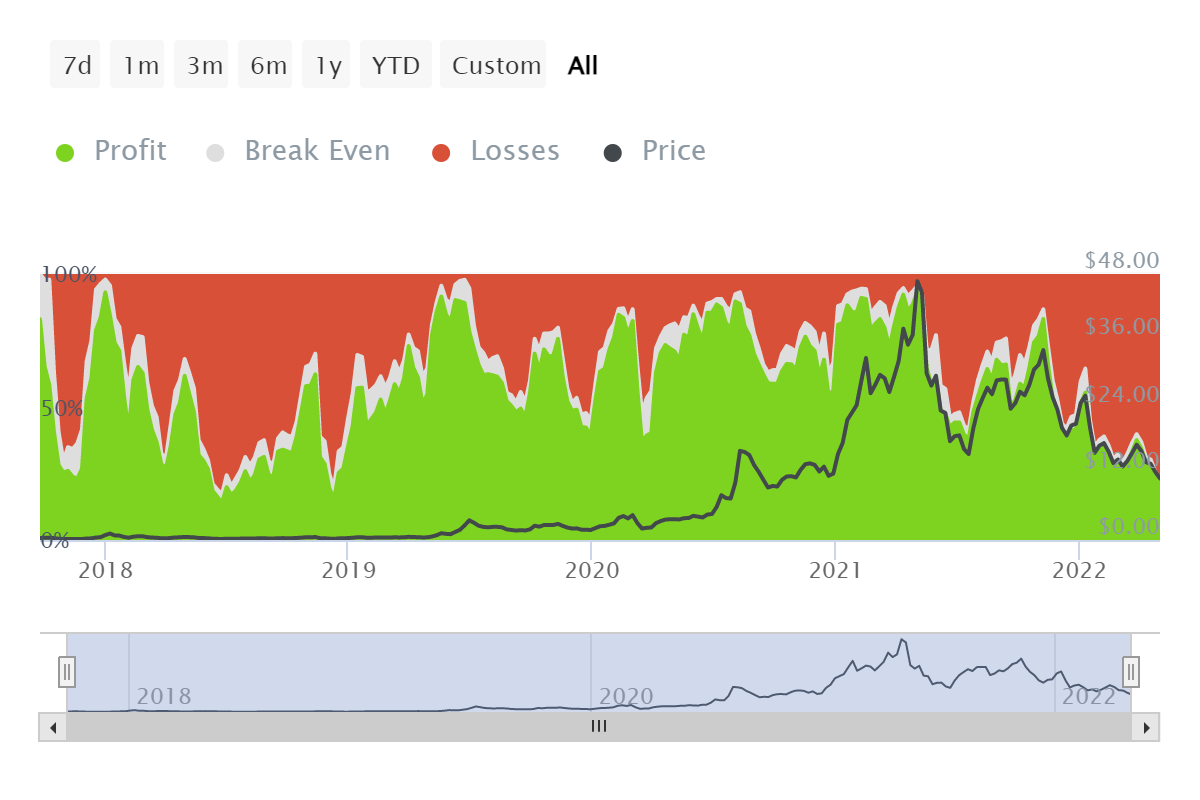

Secondly, despite multiple attempts at saving its investors, LINK continues to lose its money, sending 528k investors into losses. These people represent 82% of all the holders that have infused their time and money into Chainlink.

This is the most problematic situation since LINK investors have actually never witnessed such a phenomenon. The last time so many investors were facing losses was back in December 2018.

Chainlink investors in losses | Source: Intotheblock – AMBCrypto

Thus, this could create panic and FUD within the market, which according to Santiment, is actually a good thing. The analytics platform believes that capitulation and FUD signs are being formed at the moment, which could flip the bearish trend since, historically, prices usually bounce in these scenarios.

However, it must be noted that the altcoin is being pulled back by the broader market as it is sharing a pretty high correlation with Bitcoin at 0.96. Since the king coin isn’t setting up an immediate recovery, it doesn’t seem likely that Chainlink will rise by much either.

Chainlink correlation to Bitcoin | Source: Intotheblock – AMBCrypto

But this correlation could be a boon as well if Bitcoin decides to chart a path back to $50k.

![Polygon's [POL] short-term momentum faces strong resistance HERE](https://ambcrypto.com/wp-content/uploads/2025/03/Polygon-Featured-400x240.webp)