Chainlink [LINK]: Will $7.2 support hold steady? Analyzing…

![Chainlink [LINK]: Will $7.2 support hold steady? Analyzing...](https://ambcrypto.com/wp-content/uploads/2023/03/nina-luong-IOwItPmnkyU-unsplash-scaled-e1677659090852.jpg)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- LINK has been making lower lows in the past few days.

- There was positive sentiment and demand, which could boost short-term bulls.

Chainlink [LINK] looks hopeful despite prevailing challenges. It has cleared most of the gains made at the start of the year. So far, it has plunged by 14%, dropping from $8.4 to a key $7.2 support. If the $7.2 support proves steady, bulls could be hopeful of a successful recovery.

Is your portfolio green? Check out the LINK Profit Calculator

LINK’s momentum declined

LINK’s market structure weakened as momentum declined further. LINK made lower lows in the past few days, sliding down the descending line (white, dashed). The Relative Strength Index (RSI) also remained in the lower ranges in the same period.

Near-term bulls could target the 38.20% Fib level ($7.516) if the RSI breaks above the equilibrium mark of 50. The recovery seen at press time could be accelerated if Bitcoin [BTC] breaks above $23.86k. But bulls must clear the obstacle at $7.4 (above the 26-period EMA).

Failure to close above the 26-period EMA could tip bears to regain entry into the market. Short-term sellers could look to book profits at the 23.60% Fib level ($7.309) or $7.2 support. The descending line or the 0% Fib level could check a drop below the support.

The RSI value was 50, showing a neutral market structure. On the other hand, the Chaikin Money Flow (CMF) has been hovering slightly above the zero line since 24 February, indicating that bulls made a series of unsustainable recovery attempts.

Read Chainlink’s [LINK] Price Prediction 2023-24

LINK saw improved investors’ confidence and an accumulation trend

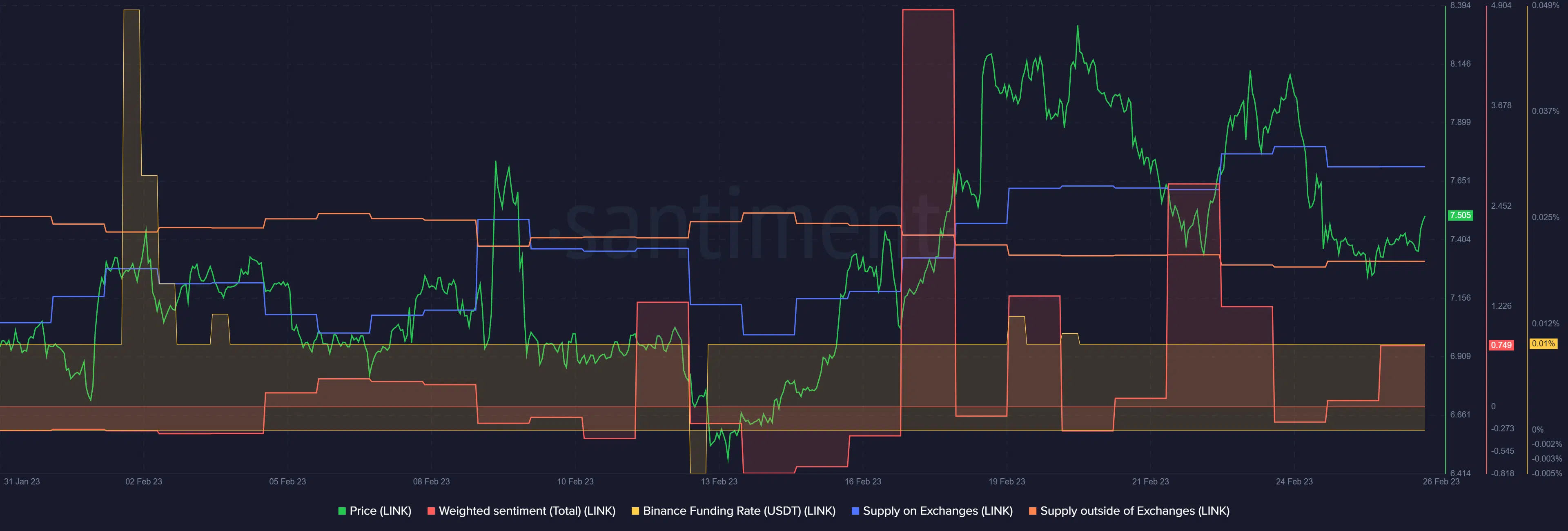

According to Santiment, LINK’s supply on exchanges dropped and stagnated, indicating reduced short-term pressure throughout last week (from February 25). Moreover, the supply outside of exchanges spiked, indicating increased short-term accumulation in the same period.

LINK’s positive weighted sentiment shows investors’ confidence in the asset improved and further reinforces the above accumulation trend. So, if the trend continues, the recovery could push LINK to retest the 38.2% Fib level ($7.516). But bulls may only be confident of such a move if BTC breaks above $23.86k.