As Chainlink explodes on charts, here’s what LINK investors are up to

- LINK’s demand climbs to new highs.

- The price uptick has led to a surge in profit-taking activity.

Chainlink [LINK] has seen a significant surge in active addresses over the past month, rising by over 220%, on-chain data provider IntoTheBlock noted in a recent post on X (formerly Twitter).

$LINK is one of the biggest gainers in terms of active addresses in the past month, surging over 220%!

?https://t.co/3nznGS2KGa pic.twitter.com/AFqIP9Xifp— IntoTheBlock (@intotheblock) November 10, 2023

Likewise, new demand for the asset has climbed by 211% during the same period.

According to data obtained from Santiment, on 9th November, LINK saw the creation of 3044 new addresses, its highest daily count since July.

The growth in LINK’s network activity in the last month is due to the market’s general rally. Benefiting from the same, LINK’s price has increased by 108% in the last 30 days.

At press time, the altcoin traded at $15.04, its highest price level since 14th April, according to data from CoinMarketCap.

LINK holders are mostly interested in taking profit

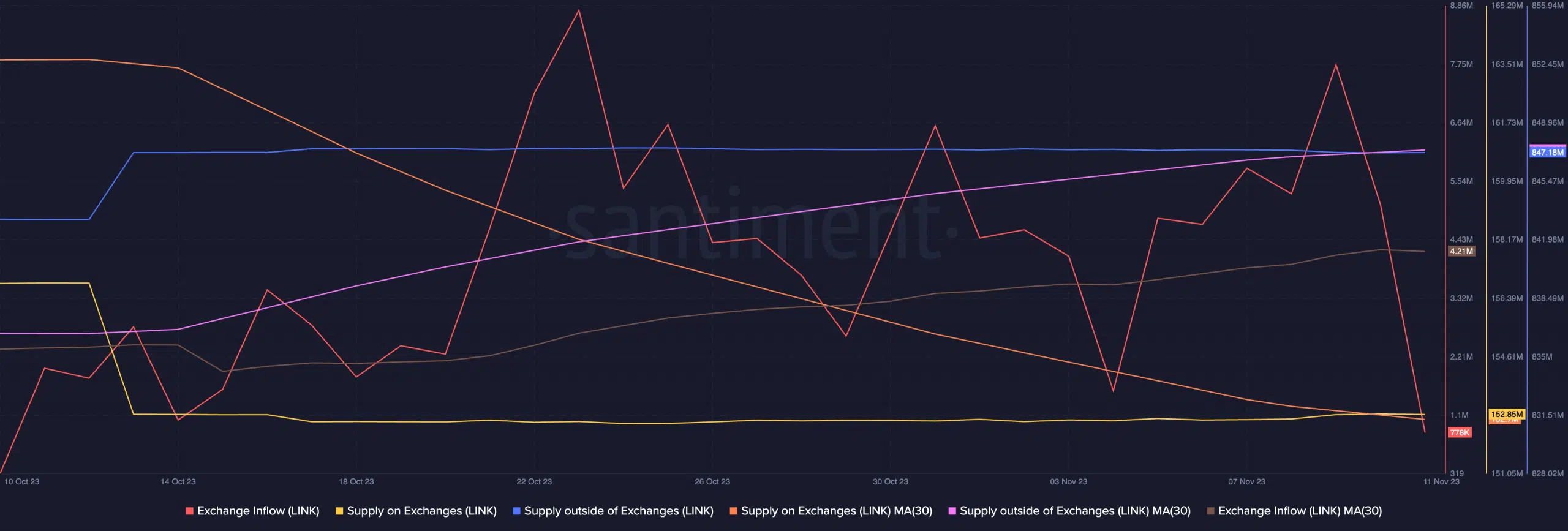

With the alt trading at a multi-month high, LINK holders have increasingly sent their tokens to crypto exchanges for onward sales. An assessment of the alt’s exchange activity revealed a steady inflow of LINK tokens to exchanges since the rally began.

LINK’s exchange inflow observed on a 30-day moving average has grown by 17%, according to data retrieved from Santiment.

This has driven up the token’s supply on exchanges by 0.1%, resulting in a corresponding 0.02% decline in its supply outside of exchanges during the same period.

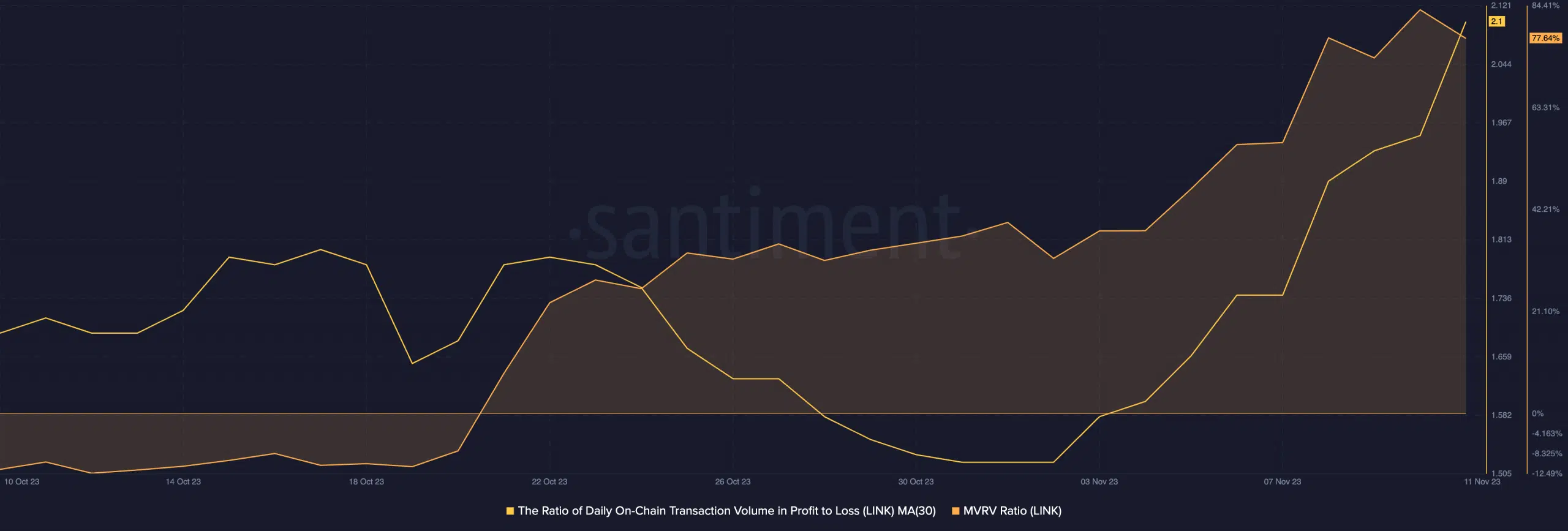

Token holders have been incentivized to distribute their holdings due to how profitable LINK transactions have been since the rally began. Data from Santiment showed the daily ratio of LINK transaction volume in profit to loss to be 2.1 (30-day MA) at press time.

Read Chainlink’s [LINK] Price Prediction 2023-24

This indicated that for every LINK transaction that has returned a loss in the last month, 2.1 transactions have ended in profit.

Likewise, with a Market Value To Realized Value ratio (MVRV) of 76.29% at press time, LINK’s current market value was higher than the average price at which it was last purchased. Hence, most holders could expect a minimum return of 76.29% on their initial investments.