Chainlink: This ‘good news’ can help LINK go up for a bull ride

The price of Chainlink [LINK] has been in a downtrend for quite some time now. Over the last seven days, the #27 ranked cryptocurrency witnessed a 19% correction as per CoinMarketCap. The altcoin further fell to the low of $11.83 and witnessed a dip in the number of holders.

What’s in store for me?

Given the low enthusiasm, Chainlink trader sentiments hit a three-month low as prices reached the lowest levels since December 2020. As per the graph below, LINK’s weighted sentiment had fallen back into negative territory and clocked in at -0.651.

In a May tweet, Santiment, contrary to popular opinion, saw this as a sign of ‘Capitulation’.

“The good news is that capitulation and #FUD signs are forming amongst traders, with sentiment dropping to 3-month low negative levels. Prices typically bounce in these scenarios.”

But is that actually the case?

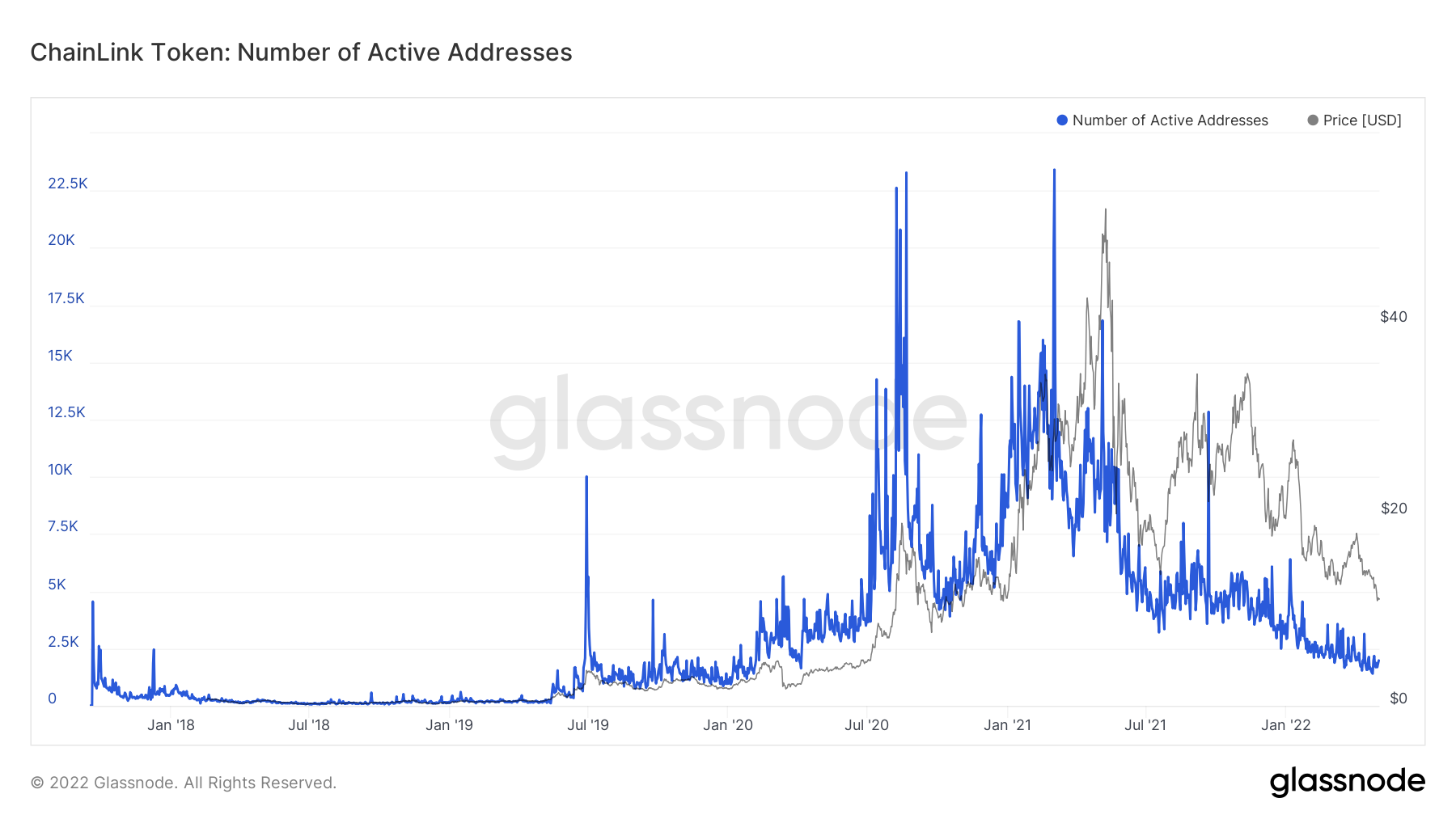

Investors or traders still could have a skeptical approach toward the flagship coin. Well, as per Intotheblock, 82% of holders witnessed massive losses. One of the reasons why the active addresses metric suffered the same fate. The graph below highlights the sheer decline in the number of active addresses.

Some sunshine at least

Extended negative weighted sentiment could sometimes trigger a rally. Well, this is the case as per CoinMarketCap- LINK saw a 3% surge as it traded at the $11.27 mark. Not only this, even the holders sensed this uptick as the number jumped from 660,492 to 660,666 just within a day.

Source: CoinMarketCap