Chainlink: Three white soldiers on LINK’s chart could mean this for investors

A cursory look at data from CoinMarketCap revealed that Chainlink’s native coin, LINK posted significant gains in the last 24 hours. Trading hands at $7.35 per LINK coin, the coin marked a 15% uptick in price. However, the on-chain analysis of the coin showed something different.

Yes, the price is up

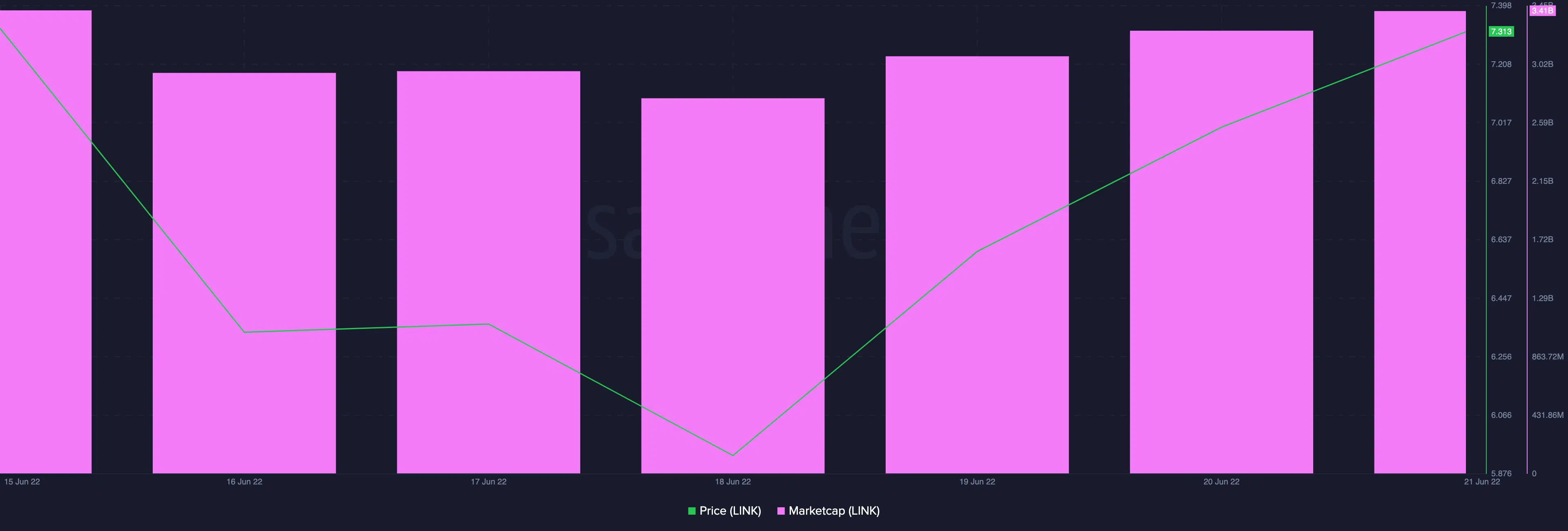

Data from CoinMarketCap showed a 15% growth in price per LINK coin in the last 24 hours. The price was $7.31 at the time of press. Trading volume also registered a 28.93% high, indicating increased trading activity across exchanges in the last 24 hours. The market capitalization, pegged at $3.43b, also saw an uptick within the past 24 hours.

The uptick in price has resulted in three consecutive daily green candles, pointing out an ongoing bullish bias for the coin. At press time, the relative strength index (RSI) was in an uptrend at 51.

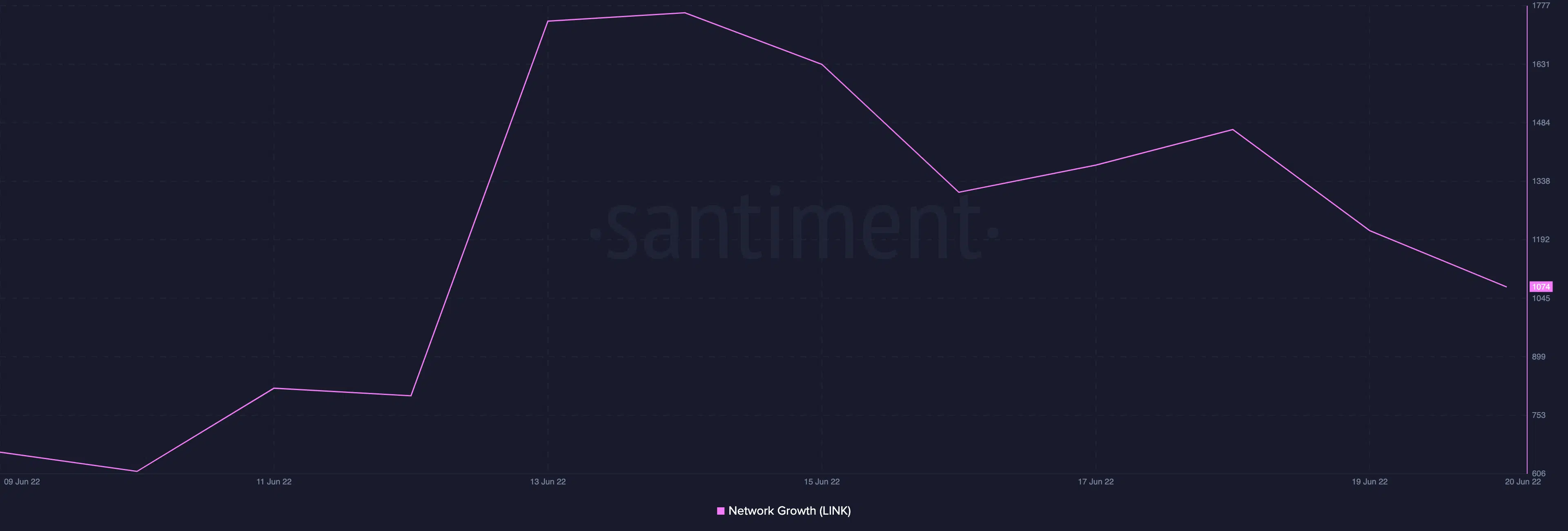

Despite its recent price rally, the on-chain analysis revealed a concerning pattern about the performance of the LINK coin. For one, the number of new addresses created on the network daily has taken a dip in the past week.

At 1074 at press time, the network growth has registered a 61% drop in just about seven days.

Also, the number of unique addresses involved in LINK transactions daily declined since 13 June. After registering a high of 4644 on 13 June, the number of addresses transacting LINK coins gradually declined to be parked at 3254 at press time.

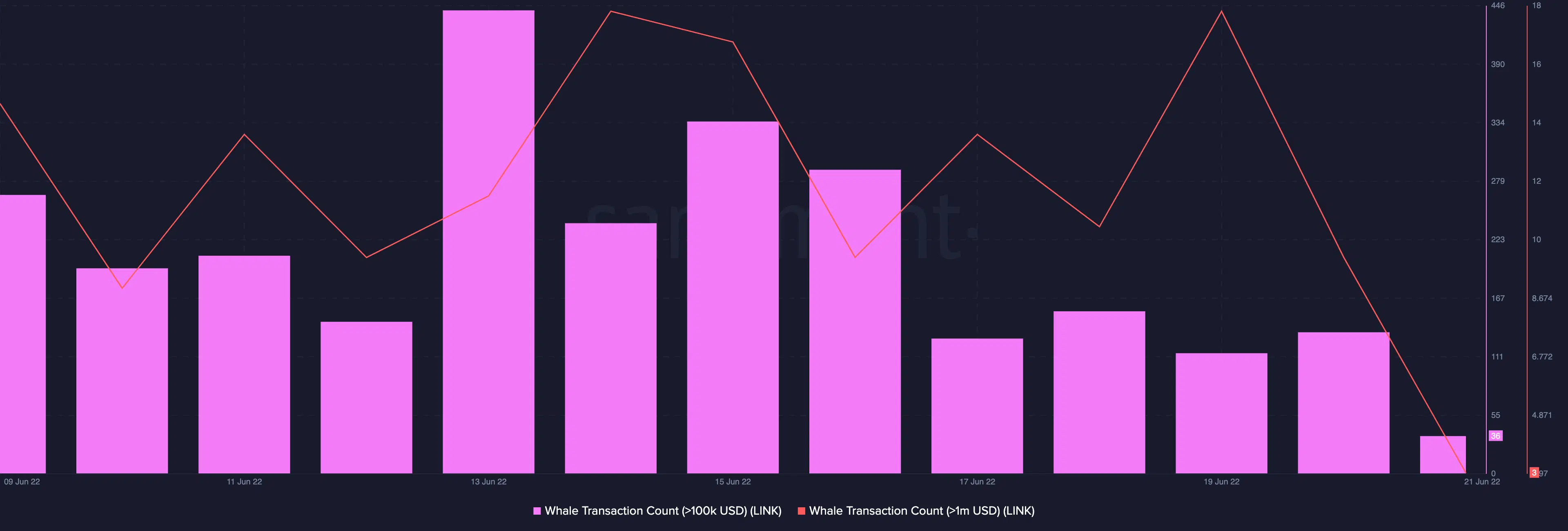

Furthermore, during last week’s bloodbath, whales gradually reduced the accumulation of LINK coins. As per data from Santiment, the transactions count for whale transactions above $100 thousand saw a 91% decline in the last seven days.

This stood at 36 at press time. On the other hand, the count for whale transactions that exceeded $1 million, after seeing a drop between 13 May and 18 May, jumped to a high of 18 transactions by 19 June. However, it declined by 83% since.

Another metric worthy of note was the exchange flow balance which stood at a negative value at press time. At a negative 204k at the time of writing, a price retracement is imminent as more LINK coins are taken out of exchanges.

Adoption continues to grow

This Oracle continues to enjoy adoption across several other blockchains and protocols as the demand for its services grows. For example, last week, there were 22 integrations of Chainlink services across five different chains such as Avalanche, BNBChain, Ethereum, Moonbeam, and Polygon.

⬡ Chainlink Adoption Update ⬡

This week, there were 22 integrations of 4 #Chainlink services across 5 different chains: #Avalanche, #BNBChain, #Ethereum, #Moonbeam, and #Polygon.

Chainlink enables a world powered by cryptographic truth. pic.twitter.com/Eqqv7dtYSX

— Chainlink (@chainlink) June 19, 2022