Chainlink, Vechain, Crypto.com Coin Price Analysis: 15 February

Bitcoin’s price after having traded very close to the $50,000 level in the past 24-hours seems to have lost a bit of bullish momentum and currently trades close to the $47,500 level at press time.

Source: CoinStats

In sync with Bitcoin’s price action, many of the market’s altcoins too noted price dips in the past 24-hours. Popular altcoins like Chainlink, Vechain, and Crypto.com Coin also saw minor dips in the past day’s time and are trading close to their immediate supports.

Chainlink [LINK]

Source: LINK/USD, TradingView

Chainlinks’s price fell by over 7 percent and currently trades at $32.03 with a market cap of over $13 billion. While the past week saw the coin surge, the past day’s time has seen LINK endure a minor price correction. At press time the coin trades close to its immediate support at $29 and if the bearish sentiment were to continue, then LINK may require assistance from its second support around the $26 price level.

The RSI indicator for the coin is now in the neutral zone after having spent quite a significant amount of time in the overbought zone. The MACD indicator recently underwent a bearish crossover with the signal line going above the MACD line – a common sign that the price may soon witness a price correction.

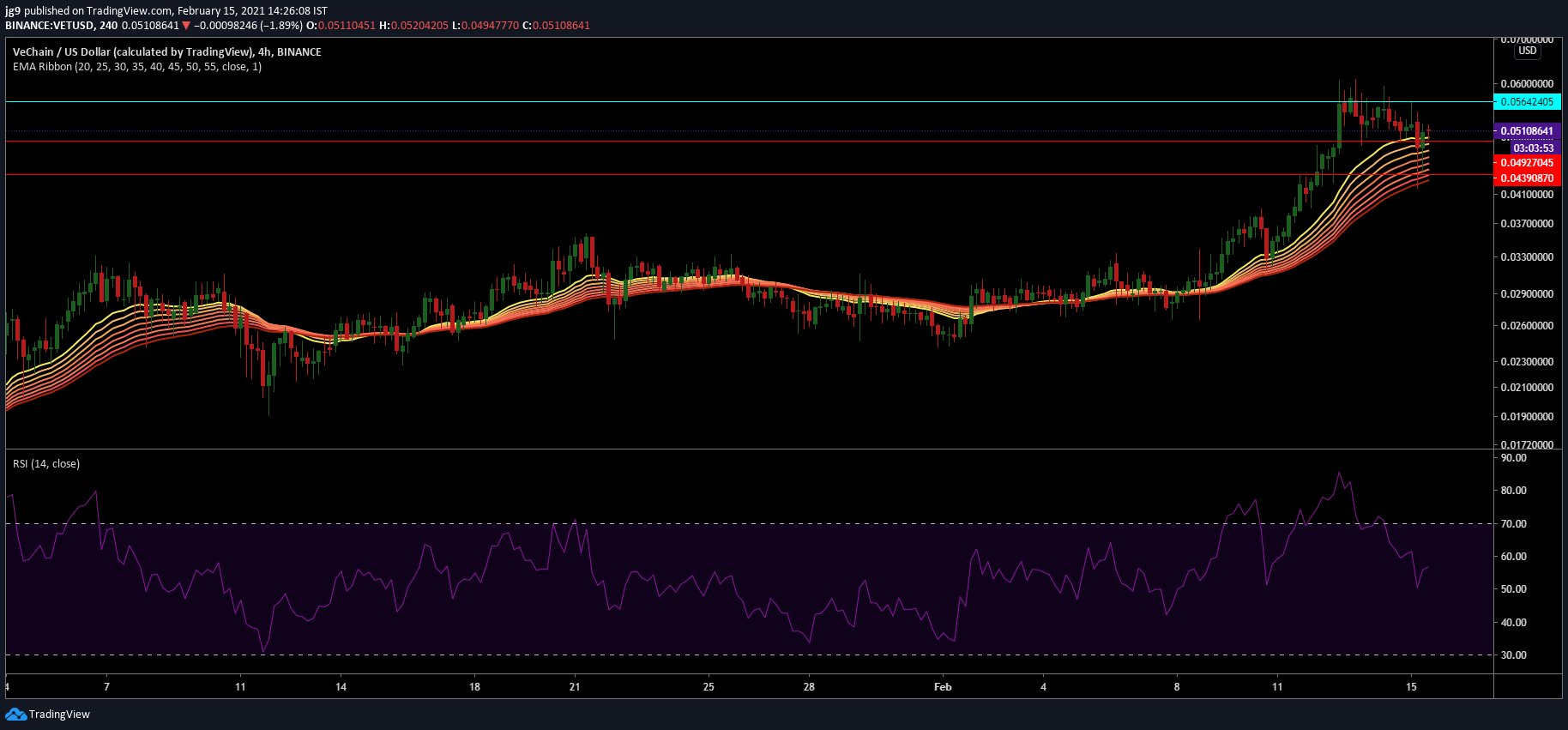

Vechain [VET]

Source: VET/USD, TradingView

Vechain’s price fell by over 4 percent and now trades at $0.05. The coin’s price is testing the support at $0.049 and if that support is breached a dip to the $0.043 range can be expected in the coming hours. However, if the bulls were to regain control, VET may soon be headed to try and breach the resistance at $0.056.

The EMA ribbons have settled below the coin’s current trading price and are likely to offer support. The RSI indicator has retraced from the overbought zone and is now headed into the neutral zone.

Crypto.com Coin [CRO]

Source: CRO/USD, TradingView

CRO saw substantial bearish pressure in the past day’s time with the coin’s value depreciating by over 8 percent. The coin currently trades at $0.084 and has a market cap of $1.9 billion. The coin is close to testing the support at $0.081. However, if a reversal were to take place with the bulls back in control, then CRO will soon have to breach the resistance level of $0.094.

The Bollinger bands have expanded significantly indicating increased volatility in CRO’s market. However, the MACD indicator has undergone a bearish crossover indicating an upcoming price drop for the coin.

![Why Jupiter [JUP] could drop to $0.41: Analyzing price action](https://ambcrypto.com/wp-content/uploads/2025/03/Editors-25-400x240.webp)