Chainlink: Why a move to $18 is more likely than a fall

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- LINK’s breakout past the nearly 18-month range saw a further 60% rally.

- The evidence at hand pointed toward further gains but FOMO should be avoided.

Chainlink [LINK] bulls were active in the market and continued to drive prices higher in the past week. LINK nearly reached $16 in recent hours of trading before dipping to $13.59 after volatility sparked across the crypto market in the lower timeframes.

This might not faze the bulls. The buying pressure was increasing and the net deposit of LINK on exchanges was lower than the 7-day average.

AMBCrypto’s report on LINK’s price action dated 3rd November noted that a retracement to $8.14 or $9.5 before another rally was possible. Such a retracement did not occur, instead, prices rocketed past the $11.5 resistance since the 5th of November.

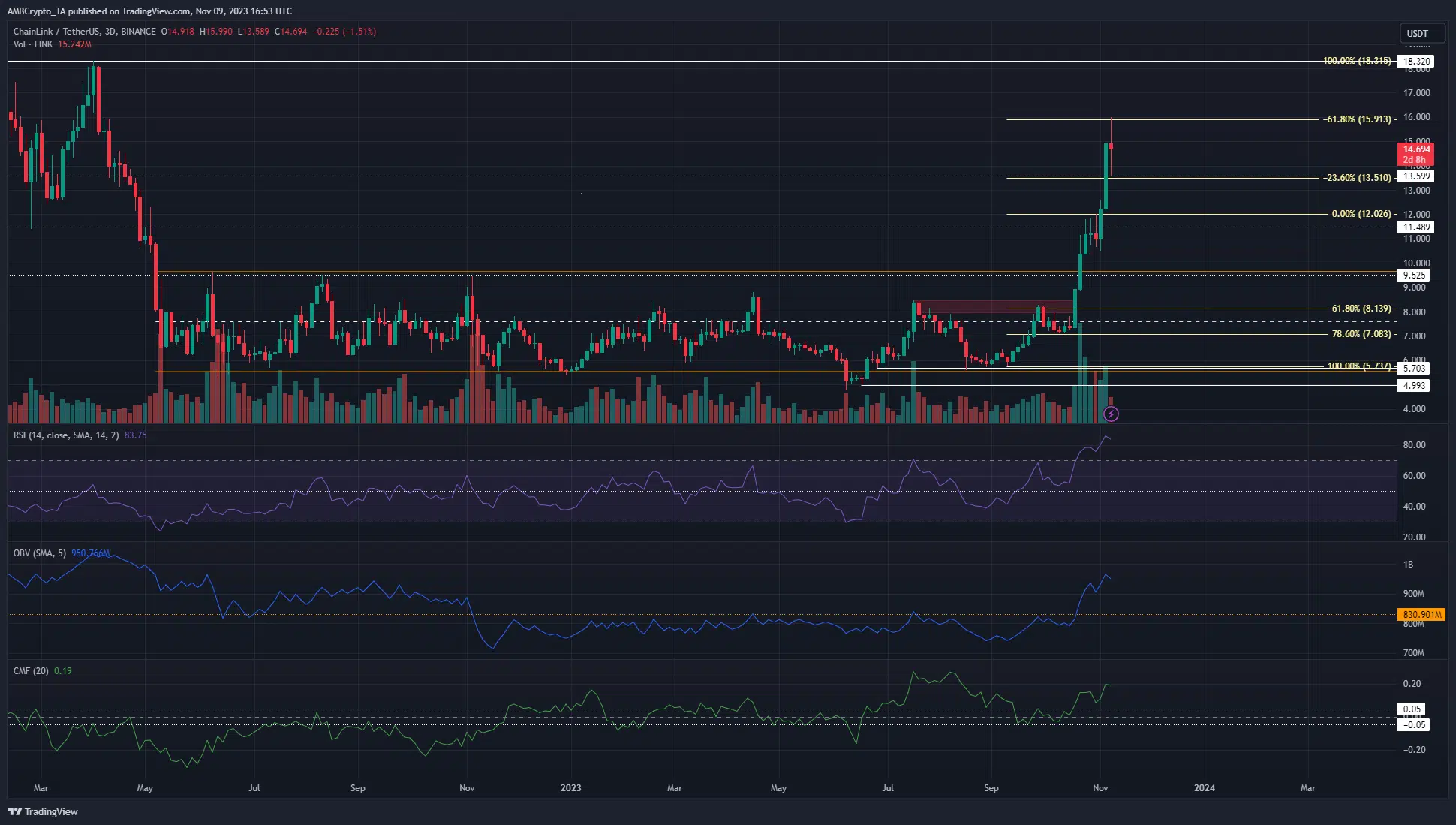

LINK prices are likely to climb higher according to the Fibonacci levels

The Fibonacci extension levels (pale yellow) plotted based on LINK’s breakout past the range (orange) at $9.5 showed the levels were still valid. The 61.8% extension level at $15.91 was close to the $15.99 local high that LINK registered in recent hours before plunging to $13.59.

However, the bulls were still solidly in control. The market structure on the three-day chart was bullish, and the RSI reading of 83 reflected vigorous effort from the buyers in recent weeks.

The On-Balance Volume was climbing higher and had also beaten a resistance level from November 2022. Therefore, further gains were likely in the long term. The Chaikin Money Flow (CMF) also showed high capital inflow to the LINK market.

Beyond $16, the $18.315 level was the next target as the 100% Fib extension level. It also lined up with a resistance level on the weekly chart at $13.2. Meanwhile, the $11.5 and $12.6 levels could serve as support in case of a retracement.

The MVRV reaches a high previously visited in February 2021

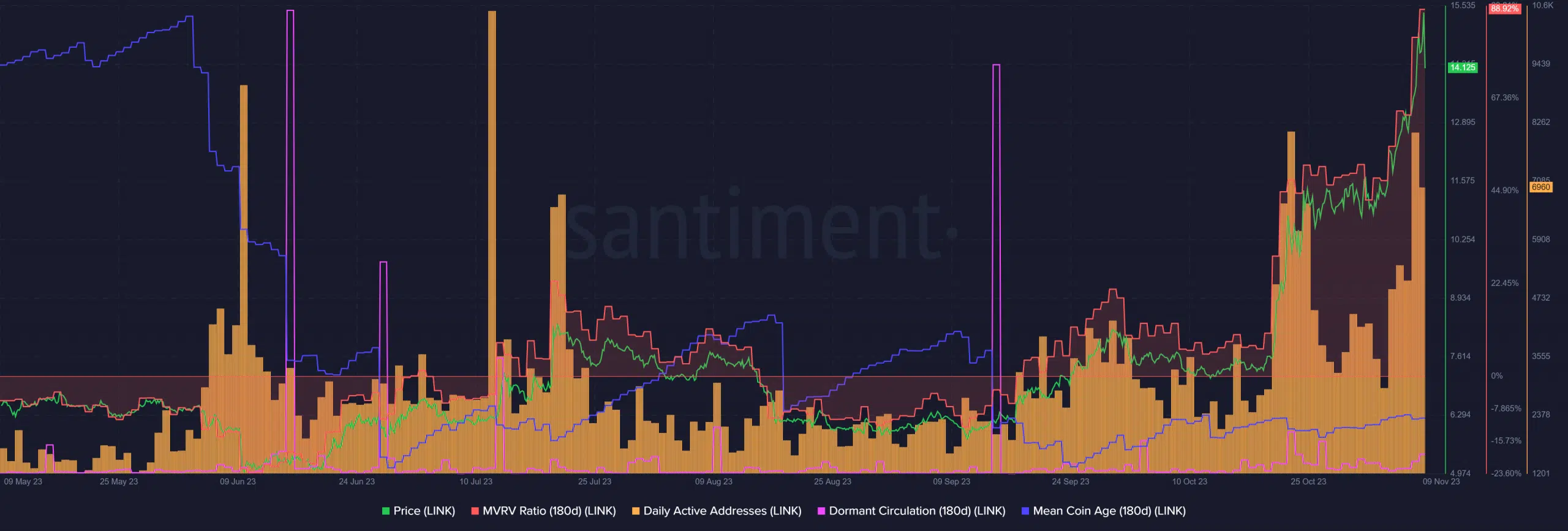

Source: Santiment

A rising MVRV ratio means that more holders are at a profit and increases the likelihood of selling pressure from current holders. At press time, MVRV was at 88.92%. On 10th February 2021, it was at 89.38% and LINK was trading at $32.

Read Chainlink’s [LINK] Price Prediction 2023-24

LINK reached $50 a few months thereafter, which meant a high MVRV does not guarantee a market top. However, investors should be aware that booking profits on their LINK tokens could be a good idea.

The daily active addresses have also been rising since October, while the dormant circulation saw no significant spikes. This meant there were no waves of selling pressure mounting just yet. On the other hand, the downtrend of the mean coin age since September was a concern.