Chainlink’s SWIFT uptick in price and everything latest to know

Interbank messaging system SWIFT on 28 September announced its partnership with Chainlink to work on a proof-of-concept (PoC) project.

It will incorporate Chainlink’s Cross-Chain Interoperability Protocol (CCIP) as an initial proof of concept. Thereby, commanding on-chain token transfers.

Ergo, with Chainlink’s help, SWIFT would deepen its foot in the cryptocurrency space. While this collaboration would help SWIFT, but can the same be told about Chainlink?

Making profits

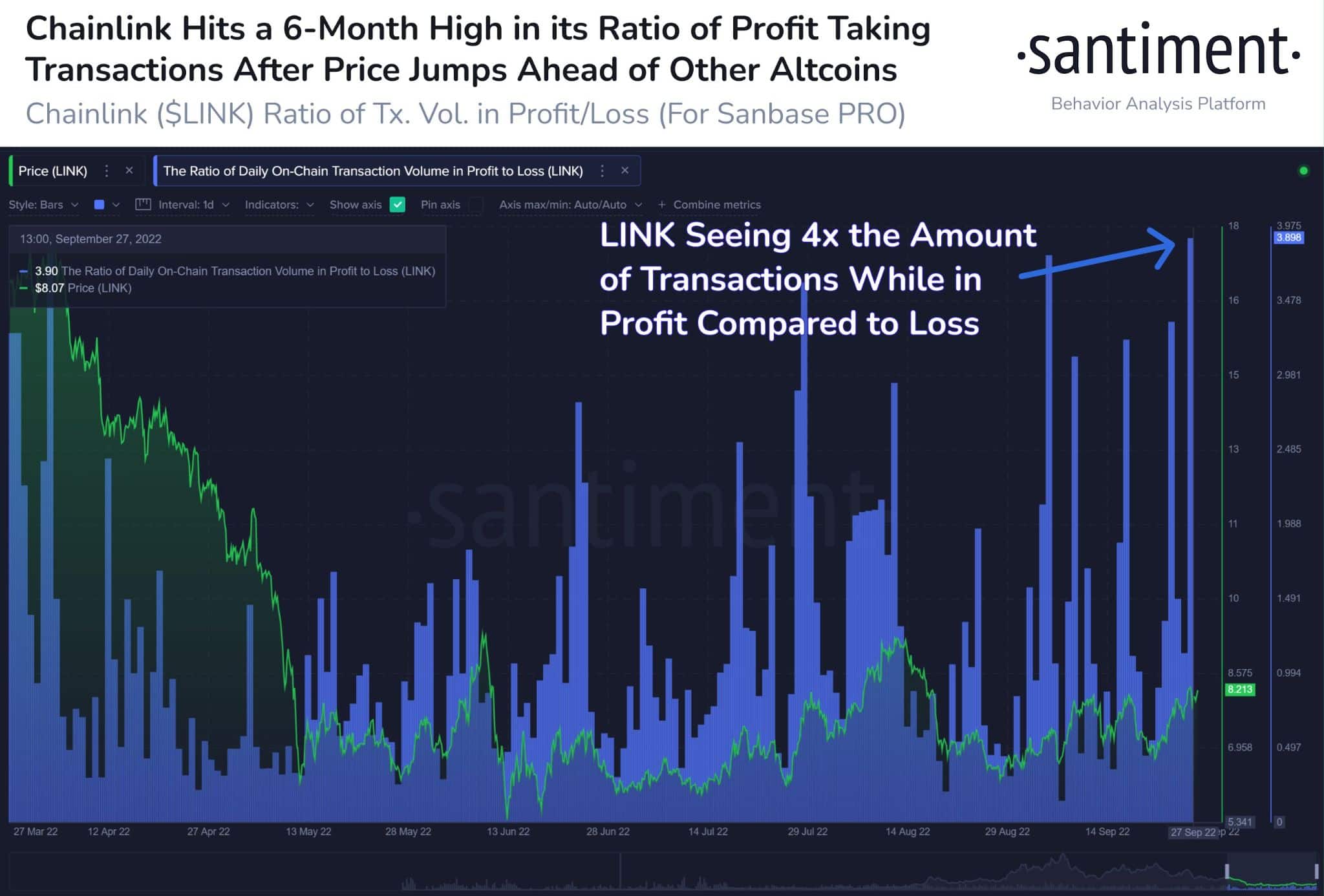

Santiment, a leading crypto analytics firm, stated in a tweet that a lot of Chainlink investors booked profits over the trades they made in the past. In the last few days, the number of profit-taking transactions increased by a tremendous margin.

This development could garner interest from other investors who are looking forward to booking a profit as well.

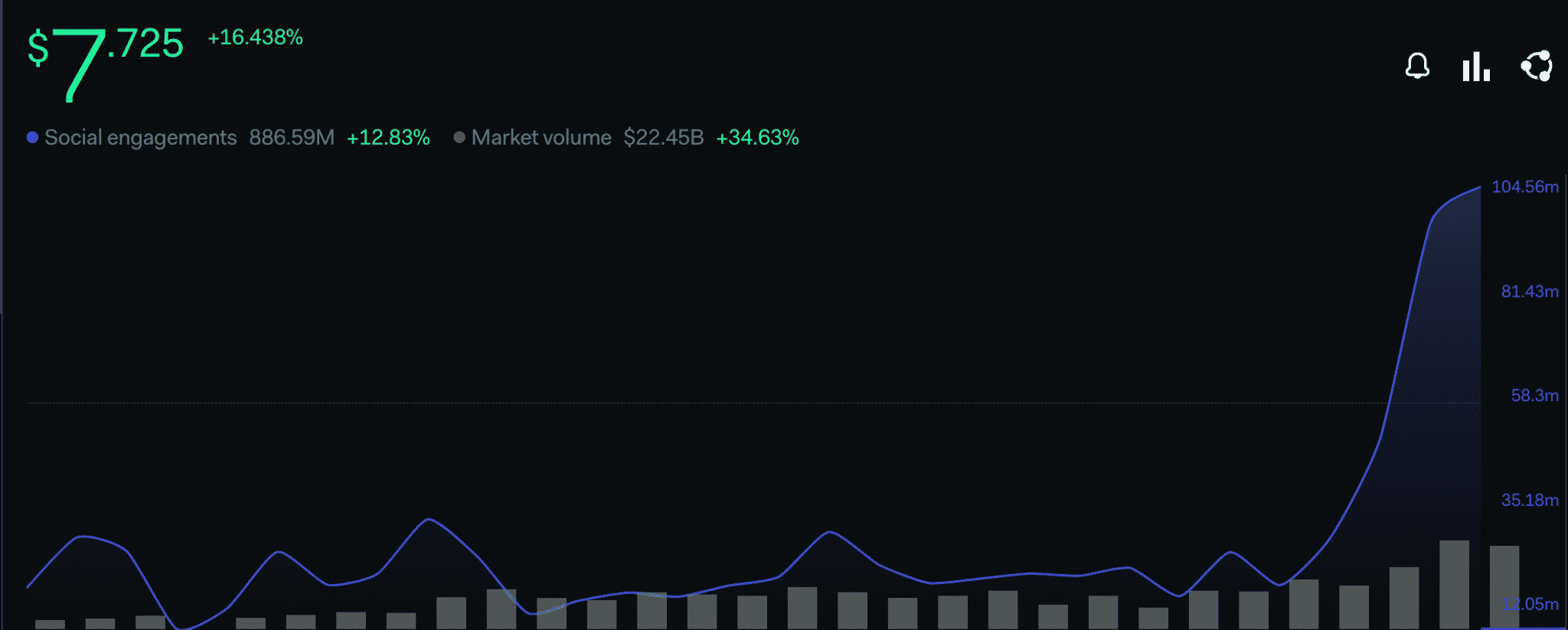

Furthermore, Chainlink grew in terms of social media presence in the last month. Likewise, Chainlink’s social engagements narrated a similar picture as the metric showcased a 12.83% growth.

Meanwhile, its weighted sentiment saw some volatility over the past month. This implies that public opinion has been both for and against the LINK over the past 30 days.

At press time, Chainlink’s weighted sentiment stood at 2.868, which implied that at the time of writing, the general view for Chainlink was positive.

Not all green here

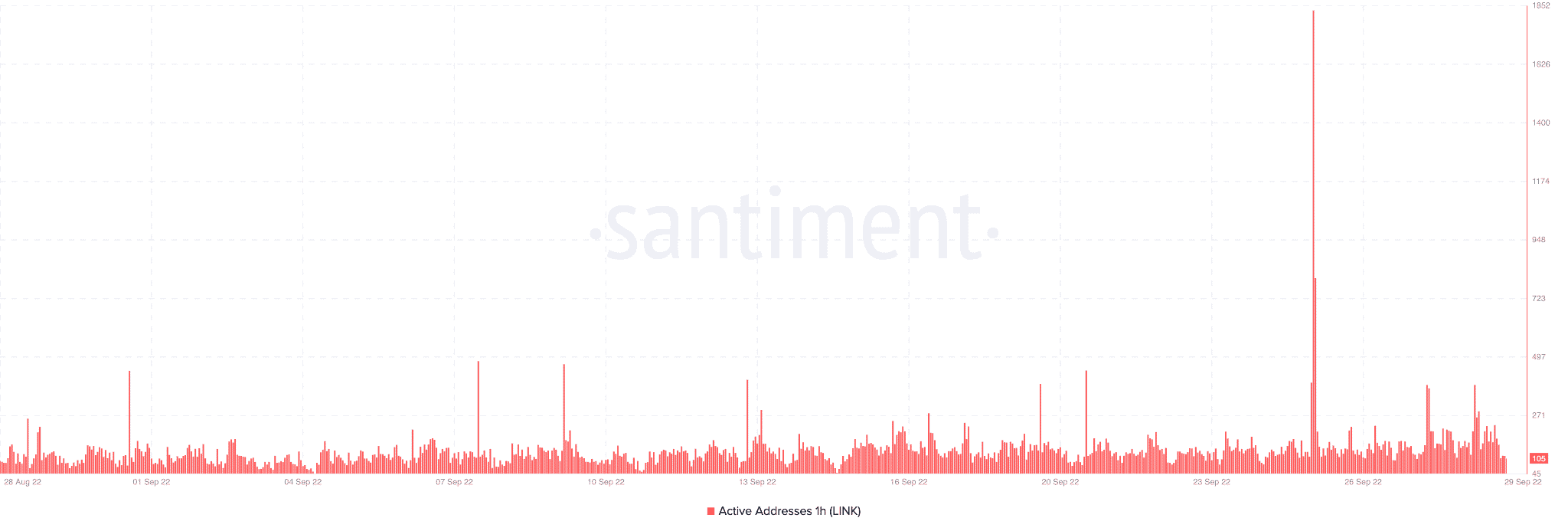

There have been some causes of concern as well. LINK didn’t quite show much growth in terms of the number of active addresses present on the network.

This could be perceived as a bearish sign by traders. But they should keep in mind that LINK had declined in volatility by 7.96% over the past week.

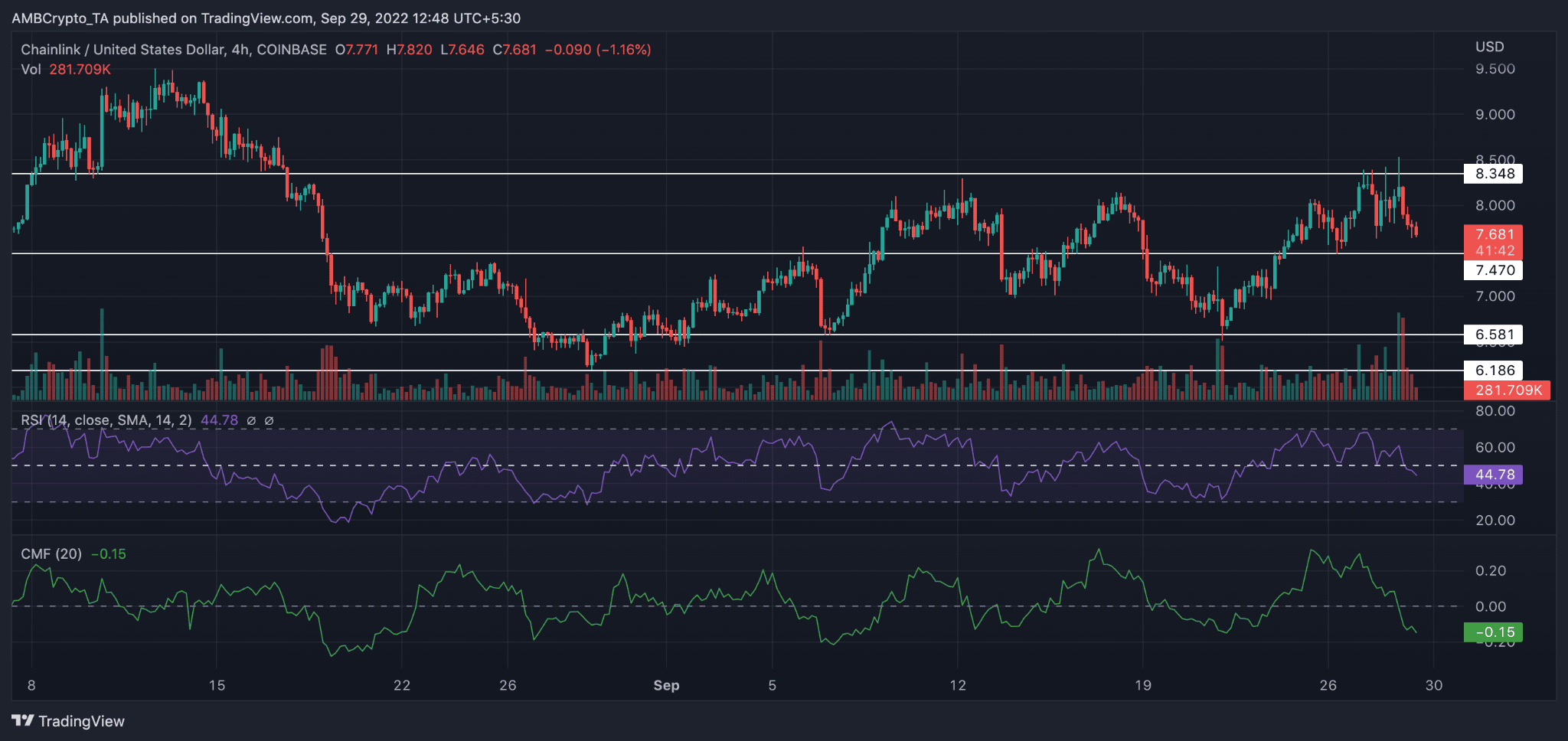

Speaking of price action, Chainlink was trading at $7.69 at press time and had depreciated by 3.16% in the last 24 hours.

Even though LINK had gone up by 15.57% since 22 September, the price had moved in a downward direction post 27 September. The RSI, at press time, was at 44.75 which indicated a slightly bearish future for LINK and implied that the momentum was mostly with the sellers.

The CMF had been depreciating as well and it was at -0.15 which could imply that the price movement could further go downwards.

Readers can look into other collaborations of Chainlink in order to get a better understanding of what the future holds for the crypto.

![Solana [SOL] gains on Ethereum [ETH] but faces sell-off risks](https://ambcrypto.com/wp-content/uploads/2025/04/5B92B32E-5F8B-49F6-94A3-D0086EF6CCA2-400x240.webp)