Changing stablecoin dynamics pique investor interest

- Stablecoin market cap fell to $124 billion as of 18 September, the lowest since August 2021.

- While BUSD was in its final phase, the market braced for the rise of FDUSD.

Stablecoins have received a lot of attention in recent years because of their unique combination of crypto-like decentralization and national currency-like stability. Many people in high-inflation regions around the world have attempted to use stablecoins to protect their investments.

Behind the cheerful exteriors, however, everything was not well with these crypto derivatives of fiat currencies, most notably the U.S. Dollar (USD).

Losing streak continues

According to the latest report by digital assets market data provider CCData, the total stablecoin marketcap recorded its 18th straight month of downfall in the month of September. The market cap fell to $124 billion as of 18 September, the lowest since August 2021.

Notably, the losing streak began with the sensational collapse of TerraUSD [UST] in 2022. As the bear market has dragged on, sentiment around stablecoins hasn’t been the same again.

Moreover, trading activity on centralized exchanges remained muted. Tight trading ranges of top assets like Bitcoin [BTC] and Ethereum [ETH] drove traders away, impacting on-ramping and off-ramping services.

Just about $174 billion in stablecoins were traded as of 18 September, with forecast of considerably lower figures than August’s tally of $462 billion.

Hits and misses

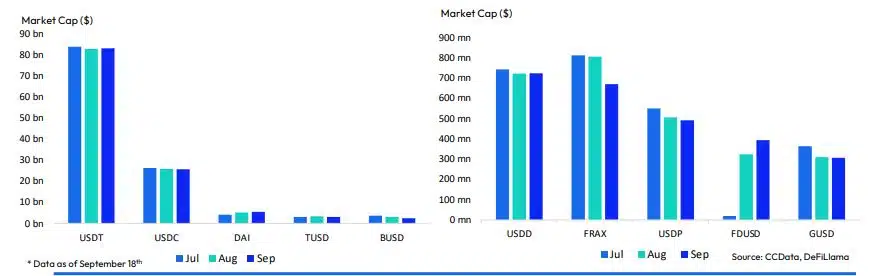

Tether [USDT], world’s largest stablecoin by market cap, turned it around in September after improving its market cap by 0.23% to $83 billion. Recall that USDT recorded its first decline in market cap in nine months in August.

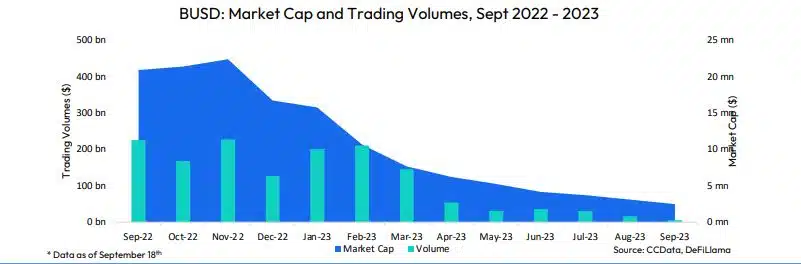

On the other hand, Binance USD [BUSD], which was probably in the last chapter of its existence, saw its market cap plunge by a whopping 19% to $2.49 billion. This was the tenth consecutive month of decline for the Binance [BNB]-branded stablecoin. Binance stated that it would end support for BUSD by February 2024.

But while BUSD makes the exit, the focus shifted to other Binance-backed stablecoins. First Digital USD [FDUSD], which made its debut on Binance in July, was the third-largest stablecoin on the exchange by volume in September.

Furthermore, its market cap rose 21.5% to $394 million in the month.

Binance has gone all guns in promoting FDUSD, part of which included the popular zero fee trading program covering all the spot pairs.

However, not-so-good news came from payments giant PayPal’s PayPal USD [PYUSD], which was launched with much expectation last month. The stablecoin has clearly underperformed and could only secure a market cap of $8.46 million as of 18 September.

That being said, it could still be early to pass judgements, as the report mentioned that PYUSD volumes and market cap could increase as more trading pairs start getting listed across different platforms.