Cardano: What a good or bad April depends on after ADA’s 5% crash

- The project has struggled to attract new holders while addresses decreased their balance.

- ADA’s momentum tanked, indicating that the price might drop to $0.54.

Cardano’s [ADA] position as the 9th most valuable cryptocurrency might be at risk. For many, this could be because of the price action which AMBCrypto agrees with. But there was more to this than the value of the token.

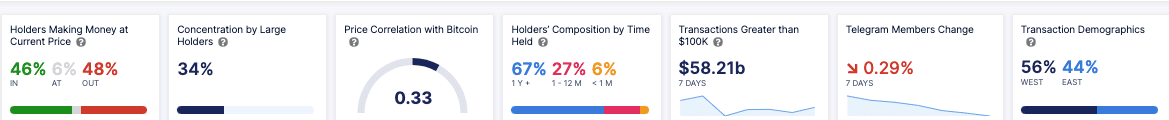

According to data from IntoTheBlock, only 6% of the ADA holder composition appeared in the last 30 days. Around 27% of the total holders bought the token within the past 12 months while 67% were long-term faithfuls.

Doubt spreads in Hoskinson’s land

A situation like this implies that the Cardano native token has not been impressive enough to attract an influx of new holders. As mentioned earlier, the price was one of the reasons.

In the last 30 days, ADA’s price has decreased by 17.84%. It got worse as the cryptocurrency failed to defy the broader market nosedive, decreasing by 5.34% in the last 24 hours.

However, we found that ADA’s challenges were not with traction or adoption alone. Instead, the token was finding it hard to keep some of the already-existing holders from exiting the network.

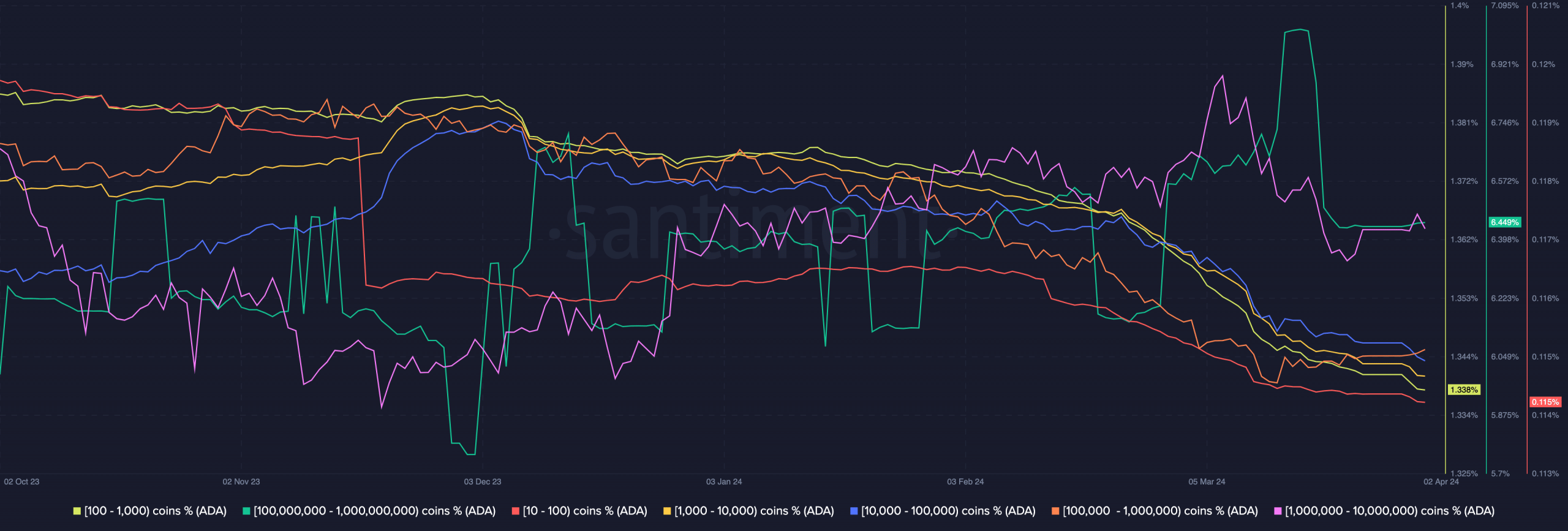

On-chain analysis using Santiment data showed that those who hold between 10 to 10,000 ADA tokens have been decreasing their balance. A further assessment of the balance of addresses showed that whales were not left out.

At press time, the 1 million to 1 billion holding cohorts have also liquidated some of their tokens. Whenever this happens, it signals decreasing trust in the short to long-term potential of the token.

ADA targets more downturn

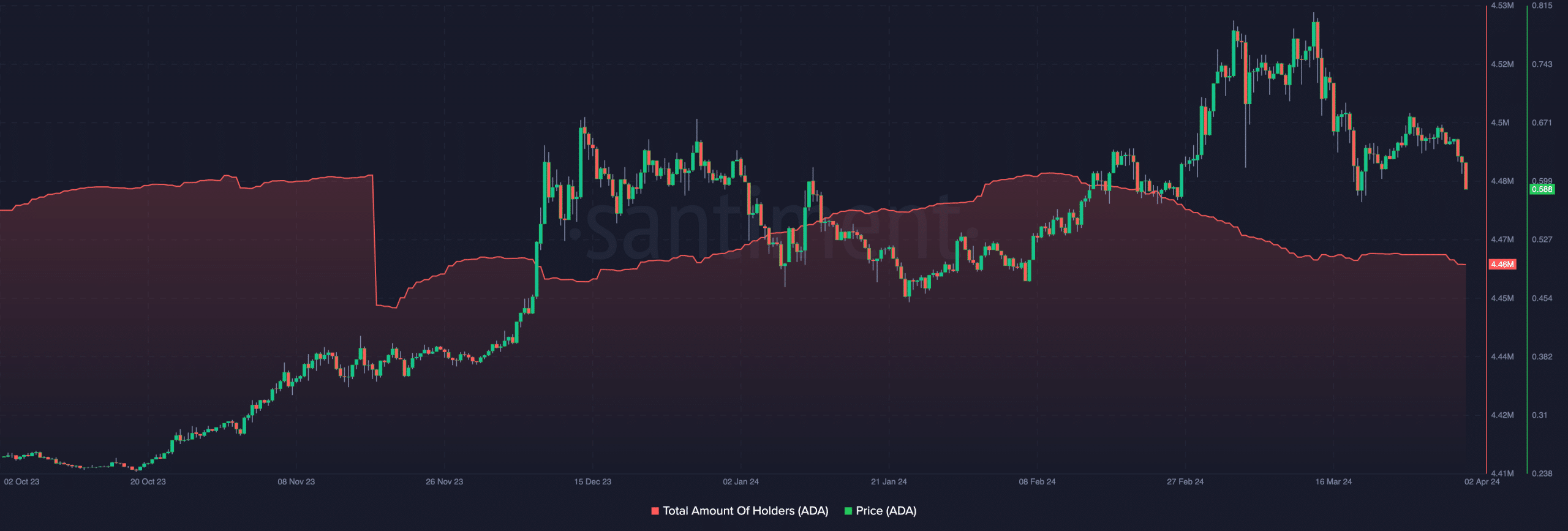

Another metric that reinforced the bearish outlook was the number of holders. On the 11th of February, the total amount of ADA holders was 4.49 million.

As of this writing, that figure has decreased to 4.46 million, meaning about 30,000 previous holders had left Cardano. This vote of no-confidence might worry the project.

However, a surge in its price could change the state. As such, AMBCrypto considered how ADA might perform in the short term.

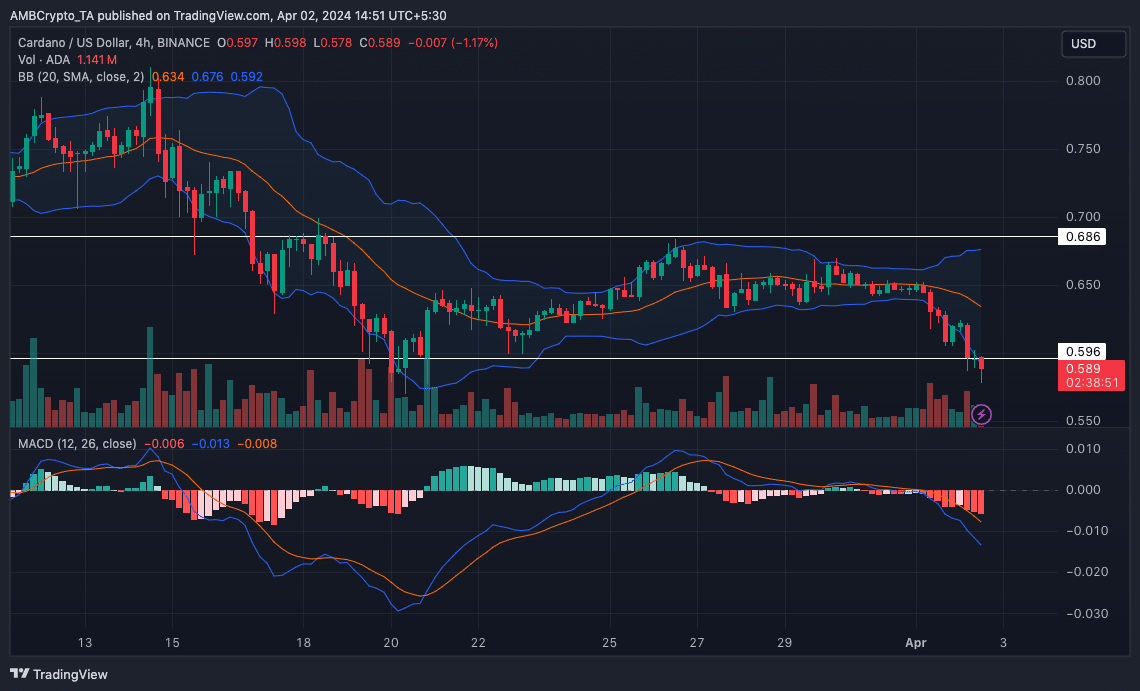

The ADA/USD 4-hour chart showed that the recent crash forced a loss of the $0.59 underlying support. Besides that, there was an overhead resistance at $0.68, formed on the 26th of March.

Indications from the Moving Average Convergence Divergence (MACD) showed that the momentum was bearish. With increasing volatility displayed by the Bollinger Bands (BB), Cardano’s price could plummet as low as $0.54.

Is your portfolio green? Check the Cardano Profit Calculator

Furthermore, the BB revealed that a bounce for ADA could see its price extend toward $0.65. But that would require a lot of buying pressure which the token lacked.

However, the bearish thesis for ADA might not drive to a yearly low. In January, the price of ADA dropped to $0.49. While further correction could be possible, the token might evade falling to the region.