Analyzing DOT after Polkadot burns 431K tokens

- DOT struggled to hit $9 despite the decrease in supply.

- A cluster of liquidity above $8.97 could trigger large-scale liquidation.

Polkadot’s [DOT] price dropped by 4.11% in the last 24 hours despite the high number of tokens burned. According to Polkadot Leader, a handle tracking the project’s activities, DOT tokens worth $3.7 million were burned on the last day of February.

It is important to note that the 431,370 burned tokens were from Polkadot’s treasury. In October 2023, Polkadot considered a new deflationary mechanism.

For those unfamiliar, a deflationary token is one designed to gradually reduce supply. This creates scarcity and helps the value of the cryptocurrency increase.

DOT goes up in smoke

However, it was not until the 14th of February that Polkadot approved the RFC-10 for burning revenues. RFC stands for Revenue from Coretime sales.

Typically, the adjusted supply dynamics were supposed to be bullish for DOT. However, the recent decline could be attributed to forces higher than the burning mechanism.

But that is not to say DOT has not gained at all from the RFC. According to AMBCrypto’s market analysis, DOT’s price increased by 15.85% in the last seven days. This meant that the cryptocurrency was not left out of the broader altcoin rally.

From the technical look of things, the daily chart showed that bulls formed a strong support around $7.47. This happened on the 21st of February, seven days after the RFC approval. Furthermore, the doggedness to defend this support helped DOT flip past the $8.14 resistance.

At press time, the price of the Polkadot native token was $8.45. However, indications from the Awesome Oscillator (AO) revealed that the value could be higher in the short term. As of this writing, the AO reading was 0.85, suggesting increasing upward momentum for the token.

However, the Accumulation/Distribution (A/D) indicator showed that there has been a dip in buying pressure. If buying pressure returns, DOT’s price might break through $9.50, which was the next major resistance.

Should this be the case, the price could surpass $10. On the other hand, a rise in bearish momentum might draw DOT back below $8.

Not every burn is profitable

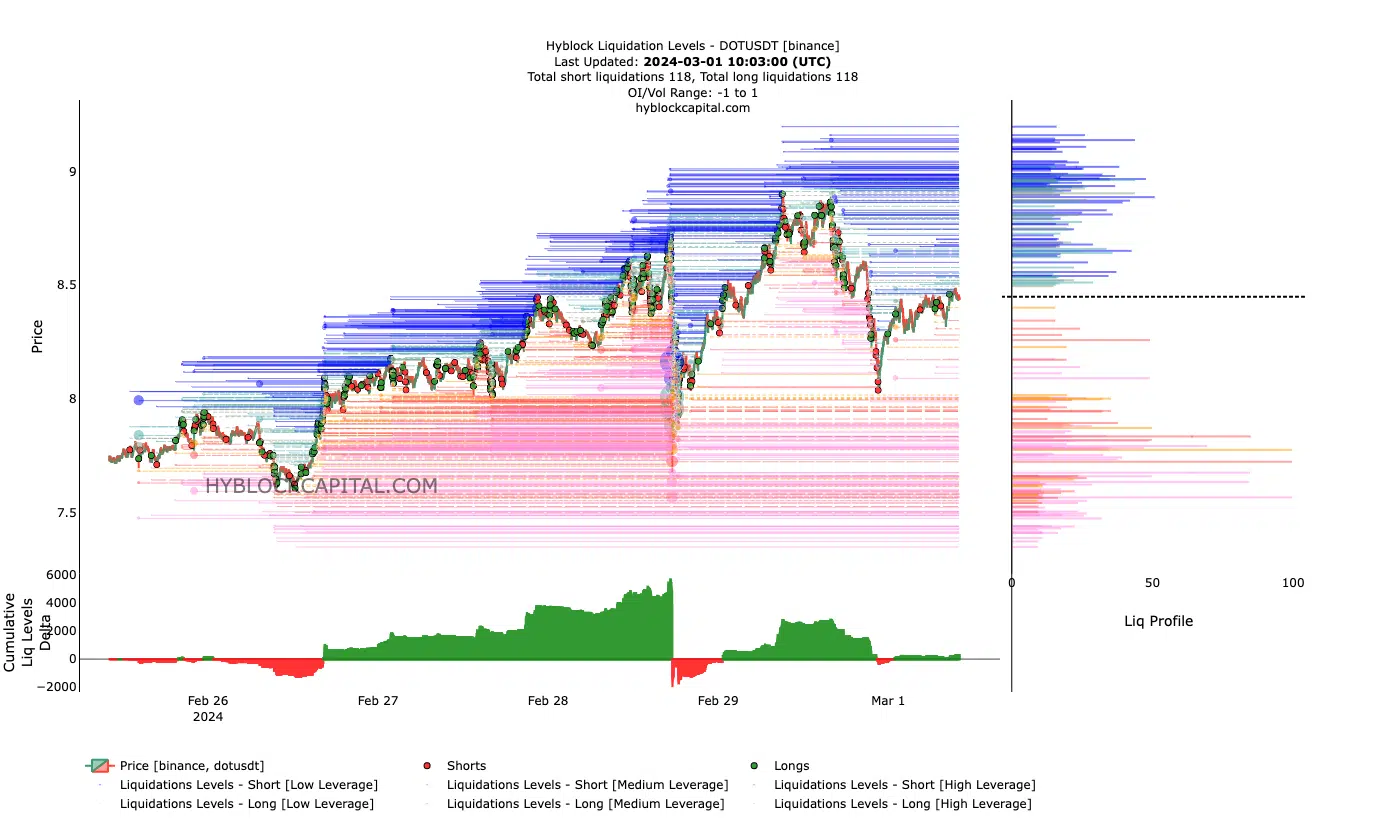

In terms of the Liquidations levels, AMBCrypto observed that there was a cluster or liquidity above $8.87. For context, liquidation levels show estimated price points where large-scale liquidation might occur. From the chart below, DOT’s price might extend higher than $8.45.

However, traders might need to apply caution if the value approaches $9. Opening long positions around that price with high leverage could lead to liquidation. We also checked out the Cumulative Liquidation Level Delta (CLLD).

Read Polkadot’s [DOT] Price Prediction 2024-2025

At press time, the CLLD was positive, implying that Polkadot’s bearish bias might take over. If the bearish thesis becomes a reality, DOT might find it had to test $10, and possibly correct.

Regardless of what happens, DOT remains a token with a long-term bullish potential.