Chiliz-Ankr collaborate and that means CHZ will…

- Chiliz pushes for interconnectivity with other networks to leverage more liquidity.

- CHZ struggles to secure enough bullish momentum to escape the support range.

Chiliz remained committed to building its ecosystem in the last few weeks despite the markets cooling down. More importantly, a recent announcement confirmed that the network was looking to expand its connectivity with other blockchains.

Chiliz is taking a leaf off the playbook that some of the most successful blockchain networks have been using.

Is your portfolio green? Check out the Chiliz Profit Calculator

Building their networks to leverage value by connecting to other networks. Its latest announcement revealed that Chiliz chose Ankr as its main RPC provider.

We are happy to share Chiliz has selected @Ankr as main RPC provider for Chiliz Chain. ?

Ankr’s RPC will facilitate fast, reliable access between blockchain applications and Chiliz Layer-1 blockchain for sports.#ChilizChain ⚡️ $CHZhttps://t.co/HmerW3NMKj

— Chiliz ($CHZ) – Powering Socios.com ⚡ (@Chiliz) June 1, 2023

RPCs are programs created to facilitate connectivity between blockchain networks and dapps, crypto wallets, or centralized exchanges. In other words, this new development will give Chiliz more access to the broader blockchain ecosystem. Blockchain networks often benefit from more access to liquidity by embracing this path.

Assessing the impact on CHZ demand

The official announcement revealed that the goal of the Chiliz and Ankr collaboration is to facilitate a stronger WEB3 sports ecosystem. It will make it easier to tap into growth opportunities within the segment and this might be accretive to Chiliz’s native cryptocurrency CHZ in the future.

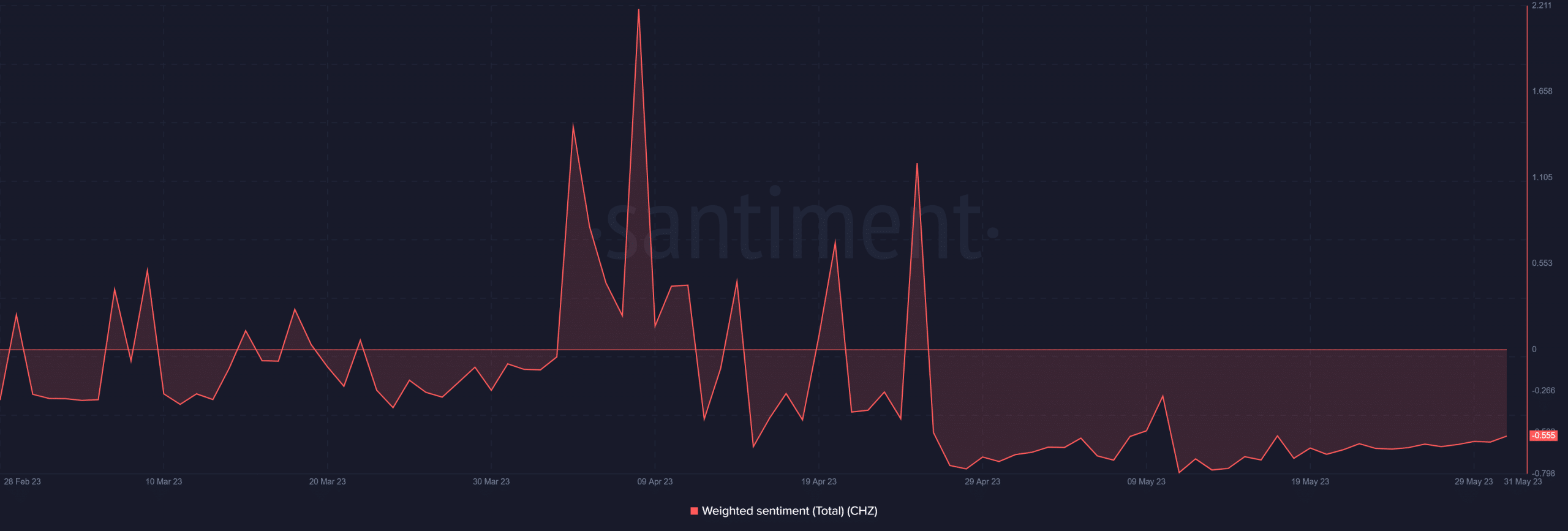

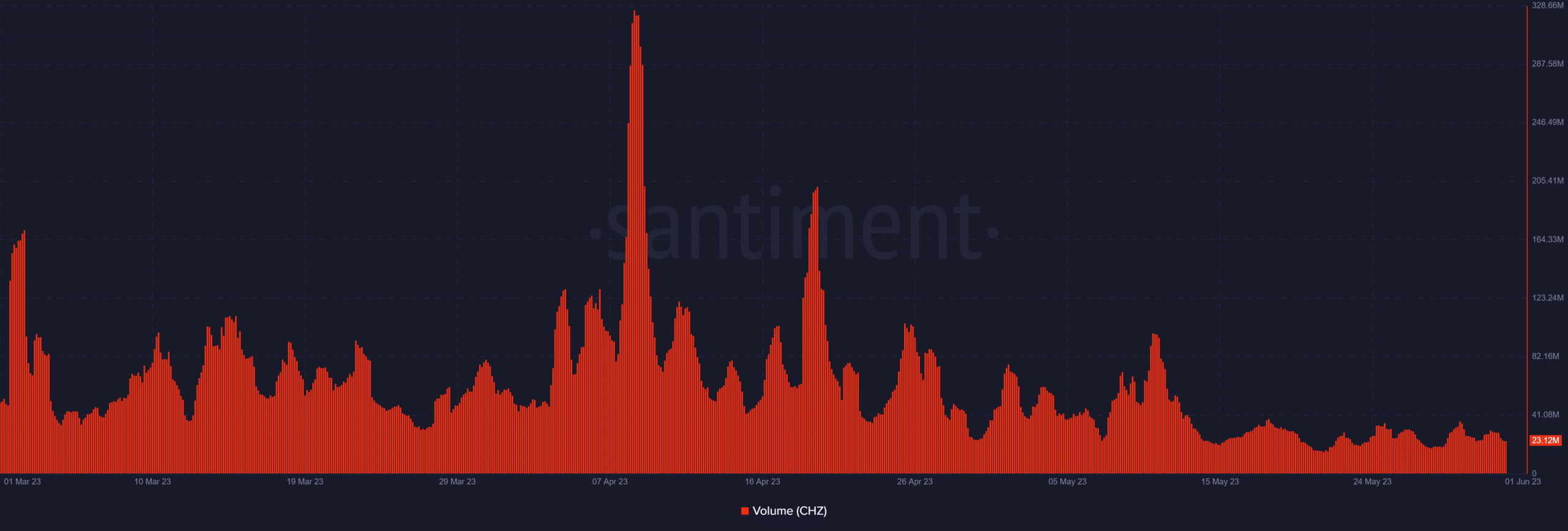

Such a development also has the potential to stimulate network activity in the short term. Chiliz experienced a significant slowdown in on-chain volume and activity in the last three months. For perspective, its on-chain volume peaked at 321.94 million CHZ in April but fell to its lowest three-month level at 15.32 million CHZ in May.

Source: Santment

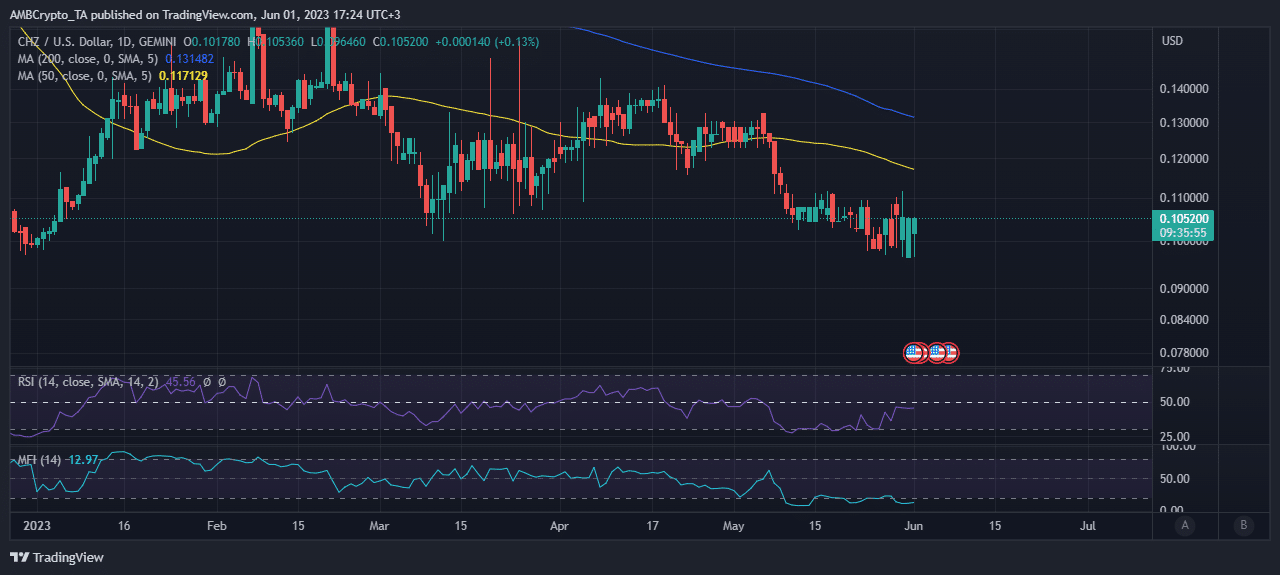

The slowdown in CHZ’s volume was also reflected in its price performance which has mostly been bearish during the same three-month period. However, there was one key observation about its recent performance that may offer some insights into what to expect moving forward.

CHZ recently bottomed out within the $0.097 support range where it experienced significant consolidation. Its performance in the last three days suggested that bullish momentum has been building up.

Source: TradingView

Is now a good time to buy? Well, its Relative Strength Index (RSI) has been recovering from the bottom range, suggesting that CHZ bulls are regaining relative strength.

However, buying momentum has been low according to the MFI indicator. This suggested that CHZ traders were still uncertain about the cryptocurrency’s next move and the same was reflected in CHZ’s weighted sentiment.

Although the support line underscores the probability of a pivot, CHZ might still lend itself to sell pressure in the short term. This means there is still a chance that it might slip below support and underscores the prevailing market uncertainty.