Circle extends interoperability protocol to Arbitrum; will ARB catch up?

- Arbitrum became the third blockchain to be supported by the protocol after Ethereum and Avalanche.

- Despite the CCTP launch, Arbitrum’s native token ARB recorded a sharp drop of 6%.

Circle, the company which issues the second-largest stablecoin USD Coin [USDC], extended its Cross-Chain Transfer Protocol (CCTP) to Arbitrum [ARB], weeks after launching the native version of USDC on the layer-2 (L2) scaling solution.

Is your portfolio green? Check out the ARB Profit Calculator

The new protocol purports to eliminate the requirement for third-party bridges to transfer USDC from one network to another. Arbitrum became the third blockchain to be supported by the protocol, after being initially introduced for Ethereum [ETH] and Avalanche [AVAX] in April.

USDC’s interconnected world

According to Circle, CCTP facilitates permission-less fund transfers between blockchains through native burning and minting. Unlike a traditional bridge which locks tokens sent to its contract, the CCTP protocol destroys them from the sending network and issues new tokens on the receiving network. By removing the need to lock up liquidity, CCTP provides a more secure and faster way to send USDC across supported chains.

With this new feature, Circle intends to address the problem of liquidity fragmentation and interoperability in the Web3 space. As an official method of transferring USDC was available, the firm expected that various unofficial versions would gradually fade away.

While users would no longer need to switch wallets depending on the network, developers on Arbitrum could create apps that allow native cross-chain deposits, exchanges, and purchases, powering decentralized finance (DeFi) growth in the long run.

ARB reacts negatively

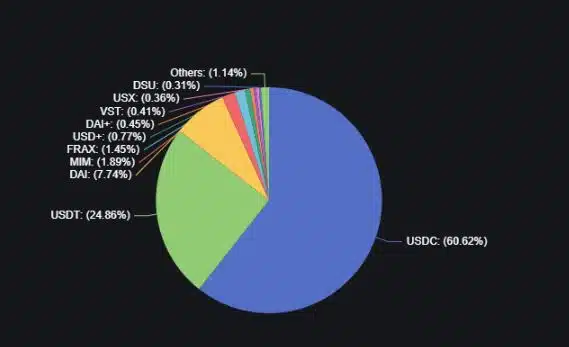

At the time of writing, USDC was the dominant stablecoin on the Arbitrum network. This was because it recorded a market cap of more than a billion, according to DeFiLlama. Overall, Arbitrum ranked as the fourth-largest blockchain for stablecoins and the largest among L2 solutions.

Surprisingly, despite the news of the CCTP launch, Arbitrum’s native token ARB went the other way. At the time of writing, ARB recorded a sharp 24-hour drop of 6%, according to CoinMarketCap data.

Realistic or not, here’s ARB’s market cap in BTC terms

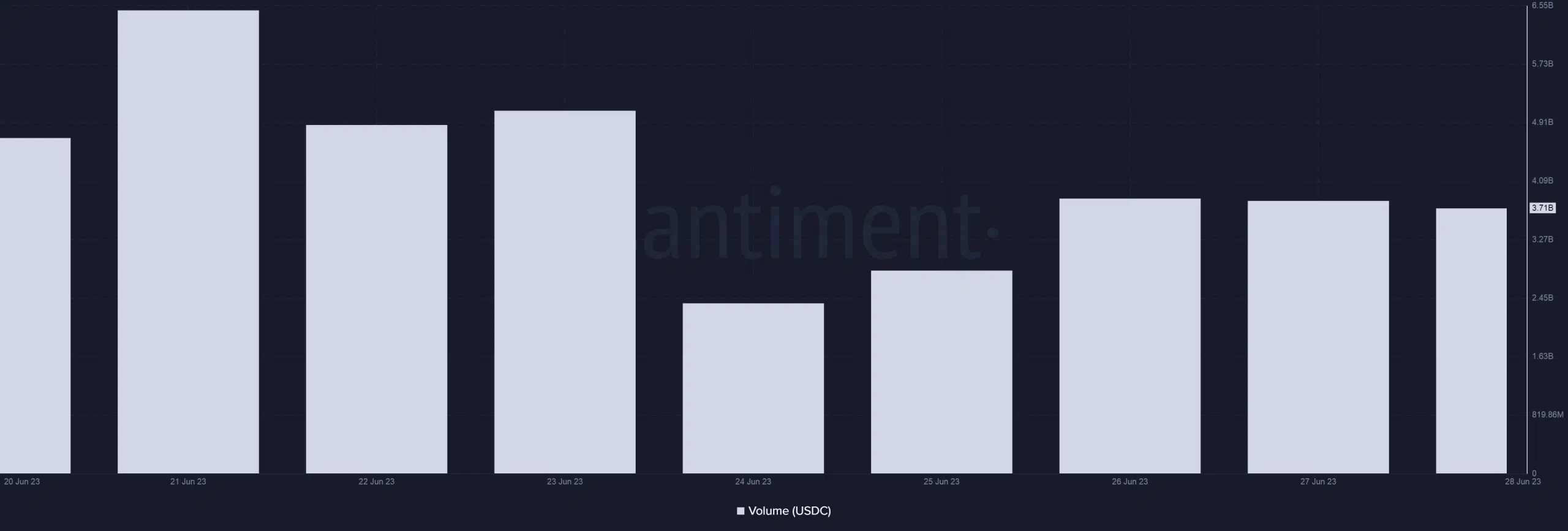

Meanwhile, there was no noticeable jump in the trading volume of USDC on Arbitrum according to Santiment. On 27 June, trade volume mirrored the previous day’s data, totaling $3.82 billion.