Stablecoins

Circle’s USDC gets approved under MiCA crypto rules: Game changer for Europe?

Crypto firm Circle gets MiCA approval for stablecoin issuance in the EU.

- Circle secures EU regulatory approval for its stablecoin under MiCA’s crypto framework.

- However, Network Growth for both USDC and USDT declined.

Despite Circle’s [USDC] growth over the last few months, it has still lagged behind Tether [USDT] in terms of market cap. However, recent developments around USDC could help the stablecoin rise to the top.

Circle enters Europe

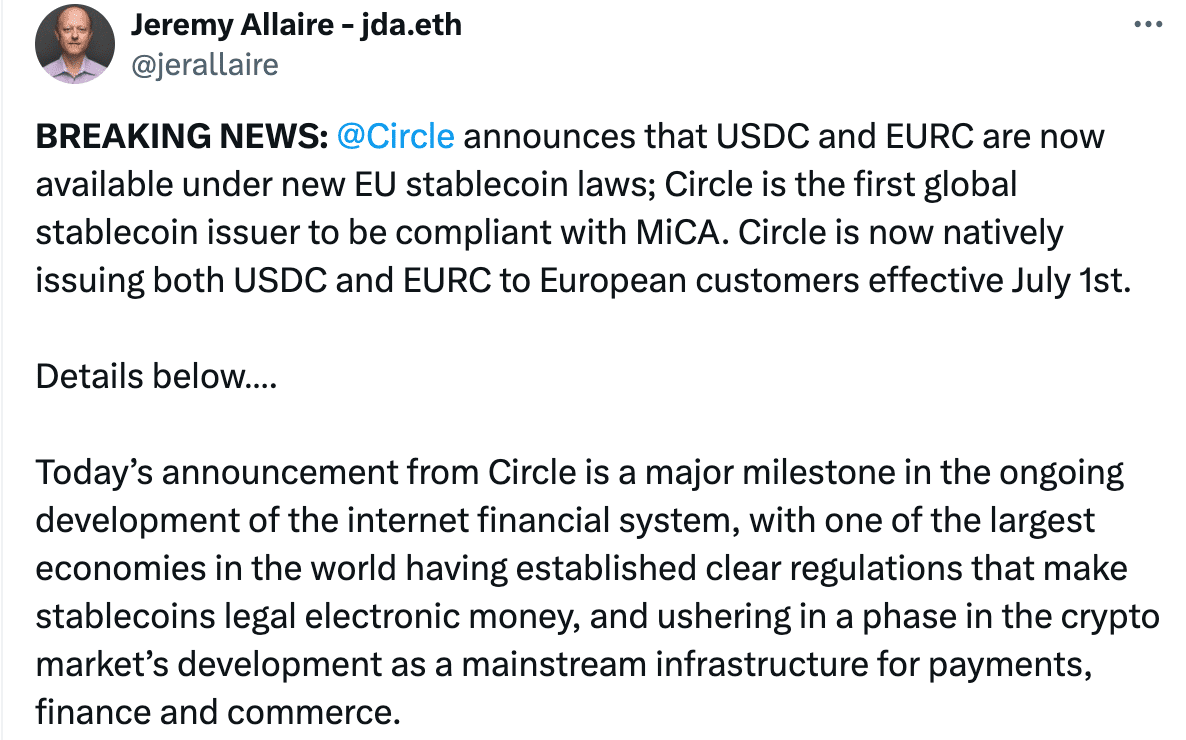

In a major win for regulatory clarity in the digital asset space, Circle secured the first regulatory approval for its stablecoins under the European Union’s Markets in Crypto-Assets (MiCA) framework on the 1st of July.

This announcement by Jeremy Allaire, Circle’s co-founder and CEO, comes as a relief to investors holding Circle’s USDC and EURC stablecoins, as they are now demonstrably compliant with the new regulations.

This eliminates concerns that investors would be forced to redeem their holdings or move them to other assets to stay compliant.

Circle also announced its selection of France as its European headquarters.

This decision was influenced by France’s progressive approach to digital asset regulation and Circle’s strong working relationship with the French Prudential Supervision and Resolution Authority (ACPR).

Allaire also underscored the historical significance of MiCA, the first comprehensive regulatory framework for digital assets in the EU.

This, he said, marked a significant step forward for the legitimacy and stability of stablecoins, and a testament to the maturing digital asset industry.

Will USDC outperform USDT?

Circle’s USDC stablecoin held a respectable 20% market share with a $32 billion market cap at press time.

However, Tether still remains the undisputed stablecoin leader with a whopping 70% market share and a $112 billion market cap.

Circle’s regulatory approval in Europe could be a turning point, boosting demand for USDC and potentially helping Circle close the gap on Tether.

This advantage comes at a crucial time for Circle, as it has been steadily losing market share to Tether.

By being the first mover in regulatory compliance, Circle can position USDC as a safe and trusted haven for European investors, especially those who may have been wary of the unregulated cryptocurrency market.

This could lead to a significant increase in demand for USDC, not just in Europe but also globally.

Despite this positive development, AMBCrypto’s analysis of Santiment’s data revealed that the network growth for both tokens had fallen over the last few days.

This indicated that the number of new addresses in both these stablecoins had declined momentarily.