Compound [COMP]: A 103% rally to its credit, but here’s why there’s always a but

In the recovering marker, some cryptocurrencies outperformed not only other altcoins but also their investors’ expectations, and one of them was Compound [COMP]. The DeFi Lending protocol token marked a massive rise, provoking investors to make equally massive moves.

Compound impresses…

The reason why this altcoin has impressed investors is due to its native token COMP’s performance, and the reason it has disappointed many can be traced back to the protocol’s performance.

Firstly, although COMP was one of the fewer altcoins to start rallying later than its compadres, it still managed to register a rise of 103.3% in the span of just a week triggered by the broader market’s bullish cues.

Compound price action | Source: TradingView – AMBCrypto

What’s to be noted, though, is that COMP holders are a volatile bunch of investors, and this has been verified over and over again as back in May, towards the end of the month, these same investors dumped about 200k COMP worth about $29 million.

Following that precedent, in the last seven days, the same duration as COMP’s rally, these investors bought back $25 million worth of COMP tokens with no regard for a possible retracement.

Compound investors buying | Source: Santiment – AMBCrypto

The rise, combined with the buying, also improved Compound’s market value by almost 21%, providing its investors some semblance of a recovery.

Compound market value | Source: Santiment – AMBCrypto

Yet disappoints…

Moving on to the part where the token disappoints. As a Lending Dapp, Compound has been observing far more depreciation than its competitors.

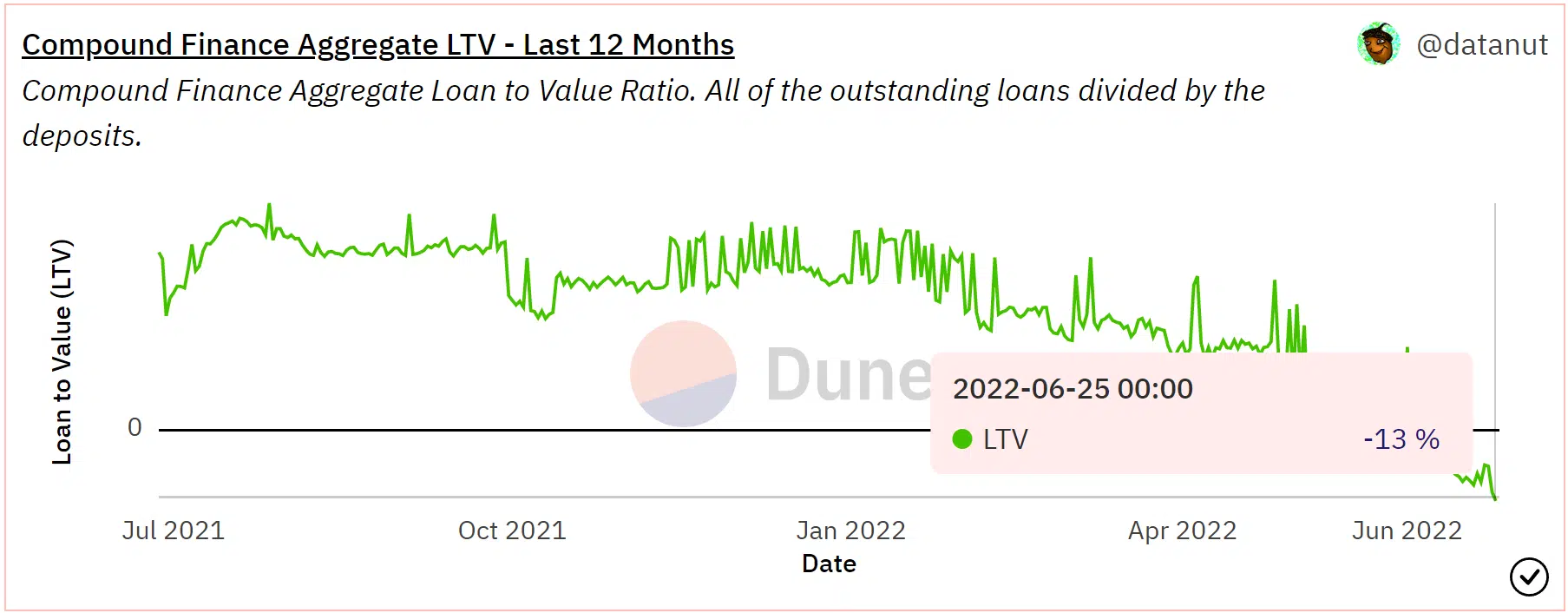

The Loan to Value (LTV) ratio, which calculates the ratio of all the amount borrowed by users to the amount deposited onto the protocol, currently stands at -13%, the lowest for Compound.

The same LTV for AAVE is at 95%, and in the case of Maker DAO, the LTV is at 225%. This is because the total money loaned through Compound has been on a steady decline along with the deposits.

Compound LTV ratio | Source: Dune – AMBCrypto

In the case of the other two Lending Dapps, deposits have taken declined considerably, but loans were not as severely hit, therefore keeping their performance above par.

Thus, Compound needs to lure users back, to not only deposit but also borrow on the protocol, as its rallies can only take the Dapp so far.