Cosmos [ATOM] attempts another support breakout: Will it crack $10.56

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Bears were poised to break below the key support level.

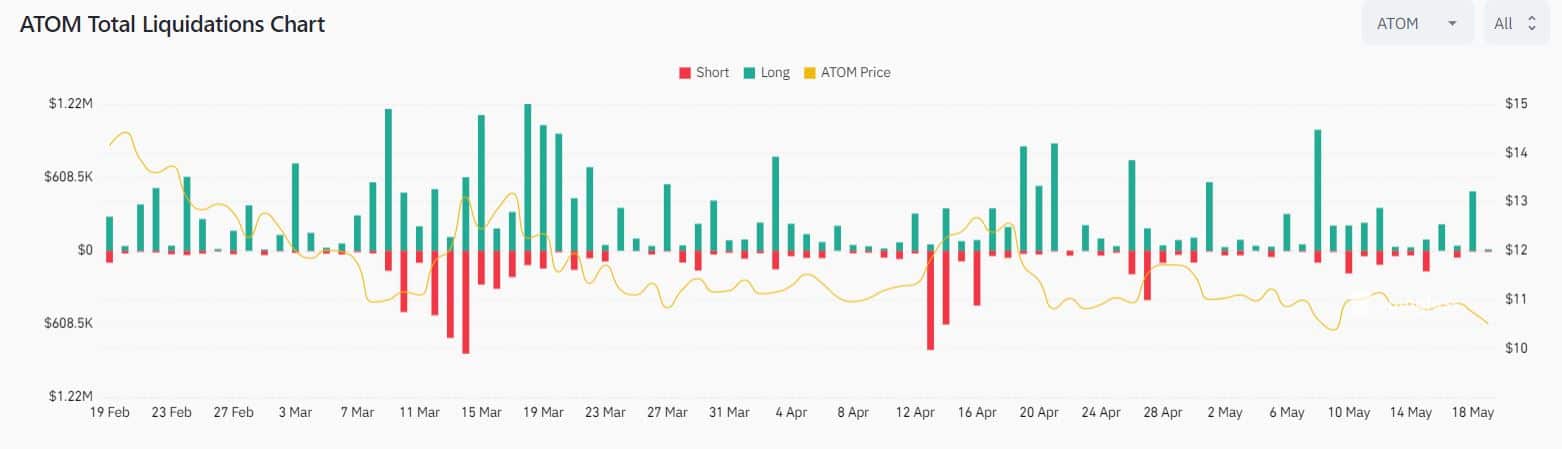

- Furthermore, at least $1.27 million worth of long positions were liquidated.

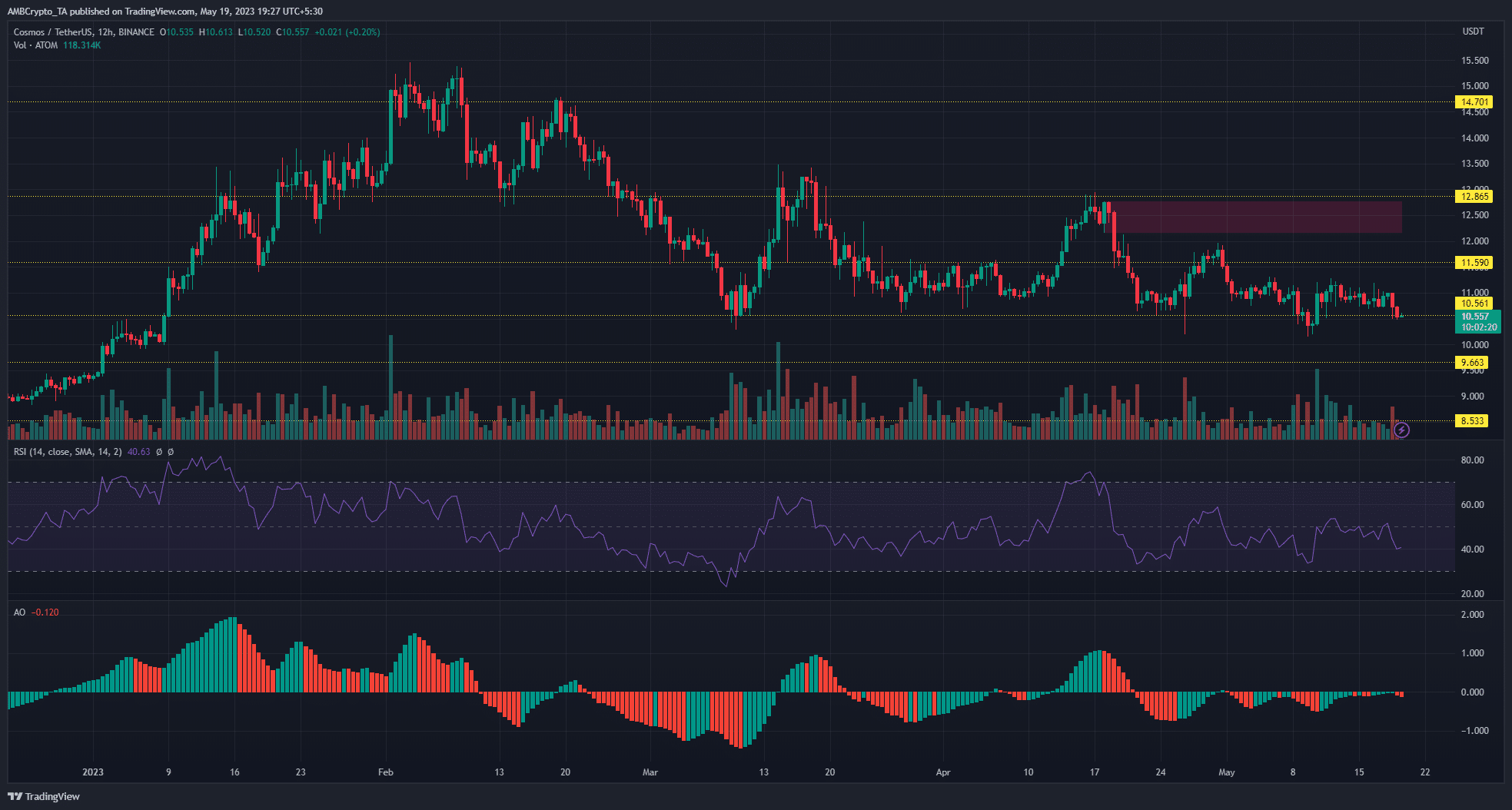

Cosmos [ATOM] has traded within a compact price range over a month-long period. The altcoin has oscillated between the $10.56 support and $11.59 resistance levels. This has seen ATOM lose 18.7% of its value within this period.

Read Cosmos’ [ATOM] Price Prediction 2023-24

Bitcoin’s [BTC] correction accelerated ATOM’s losses, as sellers dominated the market.

Bears look to push below the $10.56 support level

ATOM’s structure has been bearish since mid-March with bulls and bears engaged in a tussle for price supremacy.

Between 29 and 30 April, a brief bullish rally took the price above the $11.59 resistance. However, this rally was halted by bears to bring the price back into the range. Similarly, a bearish move below the $10.56 support on 10 May was quickly reversed by bulls.

The general market correction along with ATOM’s structure has pushed the price once again toward the $10.56 support level. On-chart indicators suggested that bears might be successful in their attempt to break below this support.

The Relative Strength Indicator (RSI) stood at 40.43 to signal mediocre selling pressure. The Awesome Oscillator (AO) remained under zero, flashing a mix of green and red bars.

Generally, the retests of a support level after the first one are weaker, and bears will be looking to use this as an advantage. With ATOM posting two bearish candles in a row on the 12-hour timeframe, another bearish candle closing under the $10.56 support level could signal a breakout for sellers.

The near-term target for bears will be the January low of $9.66. Alternatively, bulls still stand a chance of defending this support level and attempting another price rally.

How much are 1,10,100 ATOMs worth today?

Long liquidations suppressed any potential upside for ATOM

Liquidation data from Coinglass revealed huge losses for longs. $1.27 million worth of long positions were liquidated over the past seven days, compared to $445.76k short positions. This represented 74.07% of the total liquidations within the period.

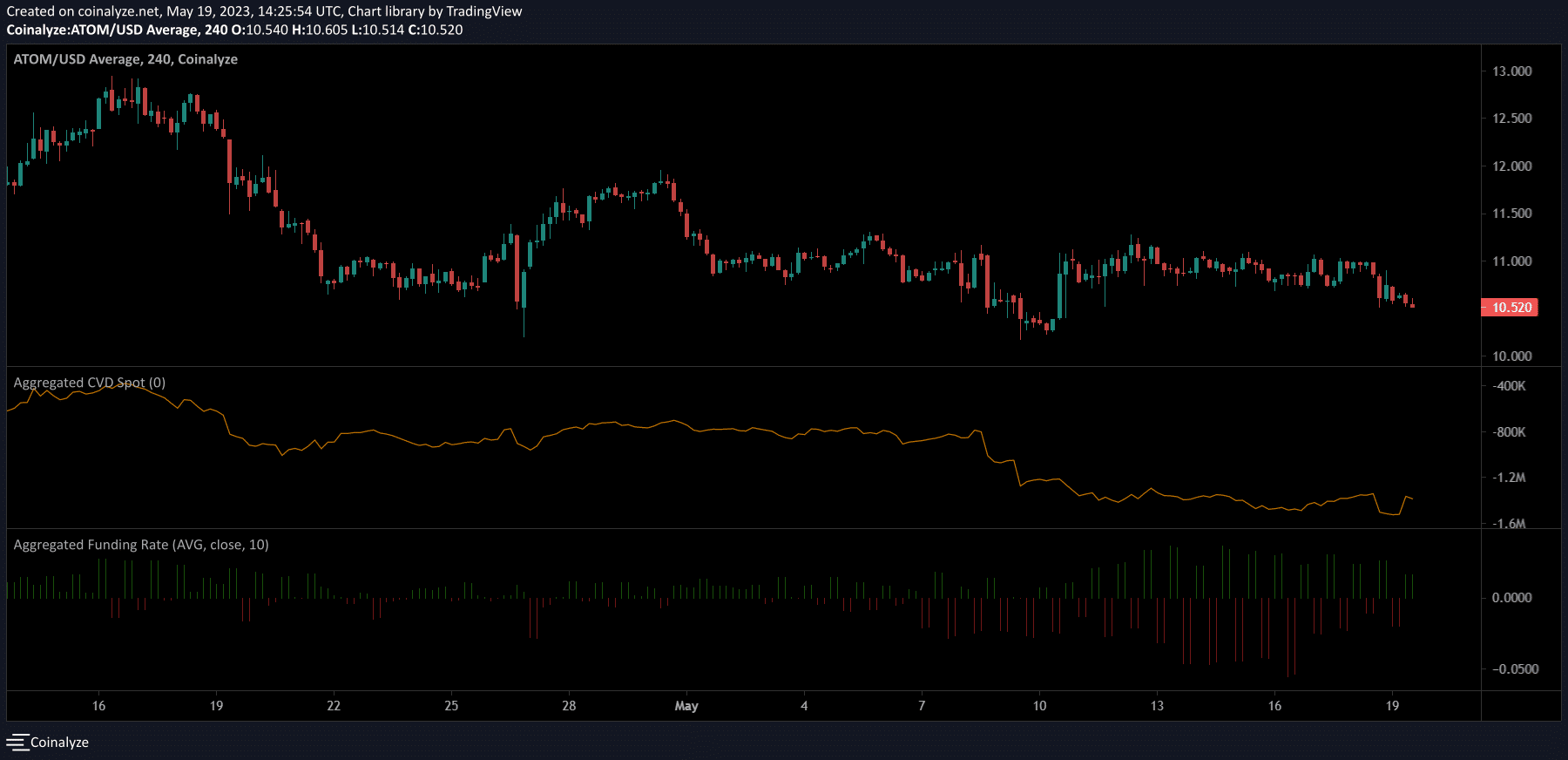

A massively declining spot Cumulative Volume Delta (CVD) and fluctuating funding rates added further confirmation of bearish dominance. This signaled that speculators were actively shorting ATOM which could lead to more price dips.

Source: Coinalyze