Cosmos [ATOM]: Extra gains could be likely if this support holds

![Cosmos [ATOM]: Extra gains could be likely if this support holds](https://ambcrypto.com/wp-content/uploads/2023/01/hal-gatewood-OgvqXGL7XO4-unsplash-1-e1674137203915.jpg.webp)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- ATOM could post extra gains to investors.

- Sentiment improved, and trading volume increased slightly.

Cosmos [ATOM] posted over 55% gains during its rally between mid-December 2022 and mid-January 2023. It rose from $8.496 to $13.379, just shy of $14.000. But bulls faced consecutive bearish orders around the $13.000 area, which made it a critical supply zone.

At press time, ATOM’s price correction was temporarily stopped by the bullish order block at $11.714 support. Bulls could launch a massive recovery in the next few days or weeks if the support proves steady.

Read Cosmos [ATOM] Price Predictions 2023-24

The supply zone at $13.000: Bull’s next target?

On the 12-hour chart, the Relative Strength Index (RSI) retreated from the overbought zone but faced rejection at the midpoint of 50. Although the RSI value was at 51, denoting a mild bullish signal, the Directional Movement Index (DMI) showed bull’s green line had the upper hand at press time.

Therefore, ATOM could target the immediate supply zone at $13.000 in the next few days, offering a 15% potential gain.

How much are 1,10,100 ATOMs worth today?

However, a breach below the support range of $11.552 – $11.072 would invalidate the bullish bias described above. The dynamic 100-day EMA (exponential moving average) could keep such a move in check.

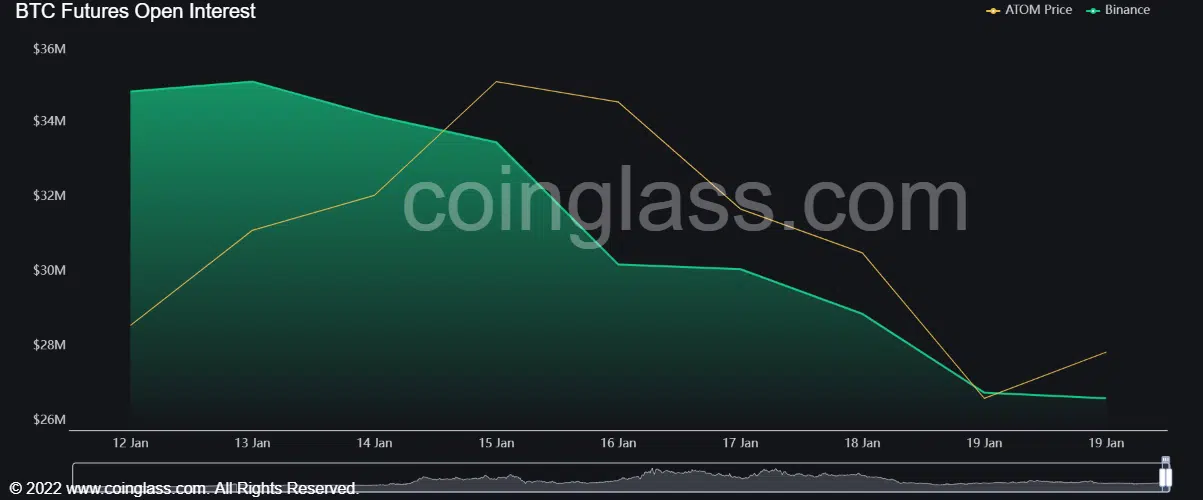

ATOM’s OI’s momentum slowed, and sentiment improved

According to Coinglass, ATOM’s open interest (OI) rate has declined since 13 January. In fact, there was an OI/price divergence between January 13 – 15, which was followed by ATOM’s price decline.

At press time, OI decline momentum was reduced, as evidenced by the smooth, shallow slope. Although it doesn’t entirely point to a trend reversal, rising prices could increase OI, boosting uptrend momentum.

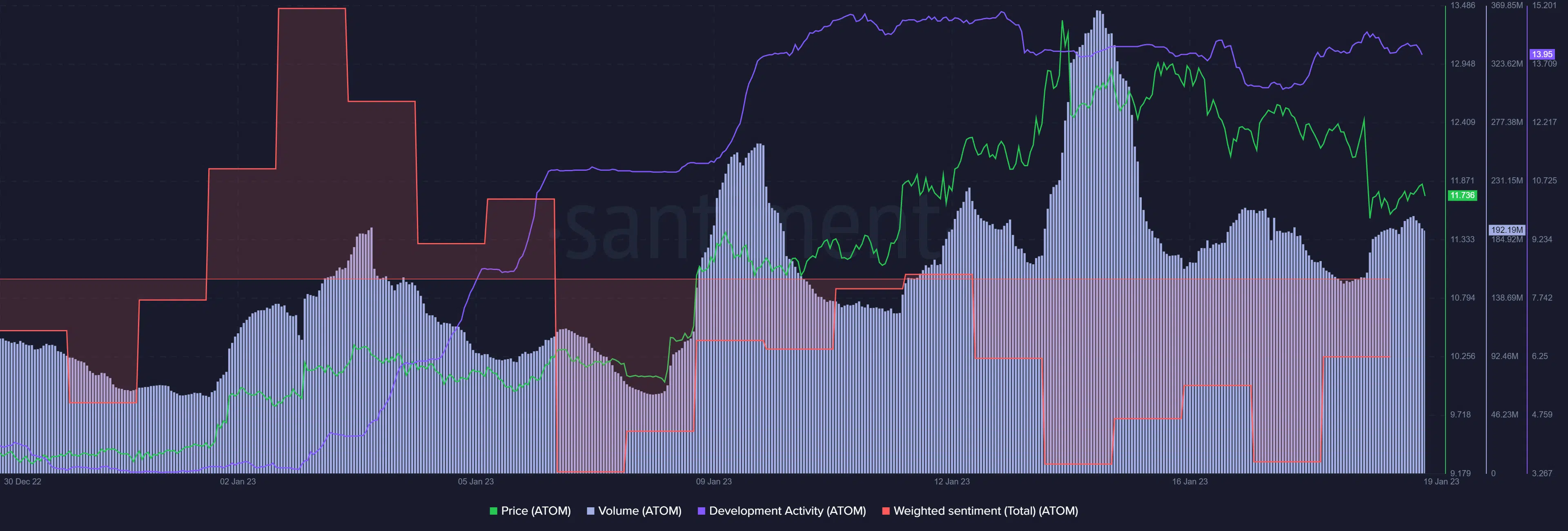

In addition, Santiment showed that ATOM’s negative weighted sentiment reduced as it moved closer to the neutral line, indicating that investors’ outlook improved. Further improvement in sentiment could influence the price positively.

However, the development activity remained relatively unchanged since 10 January and could undermine the bullish momentum.

But if BTC regains the $21K region, the ATOM’s bulls could be tipped to target or surpass the supply zone at $13.000. However, a bearish BTC could force bears to break below the $11.552 – $11.072 range support.