Cosmos [ATOM]: Traders should watch for this key price movement

- ATOM has shown strong resilience amid the recent market-wide rally, reclaiming key levels such as the 200-day EMA.

- Derivates data showed mixed sentiment, with a slight edge for the bears.

Riding the broader bullish momentum in the market, Cosmos [ATOM] surged by nearly 65% in just two weeks. The altcoin saw massive gains, pushing above the critical 200-day EMA to affirm a bullish outlook.

ATOM traders must now pay attention to key price levels as the price action hovers around a crucial resistance point.

Recent price action and EMA overview

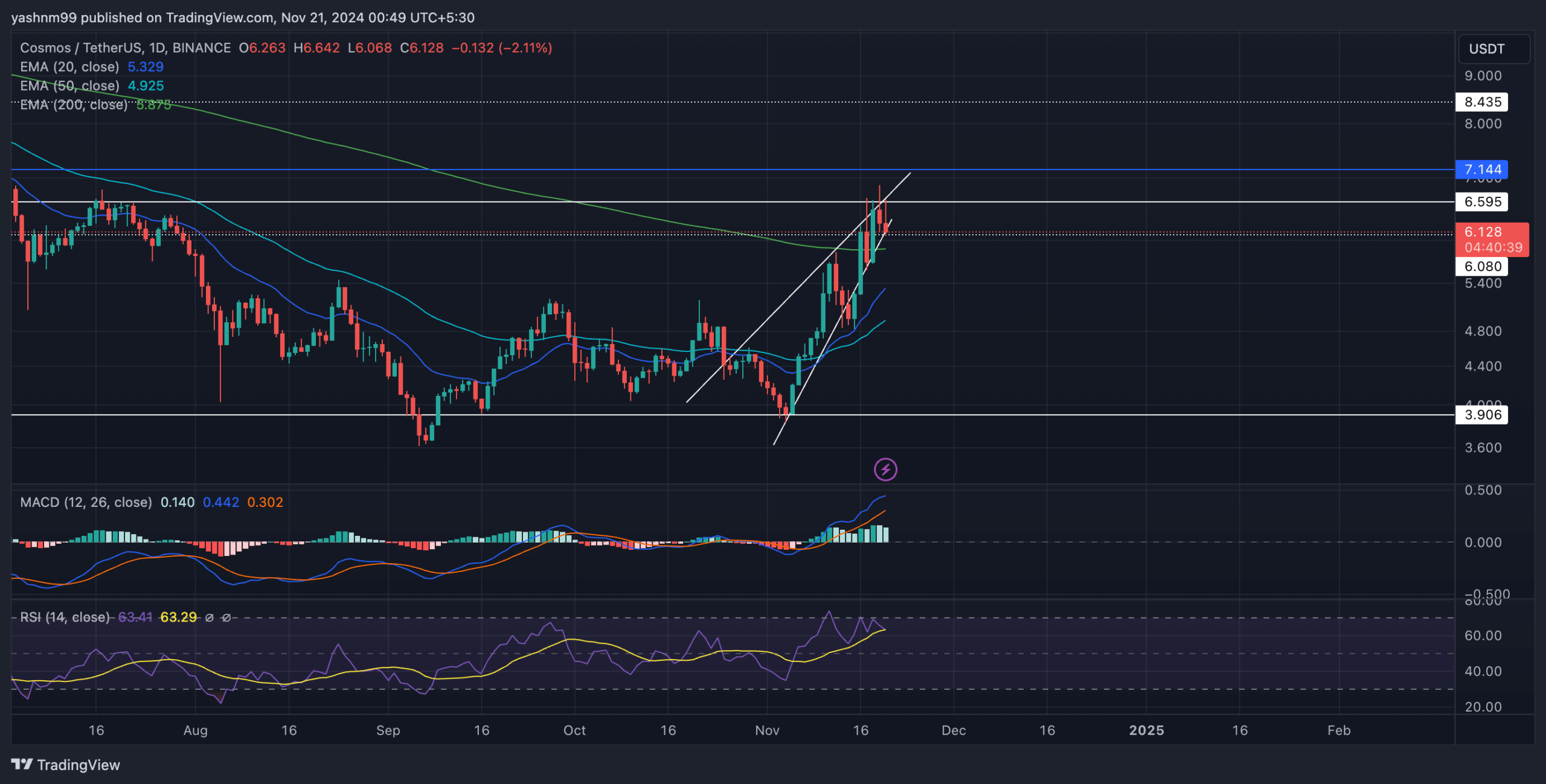

ATOM’s price action formed a rising wedge pattern, an indication of building buying pressure but also a signal that the rally might be nearing a temporary peak. ATOM was trading at $6.18 at press time, below a crucial resistance at $6.59 and facing strong pressure from the rising wedge’s upper boundary.

The 20-day EMA at $5.33 and 50-day EMA at $4.92 have provided solid support during the rally, which enabled ATOM to break above the 200-day EMA at $5.88, signaling a potential long-term trend reversal in favor of the bulls.

If buyers manage to break through the current pattern and achieve a daily close above $6.59, it could open the door to further gains. It’s worth noting that the next major resistance is at $7.14.

However, a break below the current wedge pattern could invalidate this short-term bullish bias, with potential support coming into play around the EMAs and the $5.33 level.

The MACD witnessed a bullish crossover, with the MACD line above the Signal line in positive territory. This highlights continued buying pressure. Also, the RSI stood at 64 after reversing from the overbought territory. This level suggests that buying pressure is still dominant, but it also leaves the door open for a potential correction if bulls fail to drive prices above the current resistance level.

Should it fall below the 200-day EMA, ATOM’s immediate support lies in the $4.9-$5.3 range. On the upside, the altcoin faces immediate resistance at $6.59, which coincides with the rising wedge’s upper boundary. A successful close above this level could pave the way toward the next resistance at $7.14.

Derivative data revealed THIS

ATOM’s trading volume dropped by 34.55% over the last 24 hours, reflecting cautious participation from traders. Additionally, Open Interest decreased by 4.14%, indicating that some traders closed their positions amid the recent volatility, possibly to secure gains.

The long/short ratio stood at 0.932, indicating a relatively balanced market sentiment with a slight inclination toward short positions.

Read Cosmos’ [ATOM] Price Prediction 2024-25

However, the data from Binance and OKX depicted a more optimistic picture, with the long/short ratios for ATOM/USDT standing at 3.288 and 2.94, respectively, suggesting that traders on these platforms anticipate a continued rally.

Traders should also closely watch Bitcoin’s price action, as broader market sentiment will likely influence ATOM’s next move.