Could Bitcoin [BTC] be on course for another green weekend

![Could Bitcoin [BTC] be on course for another green weekend](https://ambcrypto.com/wp-content/uploads/2023/03/po-2023-03-17T110850.448.png)

- Analyst suggests that BTC could get a key breakout in the short term.

- The Bitcoin network value remains expensive relative to the price but the coin could still hit a yearly crest.

Since 2023 began, a number of weekends have acted as stepping stones for Bitcoin’s [BTC] production of green bars.

Interestingly, the 11-13 March period of last week was no different. But with the coin losing and regaining price levels at different intervals, what do the next few days hold for BTC?

How much are 1,10,100 BTCs worth today?

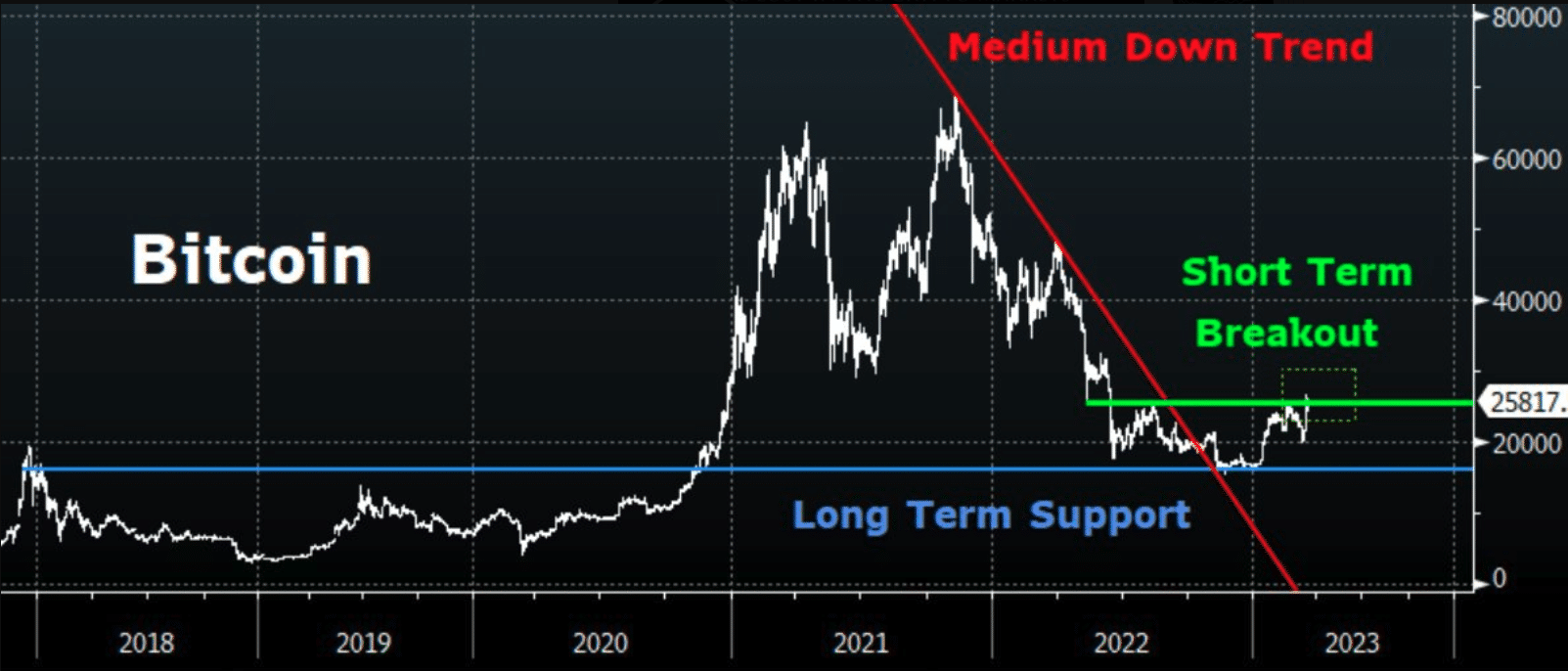

Well, a digital assets trader by the name of Markus Thielen on Twitter opined that the BTC might not stall its movement at $26,000. Thielen based his judgment on his technical analysis. There, he showed that BTC has long-term support.

Little beginnings may be faced with hurdles

Besides, the chart revealed that the mid-term downtrend could be over. And a short-term breakout at $25,817 was already in motion. According to the analyst, BTC had the potential to end up at $28,000 soon.

There have been calls for the king coin to hit $30,000 before any other major retrace lately. So, Thielen’s opinion could not be outrightly dismissed. However, enthusiasts with this viewpoint may need to exercise caution.

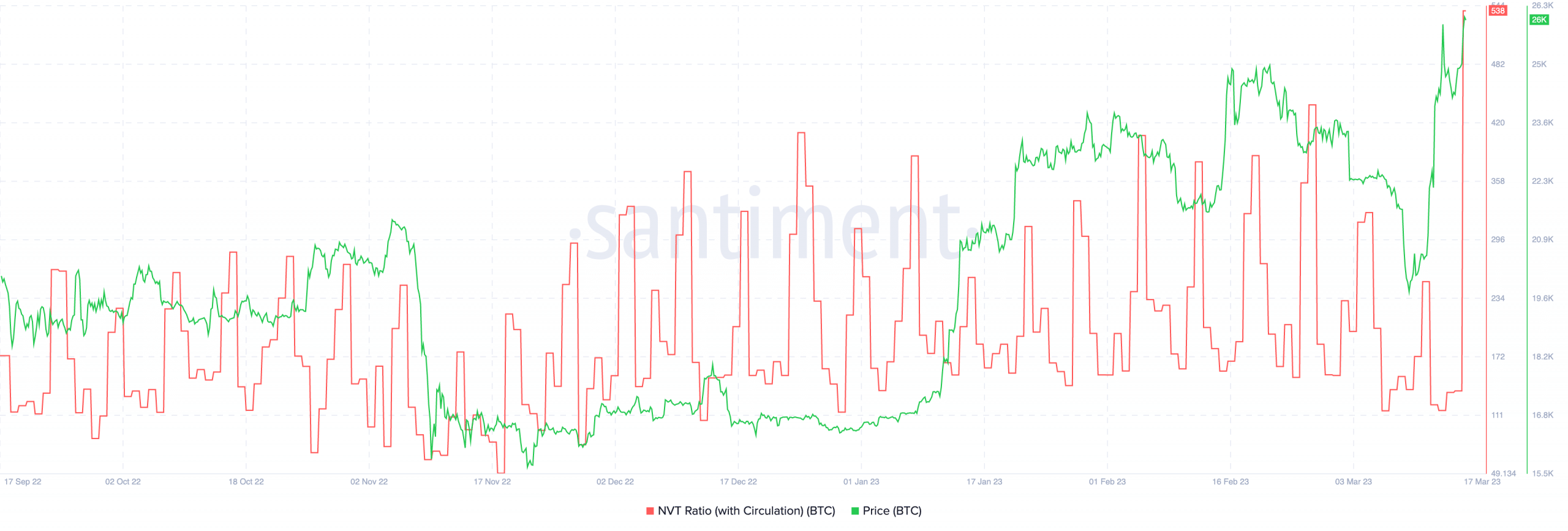

One metric that suggested the stance above is the Network to Value Transaction (NVT) in relation to the BTC circulation. The circulation NVT provides an overview of an asset’s growth potential. This is derived using the Price-to-Earnings ratio and rate of daily circulation.

At press time, the circulation NVT was extremely high at point 538. A high circulation NVT indicates that an asset’s network valuation is higher than the current value displayed on the network.

So, this means that the current BTC value was not cheap compared to its expensive network.

Will backup and support prevail?

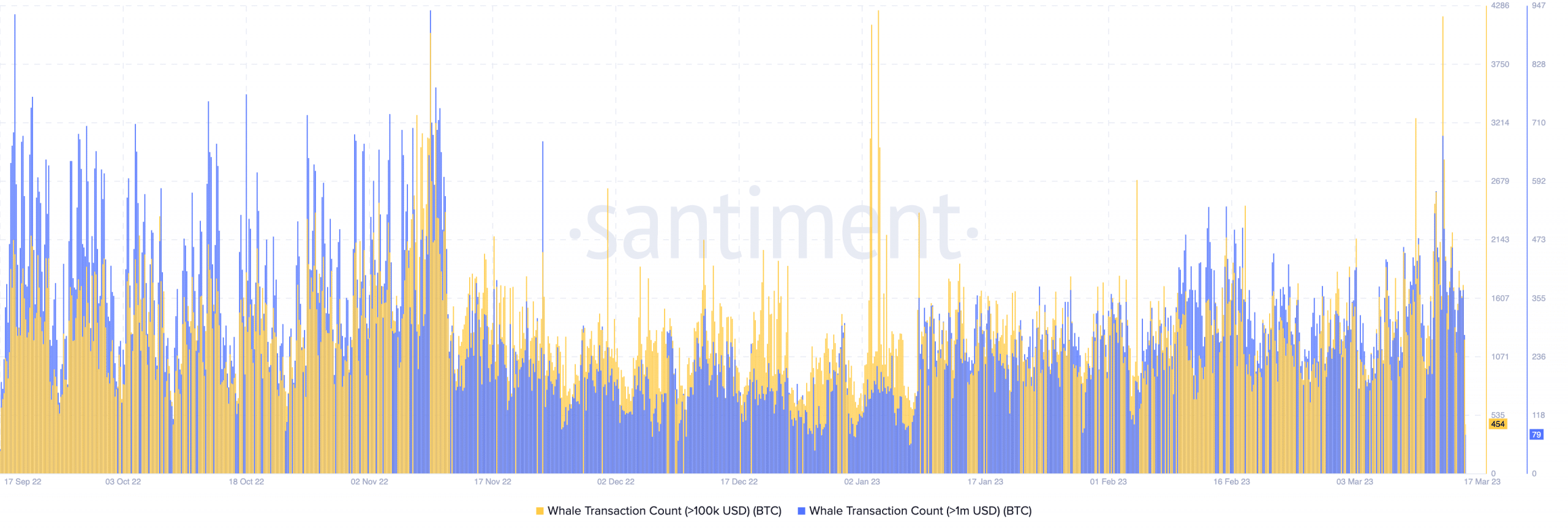

However, the NVT condition did not totally cancel the possibility of a further uptick for BTC. This was because whales’ interest in the coin remains intensified.

At press time, Santiment data showed that there has been a sustained increase in six to seven figures BTC transactions. A situation like this confirms buying pressure from this group. Also, the same whales had reduced selling some parts of their holdings as reported lately.

As per the daily chart, BTC seemed in a prime position to follow through with its increase based on the Awesome Oscillator (AO).

The indicator helps to assess market momentum in relation to trend affirmation, reversal, weakness, and strength. With the AO at 1455.59, it means that BTC had enough support to reach the price level suggested by Thielen.

Is your portfolio green? Check the Bitcoin Profit Calculator

Furthermore, the Directional Movement Index (DMI) also suggested a similar sentiment. At press time, the +DMI(green) was 39.03. And backing it up was the Average Directional Index (ADX), which was at 27.10.

![Bitcoin [BTC] price action](https://ambcrypto.com/wp-content/uploads/2023/03/BTCUSD_2023-03-17_10-40-58.png)