Could institutions pulling millions see Bitcoin [BTC] at $20K next

Even though there are many cryptocurrencies recovering today, Bitcoin is continuing to stack up more losses. Interestingly, institutions seem to have identified it beforehand, making their exit as soon as the first signs emerged.

Bitcoin takes everyone down

The high correlation that Bitcoin shares with the U.S stock market index is showing its effects both ways. While over the last three trading days the S&P 500 index (SPX) has declined by 8.5%, Bitcoin, in those corresponding five days, fell by more than 27.8%.

Most of this was in the last 24 hours alone. In fact, BTC had depreciated by 16.6% to trade at $22.3k at the time of writing.

But, this does not seem to be the end of it as the next critical support stands at $20,067. This level was last visited by Bitcoin in December 2020. And, by all means, BTC is bound to hit it.

Bitcoin price action | Source: TradingView – AMBCrypto

Not only because price indicators are heavily signalling a downtrend, but because that will be the only opportunity for BTC to bounce back. A bounce off of $20,067 will give it enough charge to head back towards $25k, the base of the Fibonacci Retracement.

As it is, towards the beginning of the downtrend, BTC was edging above the 23.6% Fib level at $30.7k. Had it successfully achieved it, the king coin would have gone closer to the 50-day Simple Moving Average.

These crucial supports would have prevented a downfall, but now Bitcoin has a couple of weeks before that’s tested.

Investors, on the other hand, particularly institutions, have been alert in their movements. Even before the crash could take form, they managed to pull their money out of the asset.

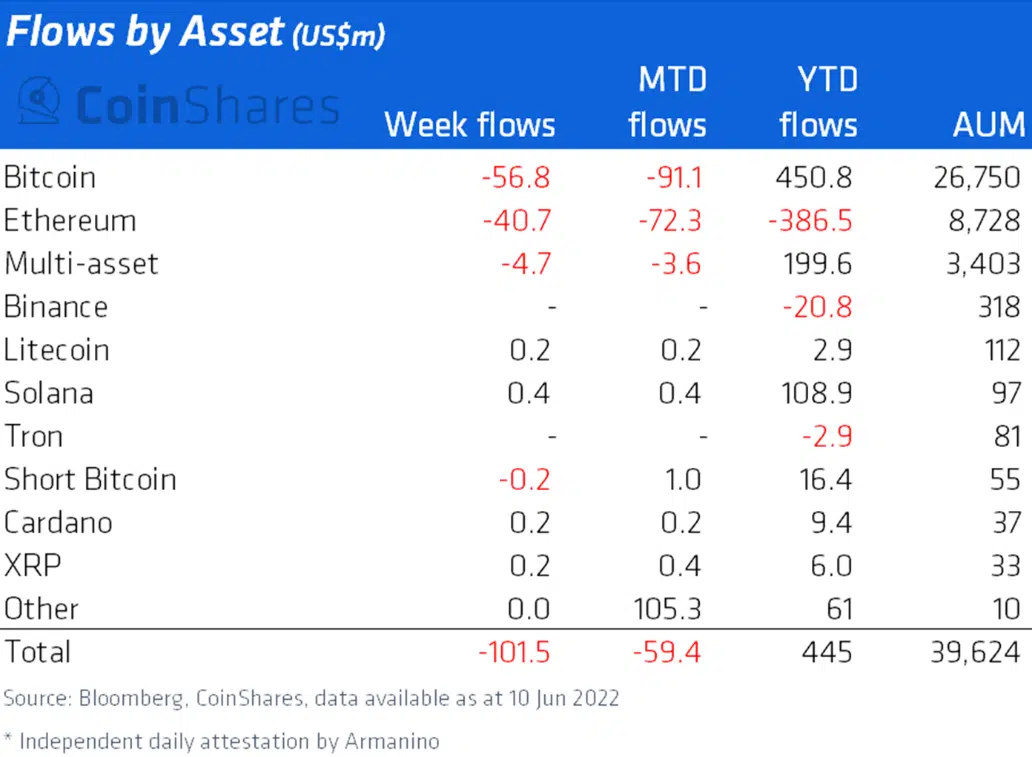

Bitcoin institutional outflows | Source: CoinShares

Over the course of the week ending on 10 June, about $56.8 million was removed by the institutions, along with Ethereum observing outflows worth $40.7 million. Naturally, the following days would’ve noted higher outflows, and this is evidence of the same.

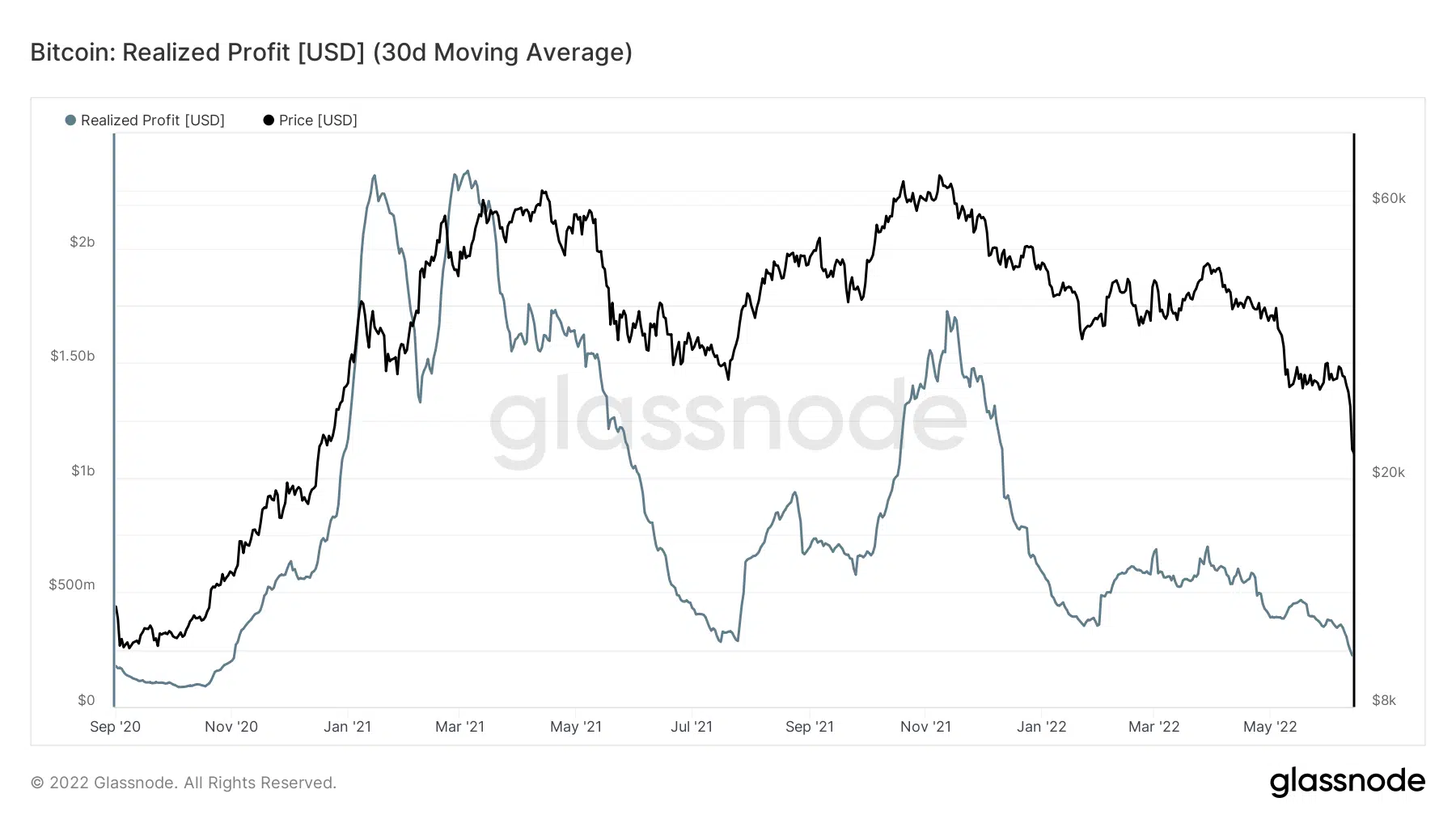

Going forward, retail investors might begin withdrawing their investments. Especially since realized profits have fallen to a 19-month low following the crash.

Bitcoin realized profits | Source: Glassnode – AMBCrypto

BTC supply on exchanges hasn’t seen an increase yet, indicating investors have refrained from selling for now. This is a good sign if Bitcoin intends on recovering soon.