Could the Options market be key to pushing Bitcoin to $50k again

For Bitcoin, recovering from the 7 September crash has been a little more difficult than expected. However, the very reason that explains the chain of events that led to the 14.69% drop also dictates how Bitcoin can get back on its feet.

What happened on 7 September?

Over the last 7 days, the entire market has been unsettled. This has led to crashes, FUDs (The Litecoin-Walmart “partnership,” for instance), and more and more investors waiting for their losses to turn into profits once again.

While this crash clearly affected the market, not many know that it was triggered as soon as and perhaps, due to BTC hitting $52k.

Bitcoin’s 14.69% drop | Source: TradingView – AMBCrypto

As Bitcoin reached that point, it marked a local top and established a 4-month high. This led to some concern that the price might soon begin to correct and as it did, liquidations began.

According to the long liquidation dominance, right before the sell-off, the market went through a short liquidation squeeze. This squeeze accounted for 80% of all liquidations over that time period.

The very next day, long liquidations spiked to 68% and BTC fell by $10k at one point soon after.

Bitcoin Long liquidations | Source: Glassnode

This also contributed to the Open Interest of the perpetual Futures market dropping by over 30% as $4 billion contracts were closed in 1 hour. At the time of writing, it stood at around $9 billion, down from $13 billion.

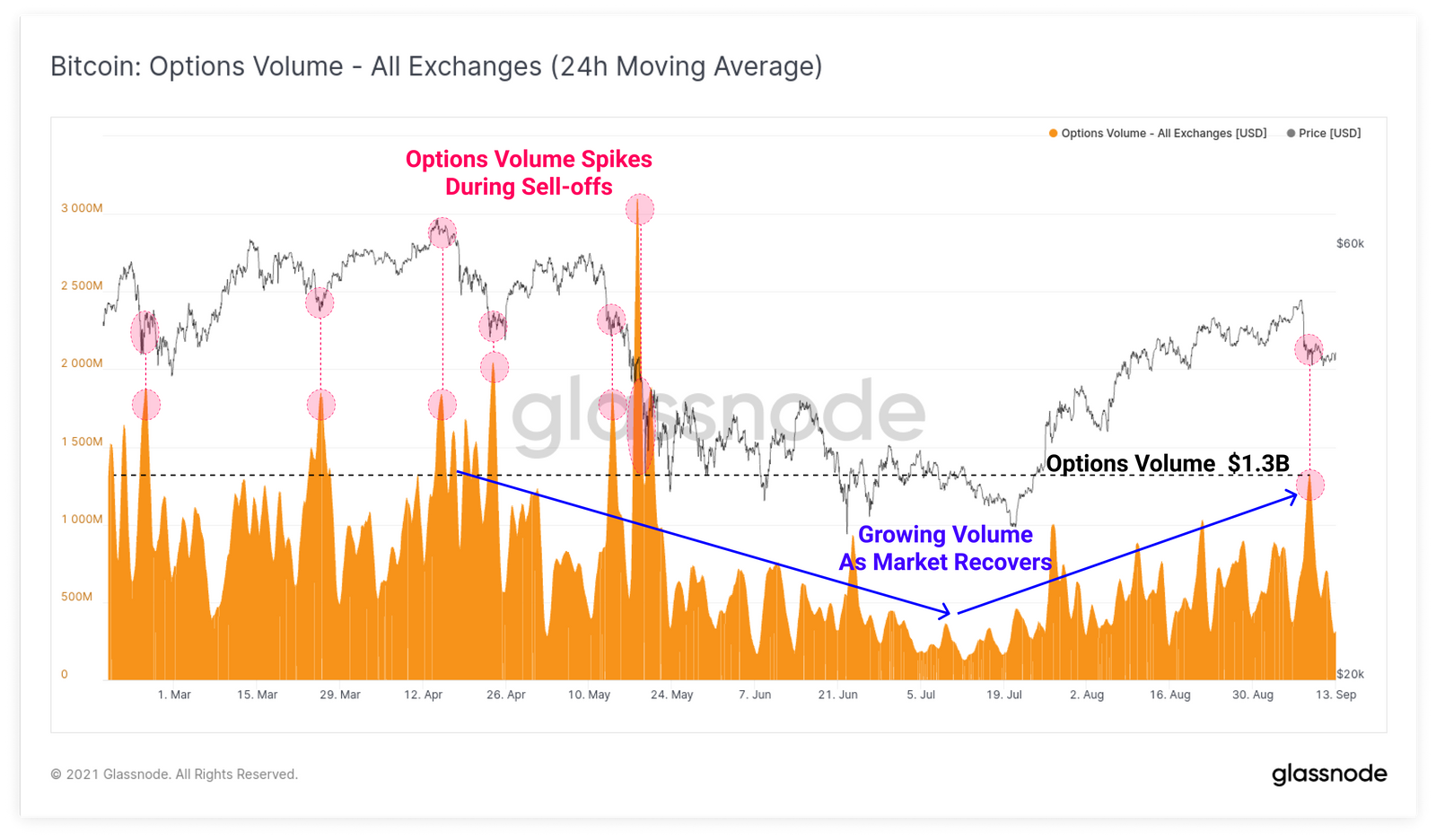

In that duration, traders found this as an attractive opportunity and hedged their positions. This pattern of spiking Options volume during sell-offs has been consistent since March, with volumes touching $1.3 billion this time.

Bitcoin Options Volume | Source: Glassnode

So, where is Bitcoin heading?

Along with the aforementioned falls came a brief slip in funding rates, which has since risen back to positive. However, the Funding Rate this time has been significantly lower than during May’s recovery from the crash.

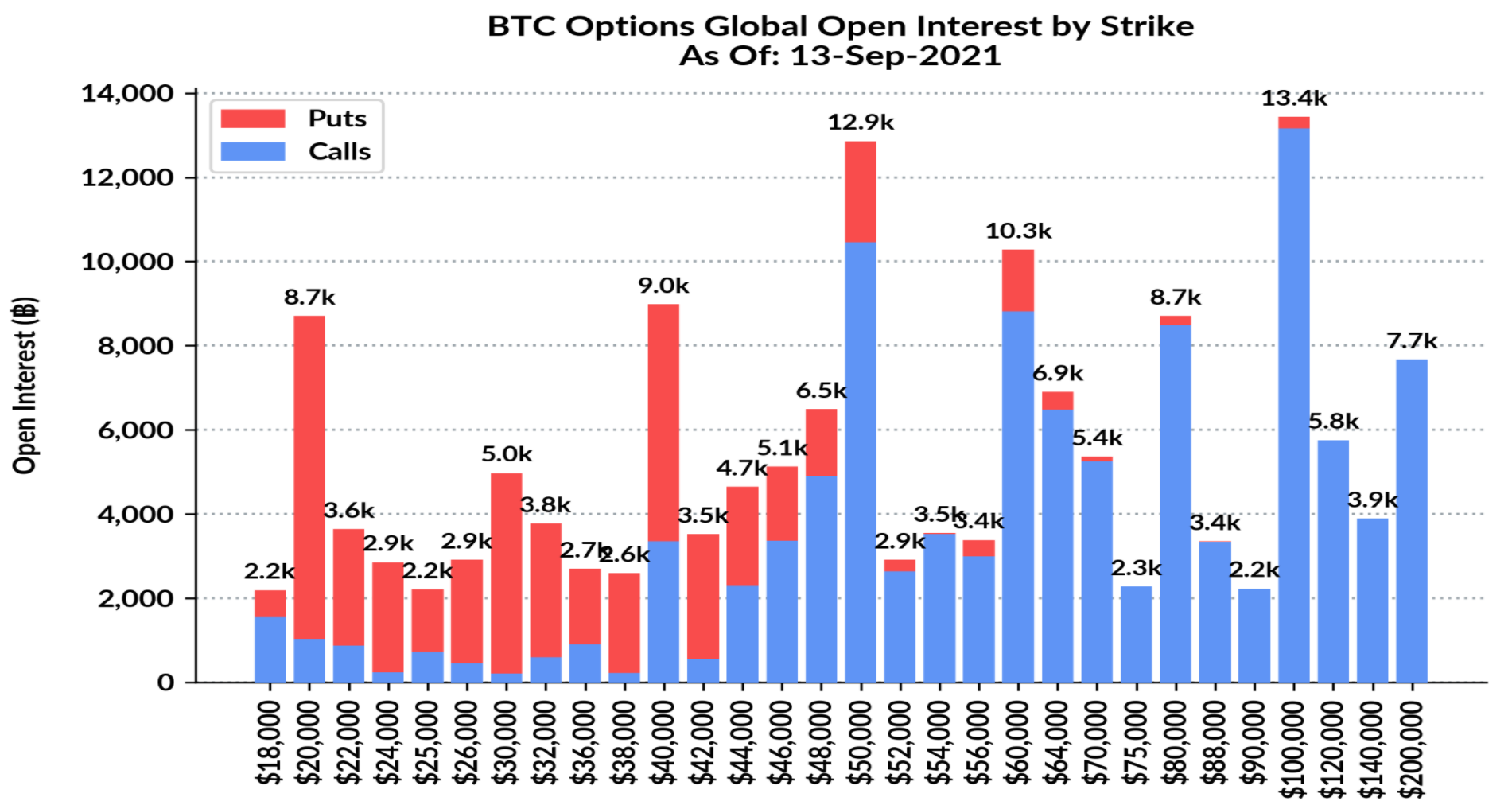

What’s important is that this rise in positive sentiment will play out in Bitcoin’s favor since there are over 12.9k and 13.4k contracts pitching the price to hit $50k and $100k, respectively.

Bitcoin OI by strike | Source: Skew – AMBCrypto

At the moment, however, looking at the price movement and network performance, $50k appears to be more probable.

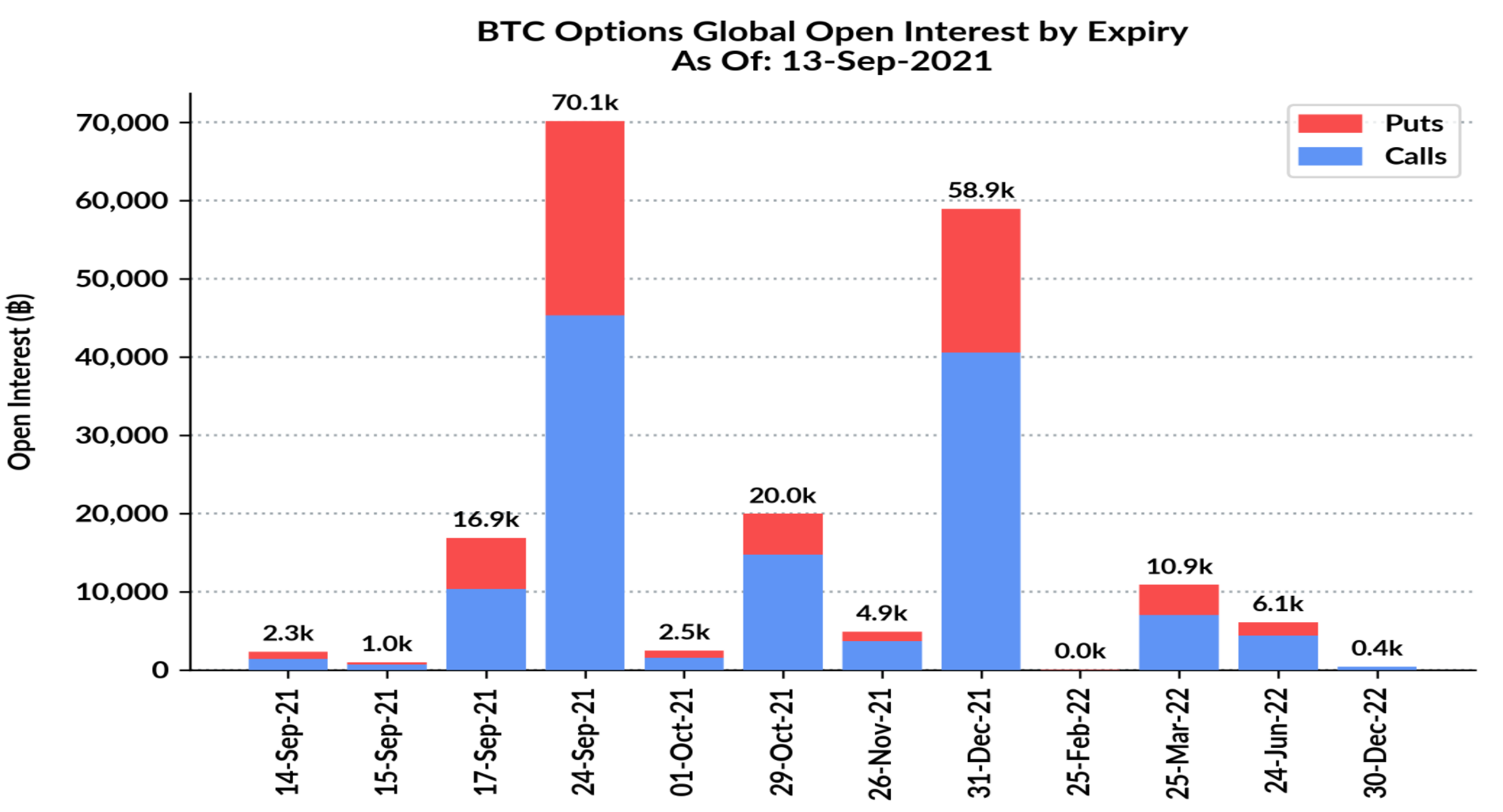

Although there is only a 21% chance of BTC reaching that price point this month, the expiry of 45k Calls and 25k Puts contracts on 24 September will give us a clearer picture of where the price will be by 1 October.

Bitcoin options expiry | Source: Skew – AMBCrypto