Crypto Fear and Greed index hits 70: Impact on BTC, ETH & SOL

- Crypto Fear and Greed index suggested that the buyers were getting greedy despite declining prices.

- BTC and ETH holders remained profitable, sentiment around SOL declined.

One would expect that the recent correction in prices for most coins could impact the overall market sentiment negatively. However, data indicates that the market was more optimistic than ever.

Crypto Fear and Greed index shows bulls are greedy

The crypto greed and fear index was at 70 at the time of writing indicating that most of the market still had an appetite for buying as prices of various cryptocurrencies fell.

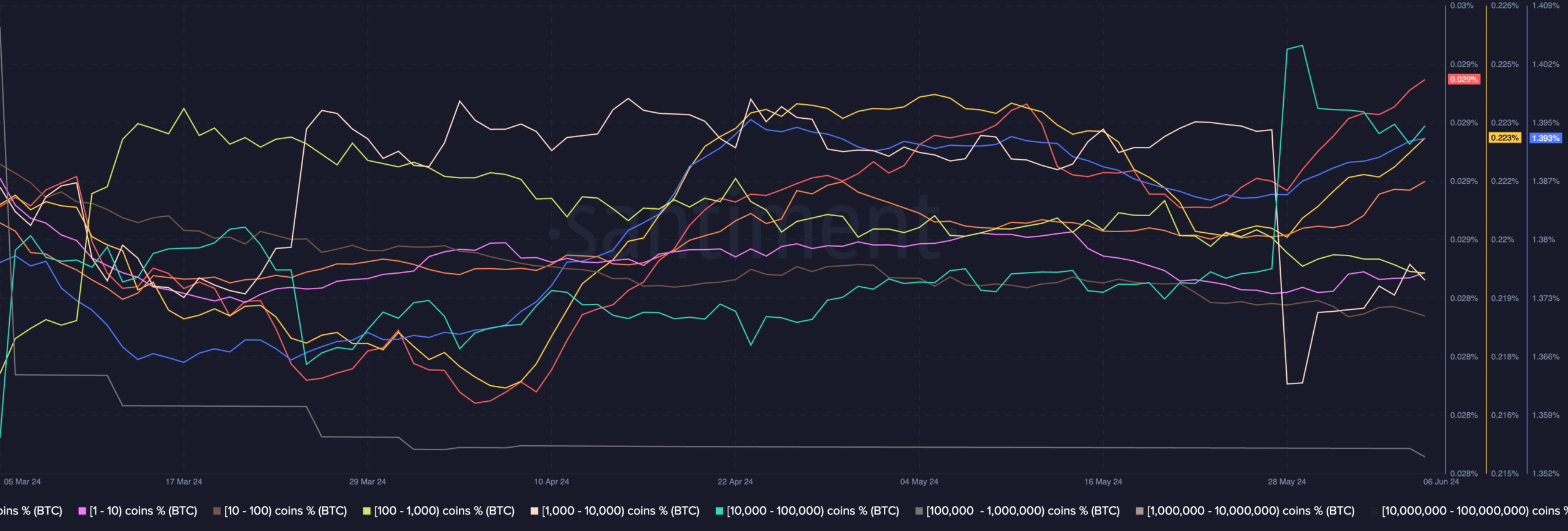

One of the most telling indicators of interest showcased by addresses would be the behaviour of whales and retail investors.

AMBCrypto’s analysis of Santiment’s data indicated that whale addresses had began accumulating large amounts of BTC. Coupled with that retail investors were showing interest in the king coin as well.

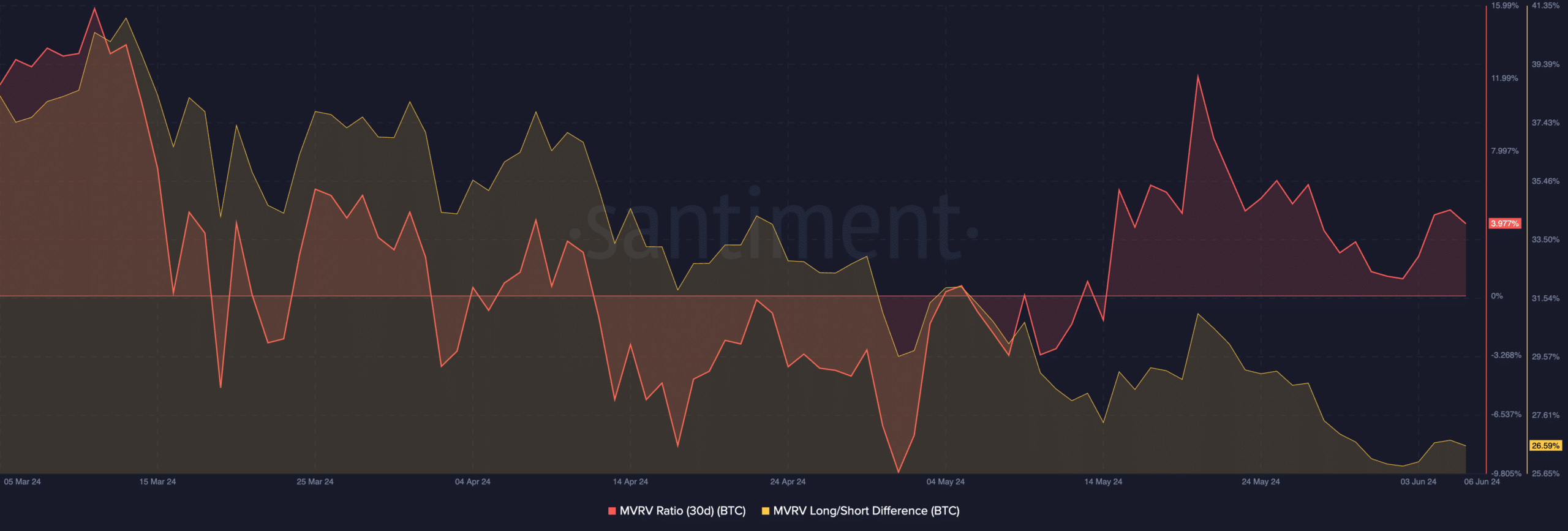

Despite the recent correction of BTC’s price, the overall addresses remained largely profitable as indicated by the MVRV ratio. Even though high profitability helps with the sentiment around the king coin, it also increases the chances of profit-taking and future sell-offs.

The Long/Short difference for BTC had also declined significantly during this period implying that long term holders of BTC had fallen which increases the likelihood of a sell off.

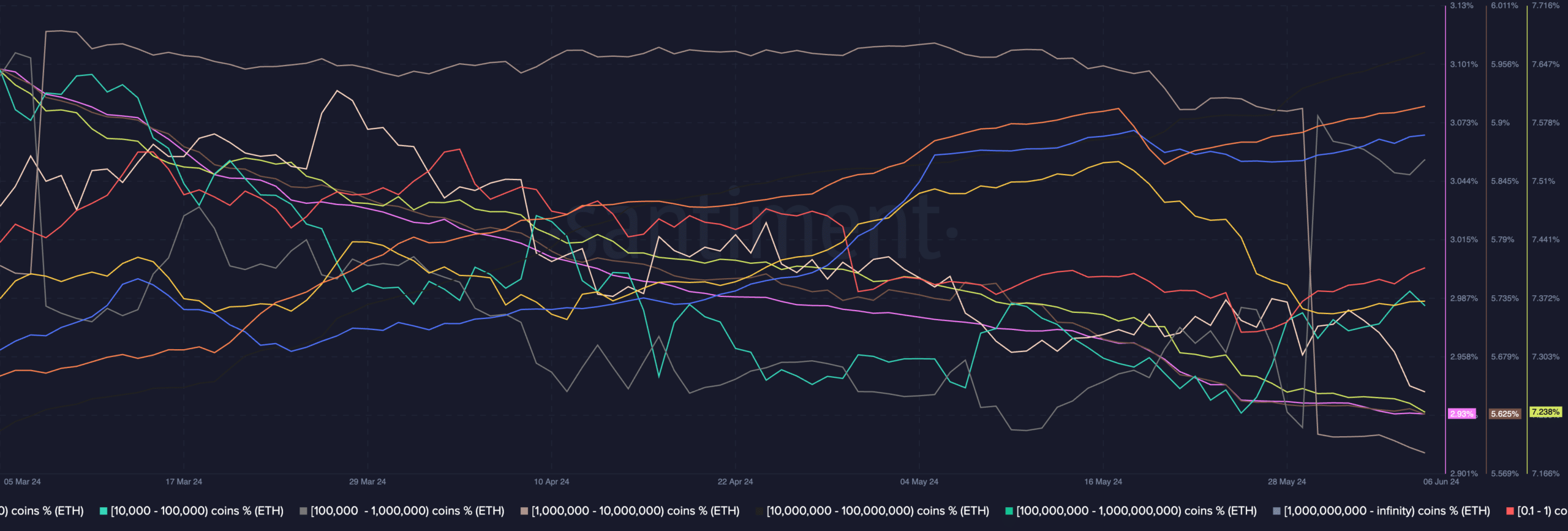

Ethereum however did not see the same level of behaviour from addresses. Retail investors showed more greed over the last few days and engaged in significant amount of accumulation.

However, the same couldn’t be said for whales that actually sold their holdings.

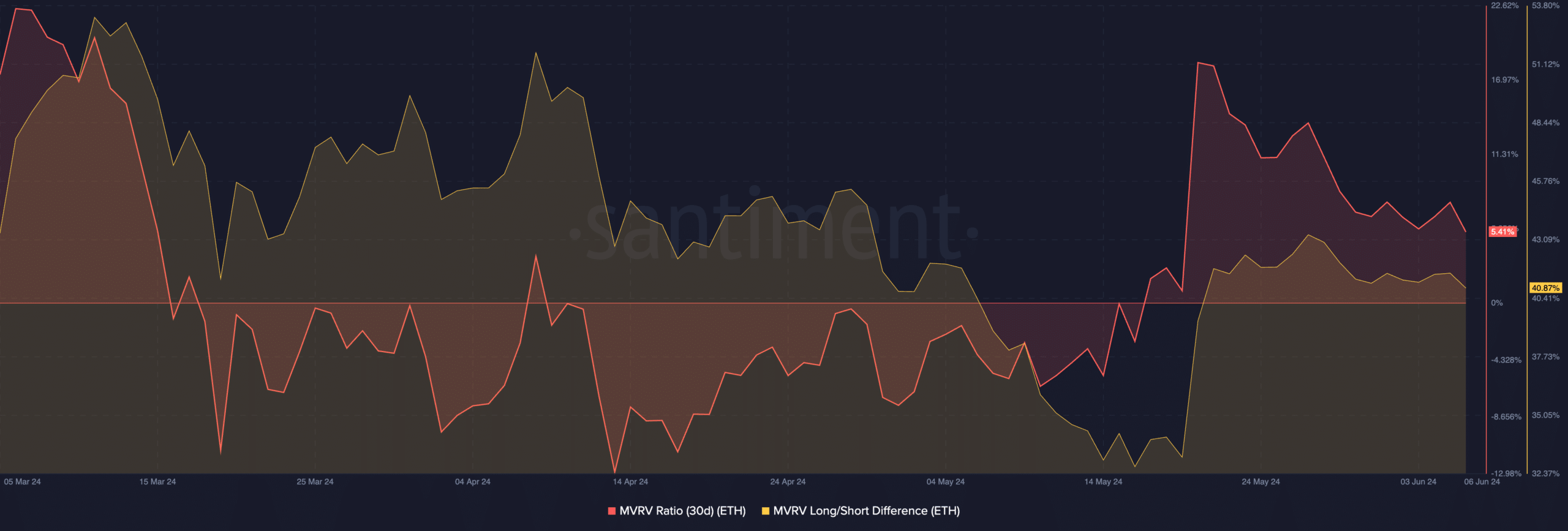

Coming to the state of its holders, it was seen that ETH holders were extremely profitable just like BTC holders.

However, the presence of long term holders for ETH was significantly higher compared to BTC addresses. The long term holders could help ETH grow sustainably in the future.

Negative outlook for SOL

Another coin that was majorly affected by the recent change in tides was SOL. Over the past week, the price of SOL fell by more than 12 %.

Is your portfolio green? Check out the SOL Profit Calculator

The social volume around SOL also fell indicative of the declining popularity of the token.

Moreover, the weighted sentiment around the SOL token also fell, implying that the number of negative comments around SOL had outnumbered the positive ones at the time of writing.