Crypto industry has ushered in a buoyant new year, what’s in store for Q2?

- Crypto market cap surged in Q1 and crossed the $1 trillion mark.

- However, data showed that sentiment towards coins like BTC, ETH, XRP, and BNB took a plunge in April.

After a dormant 2022, the crypto industry has ushered in a buoyant new year. The market showed massive growth in the first quarter of 2023 despite heightened regulatory scrutiny and the banking crisis.

The crypto market shook off its bears in 2023 by increasing its market cap from $831.8 billion on 1 January to $1.238 trillion on 31 March.

1/ 2023 Q1 Crypto Industry Report ?

After a turbulent end to 2022, the #crypto market made a strong comeback with $BTC outperforming traditional assets and #NFT trading volume seeing a resurgence.

Here are 6 highlights you shouldn't miss! ? pic.twitter.com/wqFih2jCQ5

— CoinGecko (@coingecko) April 18, 2023

Here are the gory details

According to an 18 April report from CoinGecko, the crypto market is off to a strong start in 2023 with a gain of 48.9% or $406 billion.

The average daily trading volume also picked up, having increased 30% quarter on quarter (QoQ) from -33% in Q4 2022 to a total of $77 billion in Q1 2023.

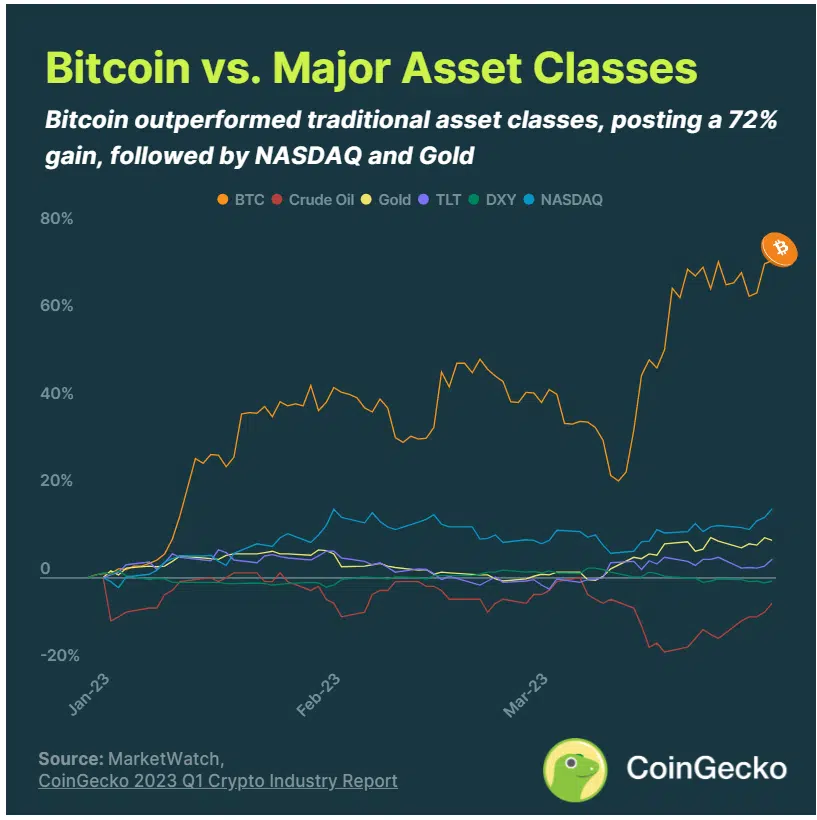

The report also found that Bitcoin [BTC] was the best-performing asset in Q1 and it outshined traditional assets like gold. BTC marked gains of 72.4% QoQ, followed by NASDAQ index (15.7%) and gold (8.4%).

However, the quarter was not so kind to stablecoins. The top 15 stablecoins saw their market cap fall by 4.5% due to the shutdown of Binance USD [BUSD] by Paxos and the USD Coin [USDC] depegging event during SVB’s collapse.

Q1 2023 also saw an uptick in NFT trading volumes. The metric rose from $2.1 billion in Q4 2022, to $4.5 billion in Q1 2023. It was interesting to note that the majority of NFT trading volume came from Blur, an NFT platform that was launched last October.

What next?

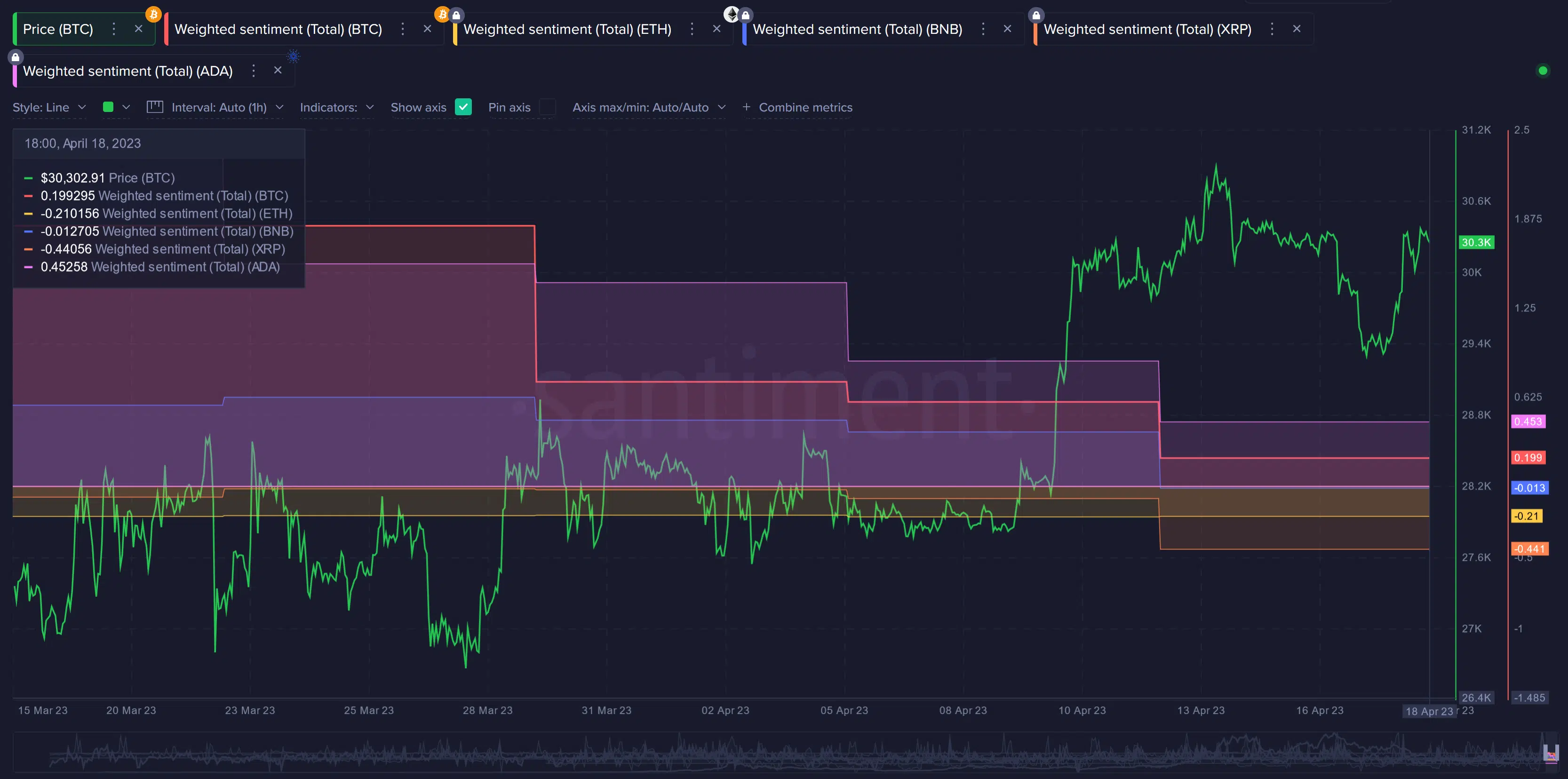

An analyst from Santiment tried to make sense of the ongoing crypto environment. A comparison of social metrics and funding rates was done, which showed that the two were showcasing contrasting stories.

It looked as if traders have become less optimistic toward top crypto assets after Q1. The data showed that weighted sentiment towards coins like BTC, ETH, XRP, and BNB took a plunge in April.

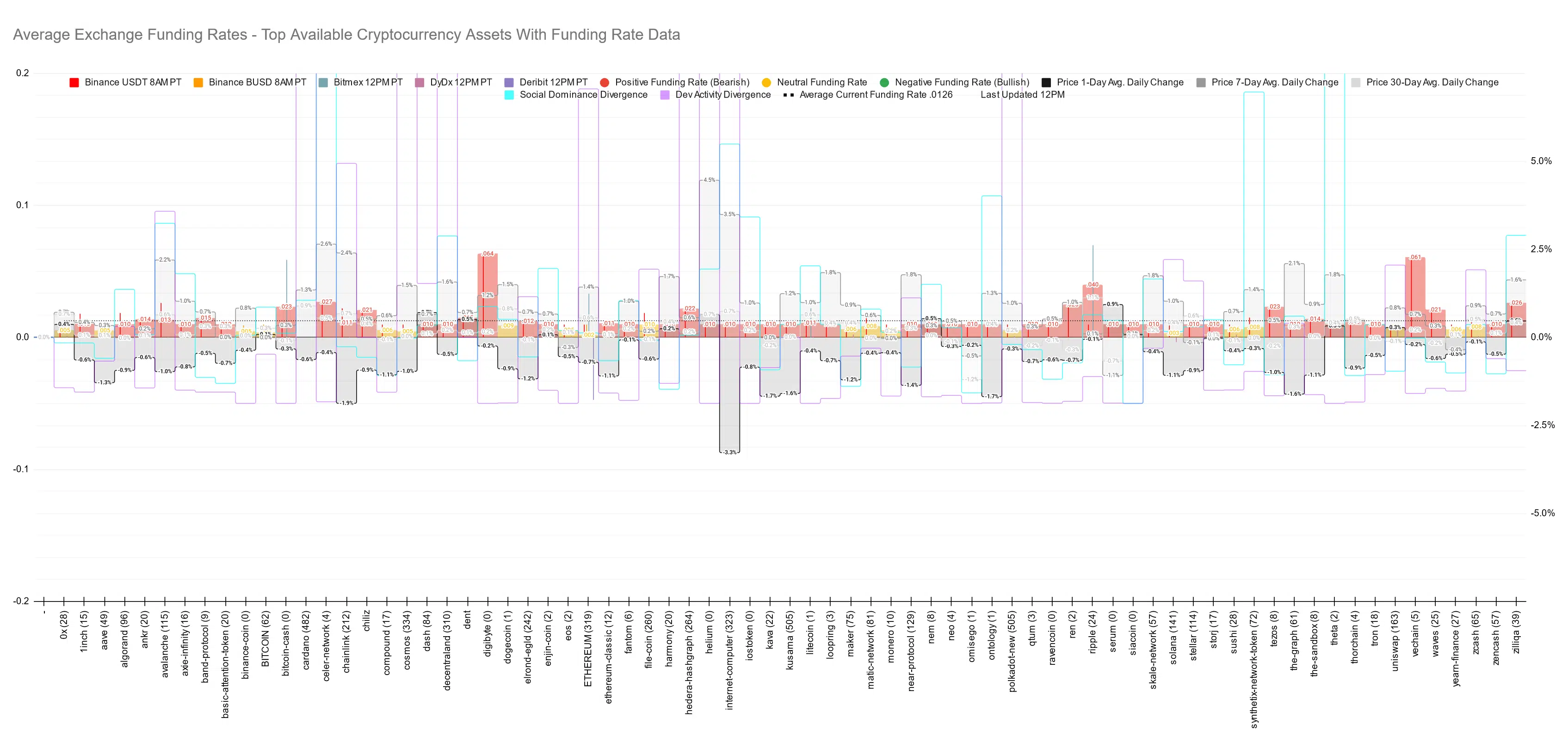

Another set of data further found that long bets were dominant in the current market structure. None of the top market cap assets showed signs of a negative funding rate when accounting for average rates across Binance, Bitmex, DyDx, and Deribit. Negative funding rates suggest that short-position traders are dominant.

This is fascinating as it is the exact opposite of what the social metrics indicated. So overall it appears as if the voices on social media are putting out a bearish stance but when it comes to where the traders are placing bets, it looks like there is a bias towards long positions.