Crypto market extends losing streak in August: Report

- Binance’s market share plunged for the sixth month in a row.

- Huobi Global emerged as the second-largest exchange by spot trading volume in August.

After a two-month hibernation period, the cryptocurrency market finally awakened in August. However, the euphoria of greater volatility quickly turned to anguish for the market’s bullish forces.

Top cryptocurrencies recorded their worst yearly declines last month, as a combination of crypto-specific and external factors resulted in Bitcoin [BTC] and Ethereum [ETH] breaking to the downside from their ranges.

About $90 billion of the global crypto market cap was wiped out in August, as per CoinMarketCap, causing a major dent to investors’ portfolios.

August sees lowest trading volumes of 2023

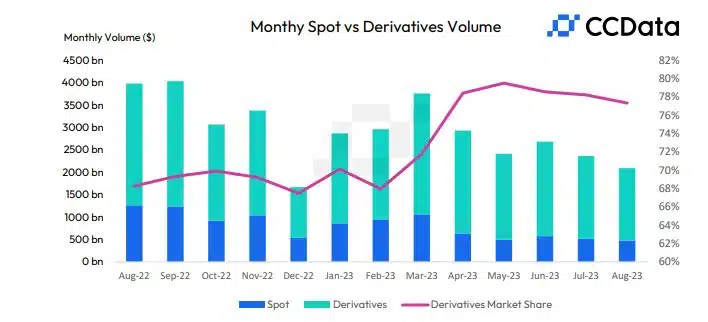

The free fall in price adversely impacted trading activity on centralized exchanges (CEX), according to a report by digital assets data provider CCData. In fact, August registered the lowest combined spot and derivatives trading volume in 2023, plunging 11.5% to $2.09 trillion.

Moreover, this was the lowest monthly volume recorded on CEXs since October 2020.

The total spot trading volume plunged to $475 billion in August, representing a sharp drop of 7.78% from the previous month. The magnitude of the decline could be gauged by the fact that daily spot volume reached a four-year low on 26 August.

As is well known, spot trading involves buying and selling assets at the current market rate, also called spot price. Therefore, a significant fall in spot prices drives short-term investors away who are on the lookout for quick profits.

According to CCData, the wild swings in August were caused by two major factors. First was Elon Musk’s spacecraft engineering company SpaceX’s reported sale of its BTC holdings. The liquidation caused panic amongst other investors, leading to a sharp fall in prices during mid-month.

Additionally, Grayscale’s victory against the U.S. Securities and Exchange Commission (SEC) at the end of the month led to a temporary price pump. These fluctuations hindered accumulation of crypto assets.

Gainers and losers

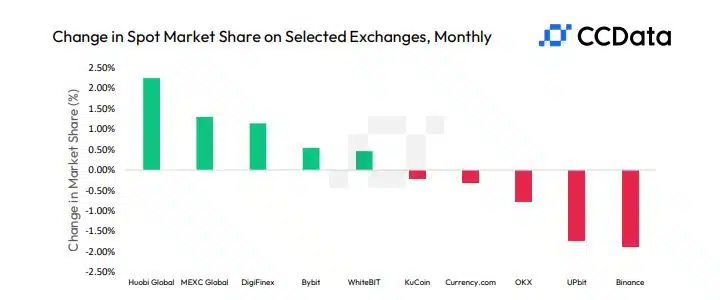

On expected lines, the lackluster trading activity was mostly driven by the underperformance of top exchanges. Top-tier spot volumes tanked nearly 12% in August.

The market share of the world’s largest crypto trading platform, Binance [BNB], fell for the sixth month in a row, as the behemoth failed to recover from the sharp blows inflicted by financial regulators.

Since the start of the year, Binance has lost nearly 13% of its market share, representing the worst decline amongst major exchanges.

The other piece of bad news came from the Korean-based exchange Upbit. After dethroning Coinbase to become the second-largest exchange in terms of spot trading in July, the platform’s market share fell by 1.73% in August.

However, amidst the gloom and failures, some encouraging developments came to light. Huobi Global, which has been battling bad press over the dramatic spike in its Tether [USDT] outflows, shook off the criticism to post the second-largest spot trading volumes in August after Binance.

The exchange, part of Tron [TRX] founder Justin Sun’s ecosystem, saw the largest increase in market share in August at 2.26%. In fact, this was the largest market share attained by Huobi since October 2021.

Derivatives market – the biggest victim

Derivatives trading volume, which formed the bulk of all crypto trading in the market, plunged 12.5% to $1.62 trillion in August. This was the lowest monthly derivatives’ volume since December 2022 and the second lowest since 2021.

Although it has a far larger market share than spot trading, the derivatives market has been losing ground in recent months. August marked the third straight decline in market share, settling at 77.3% by the end of the month.

Derivatives market relies on speculative interest for an asset. About $4.13 billion in Open Interest (OI) was wiped out following the market crash on 17 August, the largest of the year.

Exchange supply drops lower

Liquid supply of major crypto assets like Bitcoin and Ethereum were at their multi-year lows at the time of writing, data from Glassnode revealed. The growing HODLing mindset coupled with lesser confidence on exchange’s stability prompted users to stick with self-custody.

Temporary fluctuations aside, this trend was expected to continue perhaps until the next strong bull run of 2024, coinciding with Bitcoin’s halving.