Crypto-market’s liquidity only $500 million for $240 billion market capitalization

CoinMarketCap’s liquidity metric went live on 12 November and the new feature has since managed to ruffle the feathers of quite a few top crypto-exchanges.

The platform released its new index with the objective to trace real trading volume across the ecosystem. Now, according to data from CoinMarketCap, the 54 exchanges listed by the platform on its liquidity index page accounted for a total of only $350 million.

It was reported that if all other exchanges were involved, the liquidity valuation may go up to as high as $500 million. This means that from a total market cap of over $240 billion for the entire crypto-market, liquidation was achieved for only about $400-$500 million, which is an estimated 0.2 percent of the entire market cap. The uneven distribution can also be understood from the point that a mere dump of 1000-5000 BTC could cause a major market crash for the digital assets ecosystem.

The trading volume of exchanges is considered an important factor as a unit of measuring its credentials as an active exchange. The implementation of the CMC’s new index suggested that most top exchanges may have reported fake volumes.

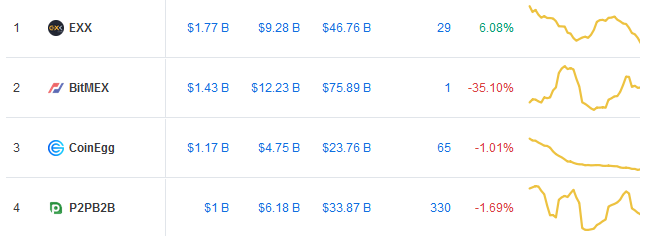

Source: CoinMarketCap

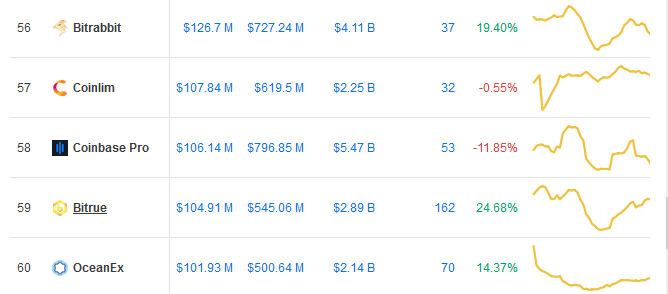

Source: CoinMarketCap

Taking the example of EXX exchange provides more clarity to the issue at hand.

At press time, the exchange was ranked 1st, registering a reported trading volume of over $1.77 billion. Over the past seven days, that number was up to $9.28 billion. However, the exchange was placed at 45th in the liquidity rankings, boasting a liquidation of only $423.09K.

Similarly, the index helped the likes of Coinbase Pro receive better credentials in the industry. Coinbase Pro is ranked 58th in the reported volume list on CoinMarketCap, whereas according to the liquidity metric, Coinbase Pro is ranked 6th, only behind the likes of Binance, Huobi Global and Bitfinex.

Source: CoinMarketCap

Source: CoinMarketCap