Crypto market’s weekly winners and losers – BONK, PEPE, ENA, RON

- Bonk, Pepe, and Hedera had the biggest gains in the past week.

- Ethena, Nervos Network, and Ronin were the biggest losers for the week.

At the top of the gainers’ table, two memecoins made significant gains, while an asset that experienced a sharp rise due to miscommunications managed to retain some profits.

Conversely, on the losers’ chart, an asset featured in the past week continued its “nervos” decline.

Biggest winners

Bonk

A closer look at Bonk [BONK] showed that it did not kick off the week on a positive note. Analysis of its price movement indicates that it began the week with a decline, trading at around $0.000020.

However, it experienced a significant uptrend throughout the week, reaching as high as $0.00029 during the trading session on 25th April. By the end of the week, it was trading at around $0.00025.

According to CoinMarketCap data, Bonk boasted the highest gain of the week, with an impressive increase of over 28.4%.

As of the time of writing, it was trading at around $0.000027, and its market capitalization had surged to over $1.7 billion. Additionally, over the last seven days, its market cap has increased by over 10%.

Pepe

Pepe [PEPE], another memecoin, experienced a significant increase in value over the past week. According to CMC data, it recorded the second-highest gains, with an impressive growth of over 26.5%.

AMBCrypto’s analysis of its price movement revealed a similar pattern to BONK: it began the week on a less positive note, trading at around $0.0000059.

However, it gained momentum throughout the week, and by week’s end, it was trading at around $0.0000070.

Further analysis indicates that its market capitalization increased by over 8% due to the price surge, reaching approximately $3.2 billion at the time of writing.

Pepe was trading with an additional price increase at the time of writing, indicating continued positive momentum.

Hedera

Hedera [HBAR] experienced the third-highest gain in the past week, with data showing an increase of almost 19%.

The price surge was particularly noteworthy, driven by confusion surrounding its connection to Blackrock during the week.

AMBCrypto’s analysis of the daily timeframe chart revealed that HBAR began the week with a 3% increase, trading at around $0.089.

However, on the 23rd of April, HBAR witnessed a remarkable price surge of over 73%, reaching approximately $0.15. This surge was attributed to news surrounding Blackrock tokenization.

Nevertheless, its price saw a rapid decline on the 24th of April, with a decrease of over 20%, bringing its price down to $0.12. By the end of the week, its price had declined to around $0.10.

Despite this decline, it emerged as the third-highest gainer for the week. At the time of this writing, HBAR was trading at around $0.10, with a slight increase.

Its market capitalization stood at over $3.8 billion, having declined by over 1.7% at the time of writing.

Biggest losers

Ethena

AMBCrypto’s analysis of Ethena [ENA] revealed that it commenced the week trading at around $1.05 but, unfortunately, experienced a decline afterward.

According to CoinMarketCap data, it declined by close to 22% over the past week, earning it the title of the highest loser. By the week’s end, it was trading at around $0.82.

At the time of writing, ENA was trading at around $0.86, indicating an attempt to start the new week positively. Furthermore, its market capitalization stood at over $1.2 billion, increasing over 4%.

Nervos Network

This marked the second consecutive week that Nervos Network [CKB] has appeared as one of the biggest weekly losers.

According to CoinMarketCap, CKB experienced the second-highest loss for the week, with a close to 19% decline in its price.

AMBCrypto’s analysis of its price trend revealed that on the 21st of April, CKB started the day at around $0.02, but by day’s end, it had declined to around $0.019.

It further declined to around $0.017 by the end of the week.

At the time of writing, its market capitalization was approximately $784 million, with its price starting the new week at around $0.018.

Ronin

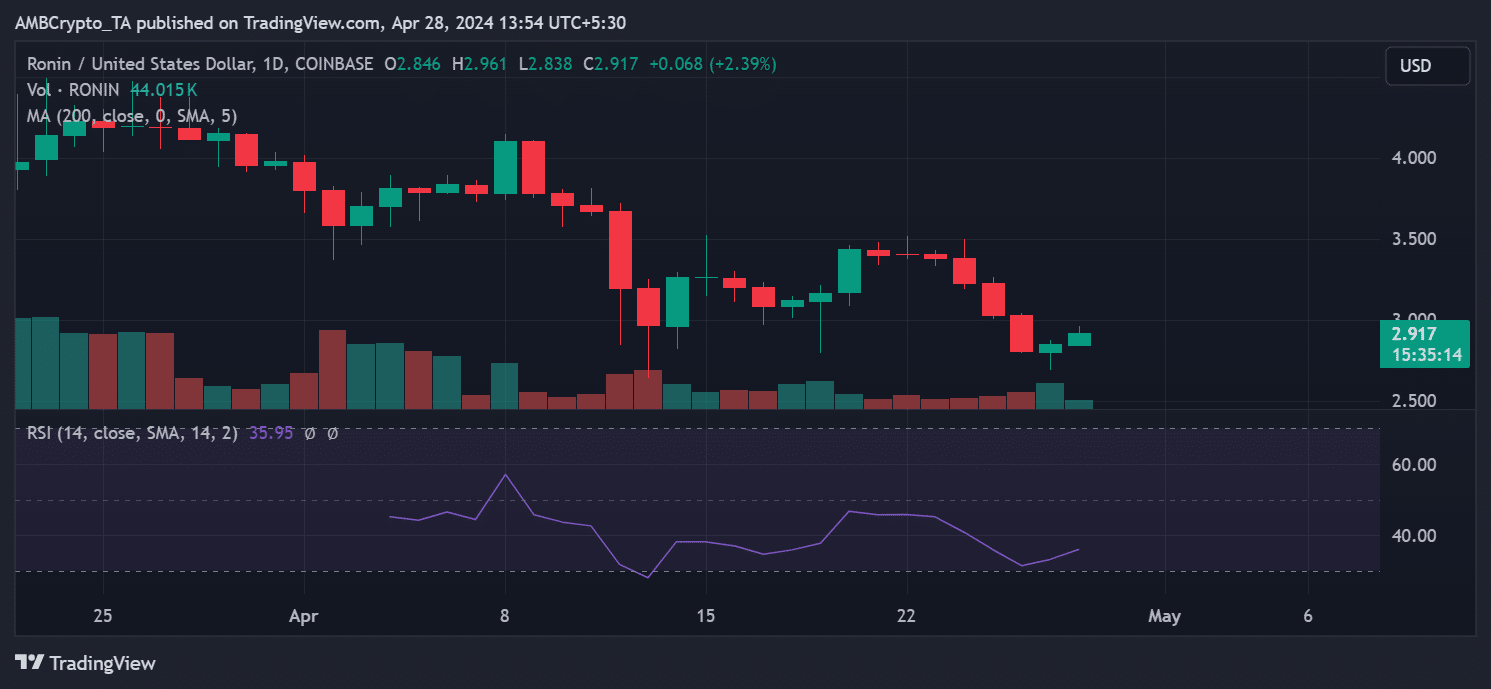

AMBCrypto’s analysis of the daily timeframe chart of Ronin [RON] (RON) revealed consecutive declines over the past week, resulting in a drop of over 15% and earning it the position of the third-highest loser for the week.

AMBCrypto’s analysis of its chart showed the week started with a decline on the 21st of April, closing at around $3.39.

By the 26th of April, the price had further decreased to around $2.80, reflecting a decline of over 7%.

However, on the 27th of April, it experienced a modest increase of over 1.5%, bringing its price up to around $2.84.

Unfortunately, this increase was insufficient to offset the six days of consecutive declines that had caused a decrease of over 15% in its value.

At the time of this writing, the Relative Strength Index (RSI) was below 40, indicating a strong bear trend. Additionally, its market capitalization stood at over $919 million.

Conclusion

Here’s the weekly recap of the biggest gainers and losers. It’s crucial to bear in mind the volatile nature of the market, where prices can shift rapidly.

Thus, it is best to do your own research (DYOR) before making any investment decisions.