Curve DAO surges 24% in 7 days: Is $1.16 ahead for CRV?

- CRV has surged by 24.79% over the past week.

- With strong bullish sentiment, Curve DAO is well positioned for gains.

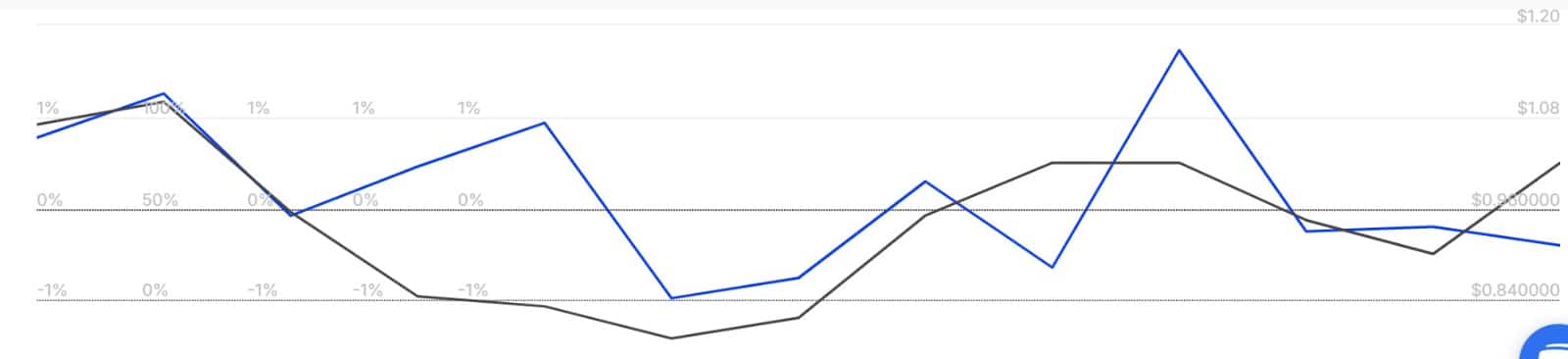

After hitting a local low of $0.68 a week ago, Curve DAO [CRV] has maintained a strong upward momentum.

Over this period, CRV has increased by 24. 79% to reclaim the $1 level. Over the past day, the altcoin reached to a high of $1.08. However, it has experienced a slight pullback since then.

In fact, as of this writing, Curve DAO was trading at $0.97. This marked an 8.03% increase on daily charts. Equally, its trading volume increased by 21% to $386 million over the same period.

The current market conditions raised questions about whether CRV is on the verge of a sustained recovery, or whether recent price movements are just mere market corrections.

Is CRV ready for a sustained uptrend?

According to AMBCrypto’s analysis, Curve DAO experienced strong positive sentiments as the downward pressure is dwindled.

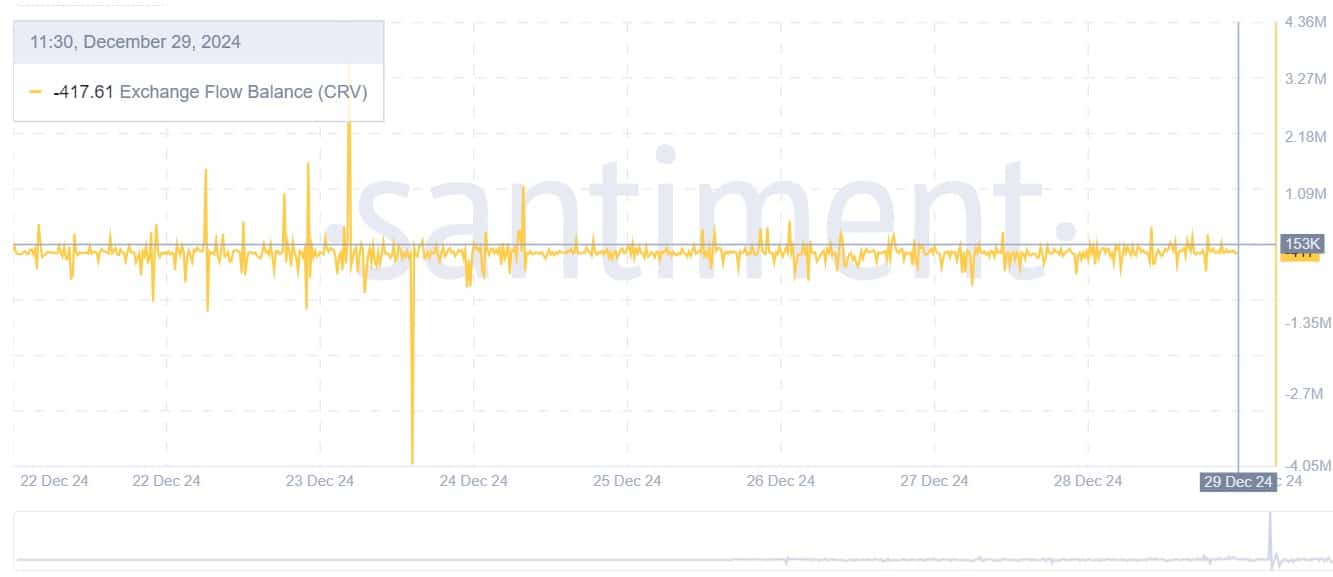

Firstly, Curve DAO’s exchange flow balance has declined over the past week to hit a negative value of -417.6. This showed that investors are moving their CRV tokens off exchanges.

As such, outflow from exchanges is outpacing inflow, with investors transferring their assets to private wallets.

This outflow is observed even more strongly from whales. According to IntoTheBlock, Large Holders Netflow to Exchange Netflow Ratio has dropped from 1.38% to -0.32%.

When this drops to a negative value, it implies that whales are in the accumulation phase, which is often a bullish signal.

Importantly, with large holders moving their CRV tokens off exchanges, it reflects their confidence in the market, and they are unlikely to sell soon.

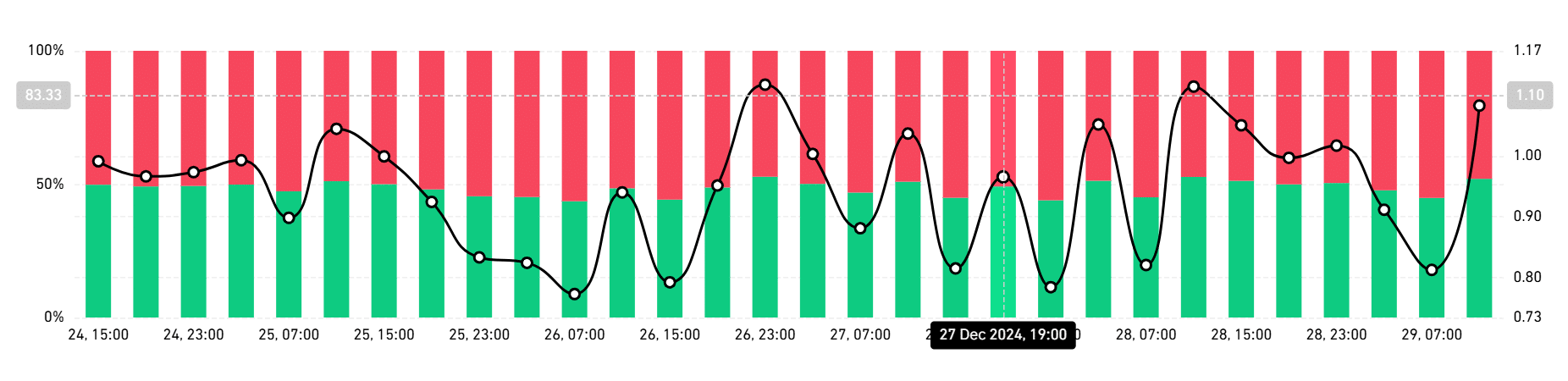

Additionally, Curve DAO is experiencing a strong demand for long positions on Binance. As such, the Binance Funding rate has remained positive over the past five days.

Therefore, longs are strong enough to support the Spot market. As such, long-position traders are willing to pay a fee and hold their trades during downturns.

Finally, on short timeframes, CRV investors are bullish and are going long. According to Coinglass, longs are dominating the market on a 4-hour timeframe with 52% of the total.

When longs dominate, it suggests that investors are betting on prices to rise.

Read Curve DAO’s [CRV] Price Prediction: 2025–2026

Simply put, Curve DAO is currently signaling a potential recovery with strong momentum building to the upside. If these bulls can hold the market, CRV will reclaim $1.12.

If it breaches this level to the upside, the next target is $1.16. Subsequently, if sellers regain the market, CRV could drop to $0.87.