Curve Finance: A-Z of how stETH pool has fared amid market drawdown

With the current liquidity provided at its February level, new data from the on-chain analytics platform, IntoTheBlock, revealed a consistent decline in key ecosystem metrics on Curve Finance.

Housed within the Ethereum network, Curve Finance is a decentralized exchange that focuses primarily on efficient stablecoin trading.

According to data from DappRadar, Curve Finance ranks as the 5th DEX with the largest total value locked (TVL). At press time, the protocol’s TVL stood at $5.09 billion.

Following the boom in the decentralized finance (DeFi) space in 2021, courtesy of the broader financial market woes, countless DeFi hacks, and scams, and the general decline in the cryptocurrency market, the year so far has been marked by decreased activity on DeFi protocols.

Also impacted by the general market decline, data from IntoTheBlock showed that the total liquidity provided on Curve has fallen by 81% since the beginning of the year. It fell from $27.17 billion in January to $4.01 billion by press time.

Uneasy lies the head

Curve Finance is a protocol with over 100 different liquidity pools. With a TVL of $1.4 billion, the stETH pool is the largest. As a result, the pool has been the most impacted by the general decline suffered by the DEX.

At press time, the total liquidity offered by the pool sat at $1.41 billion. On a year-to-date analysis, this has declined by 67% since the beginning of the year. On 1 January, the total liquidity provided by this pool was $4.32 billion.

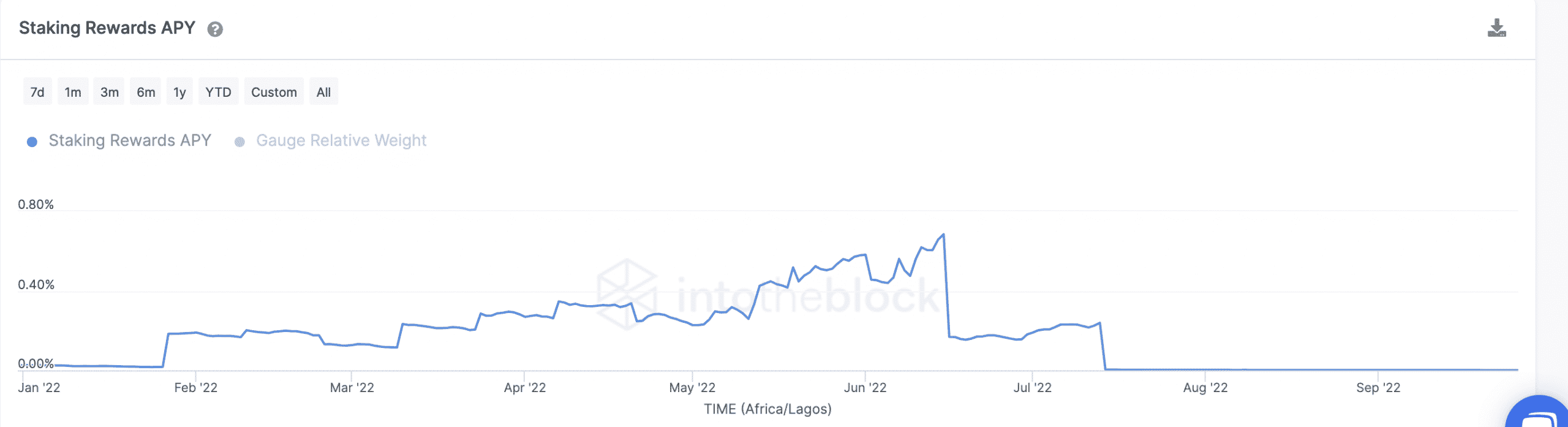

In addition to a free fall in the total liquidity offered by the stETH pool on Curve Finance, the annual percentage yield (APY) paid out as a reward to users who stake on the pool has declined significantly since 15 June.

At the beginning of the year, staking rewards APY was pegged at 0.03%. It rallied to a high of 0.68% by 15 June, after which it plummeted.

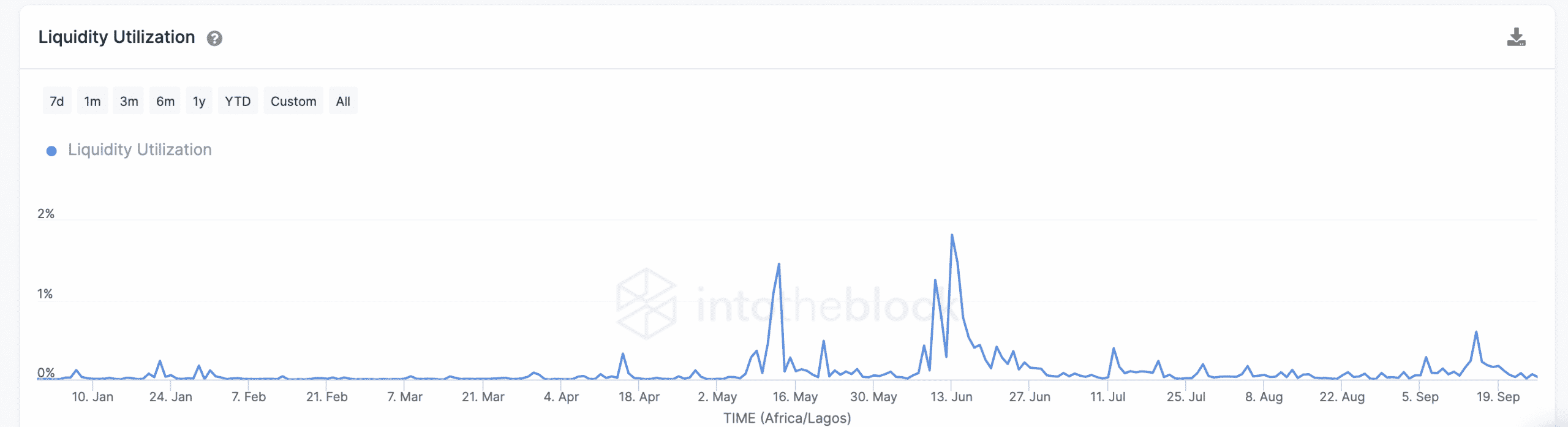

Furthermore, liquidity utilization on the stETH pool on Curve Finance has declined consistently in the last six months. A pool’s liquidity utilization is the ratio of volume traded on that pool over its total liquidity.

On 13 June, stETH liquidity utilization went as high as 1.82%. At 0.03% at press time, it has since fallen by 98% in the past six months.

According to CoinMarketCap, Curve DAO Token (CRV), the DEX’s native token, traded at $0.895 at press time. In the last month, the price of the asset has dropped by 17%.