Curve investors could watch out for these levels after CRV’s 5% rally

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

- Curve DAO [CRV] is up 5% in the last 24 hours

- Price/volume divergence could lead to a price correction in the short term

Curve [CRV] rallied after losing over 20% in recent days. The rally responded to a voted proposal on the AAVE network to secure CRV and other tokens amid extreme market conditions and migrate to AAVE V3.

Read Curve’s [CRV] price prediction 2023-2024

At press time, CRV was trading at $0.672 but encountered significant resistance to the north. In addition, a price-volume divergence could complicate any attempt at further price recovery.

CRV faces an immediate bearish order block around $0.715; will the bulls be able to get around it?

A Fibonacci retracement tool (yellow) was placed between the highest and lowest price points between 20 and 29 November. The white lines are trend lines marking important support and resistance levels within the drawn period.

It was seen that the recent CRV price correction found support at $0.633, near the 61.8% Fib retracement level. Furthermore, this current support level offered bulls an opportunity to initiate a new price rally at the time of the writing.

However, the rally faced significant resistance at the 78.6% Fib level ($0.682) and the bearish order block zone around $0.715. If the bulls break the resistance at $0.682, the new target could be $0.715.

The Relative Strength Index (RSI) witnessed a slight upsurge and stood just above the neutral 50 level. This showed that the bears lost their ground, and the bulls were approaching to take complete control. Although a near-neutral mark didn’t indicate clear strength on either side, the upward curve suggested that the bulls could advance further.

Furthermore, the On-balance Volume (OBV) also recorded an uptick after a series of highs followed by a flat line. This showed that the bulls had enough trading volume to push them forward. Therefore, the short-term outlook of CRV between the 61.8% Fib level and $0.715 could be bullish.

However, a break below the 61.8% Fib level ($0.622) would negate the above inclination. Such a break could lead to a downtrend toward the 50% Fib level ($0.580) or below.

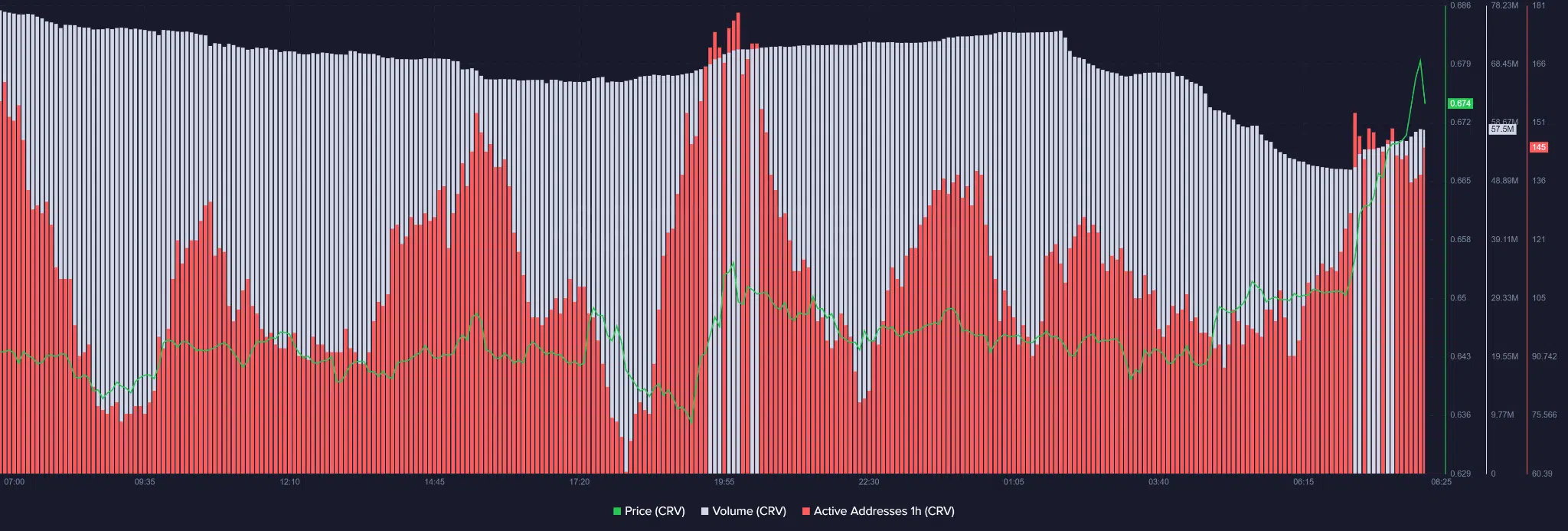

Price/volume divergence could lead to a price correction

According to Santiment, CRV showed a decreasing trading volume when prices were rising. Additionally, the active address steadily increased within the last hour of press time but later dropped. This indicated a lower number of accounts participating in CRV trading and could point to a possible price correction.

Interestingly, CRV lost the $0.64 level after Bitcoin [BTC] lost $16.2. Therefore, short-term CRV investors should watch BTC’s performance and the current price-volume divergence.