Curve, Uniswap and SushiSwap battle it out as DEX fee keeps declining

- DEX fees decline as competition increases.

- Despite the growth of protocols, tokens face the heat.

According to data provided by Messari, the fees on DEXs have drastically reduced over time. This decline in fees would help DEXs such as Uniswap, Curve, and SushiSwap attract more users to their respective protocols.

The decline in fees is also an indicator of increasing competition amongst various DEXs.

Read Uniswap’s Price Prediction 2023-2024

This battle for liquidity among protocols is displayed in the steady decline of DeFi fees as a percentage of volume.

Open-source code, competitive protocol designs, and the ease of moving LP capital forced swap fees lower. pic.twitter.com/46XSwmIecD

— Messari (@MessariCrypto) February 19, 2023

Battle of the DEXs

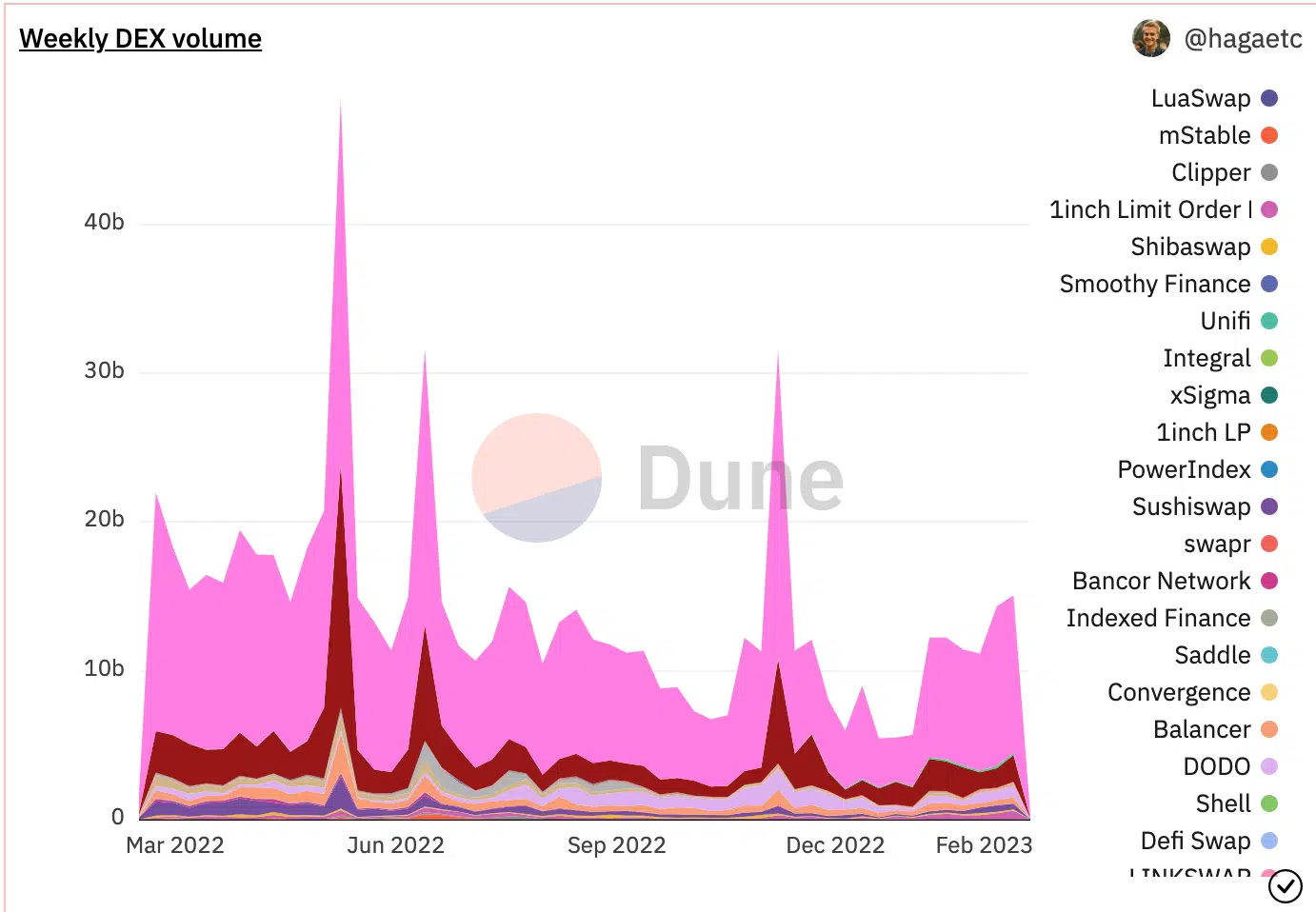

However, despite growing competition amongst decentralized exchanges, the overall volume across all the DEX platforms has continued to increase.

Uniswap managed to benefit the most from the growth of the DEX space. Based on Dune Analytics’ data, it was seen that Uniswap’s market share grew from 52% to 72% over the last month.

The number of Uniswap users also grew during this period and increased by 0.11%. The overall number of unique users on the protocol increased by 453,441 at press time.

However, SushiSwap, outperformed Uniswap in this area. The number of unique users on the SushiSwap protocol grew by 0.5% and 666,382 new users used it over the last month.

Although these two DEXs managed to gain new users and capitalize on the growth, the same could not be said for the Curve Finance protocol.

It witnessed a drop in the number of unique users which fell by 0.31% in the last month.

However, Curve managed to improve its revenue by 0.3%. Well, Uniswap also witnessed a surge of 0.68% in terms of revenue.

How much are 1,10,100 SUSHI worth today?

However, SushiSwap wasn’t able to generate the same amount of growth in revenue. At press time, the revenue generated by it in the last month was $5.32 million- indicating a fall of 0.33%.

No impacts on the token

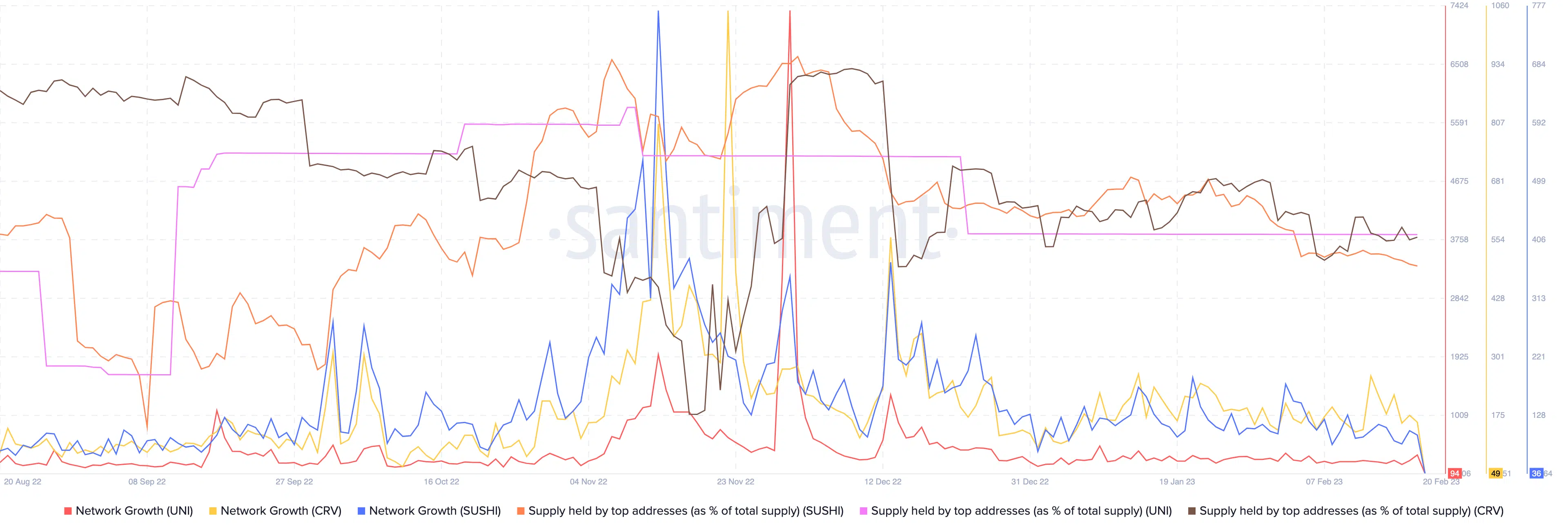

On the other hand, SUSHI, UNI, and CRV witnessed a decline in network growth. Suggesting that new addresses were losing interest in the tokens.

Moreover, whale interest in these tokens had started to decline at press time. Due to this, the percentage of large addresses holding SUSHI, UNI, and CRV had fallen.

Another area where these DEXs faced problems was the futures and derivatives market. According to Delphi Digitals data, CEXs still continued to dominate the majority of the Options market.

On-chain options only account for 0.19% of notional open interest (OI), with a high of 2% OI in April 2022. pic.twitter.com/YK7s4N3kS0

— Delphi Digital (@Delphi_Digital) February 19, 2023

In conclusion, even though the DEXs have made considerable progress, they still have a lot of problems to overcome before they can compete with centralized exchanges.