Crypto and DeFi opportunities are a result of this

Equating the early days of the internet with the crypto boom is now just a hackneyed adoption analogy. However, now that it is understood, investors can use it to diversify their portfolios.

Crypto evangelist Chamath Palihapitiya recently called “Bitcoin the most profound iteration of the internet that we’ve seen.” However, this time around it is “headless”.

Palihapitiya explained that Google ruled the roost at the beginning of the internet boom. And, Facebook has dominated the industry for the last 15 years, he added. Therefore, current crypto and DeFi opportunities are a result of problems the sector had with ‘just two companies’ marking their territory.

While several analysts remain bullish for Bitcoin and DeFi, let’s understand how Google and Facebook have performed with respect to the return-on-investment (ROI) percentage of the coin.

At press time, Bitcoin investment outperformed Google stocks by around 8% in the last six months. But, Facebook performed better than Bitcoin for the same period at around 7.3% ROI. Here’s the daily chart for the past months.

However, stressing on values of decentralization and a peer-to-peer network, Palihapitiya said,

“We all need to pay attention to it [crypto] because I think the implications are enormous.”

Having said that, Palihapitiya reinforced that decentralization is a very important principle in democratic countries. In this context, he said that many large investors are now avoiding investments in China.

In terms of individual portfolios, he explained his three-point strategy, as medium-term inflation concerns grapple him. Own “hyper growth” assets, “non-correlated assets,” and “cash generative assets,” he said. And, in terms of battling inflation, he opined that “Bitcoin has effectively replaced gold.”

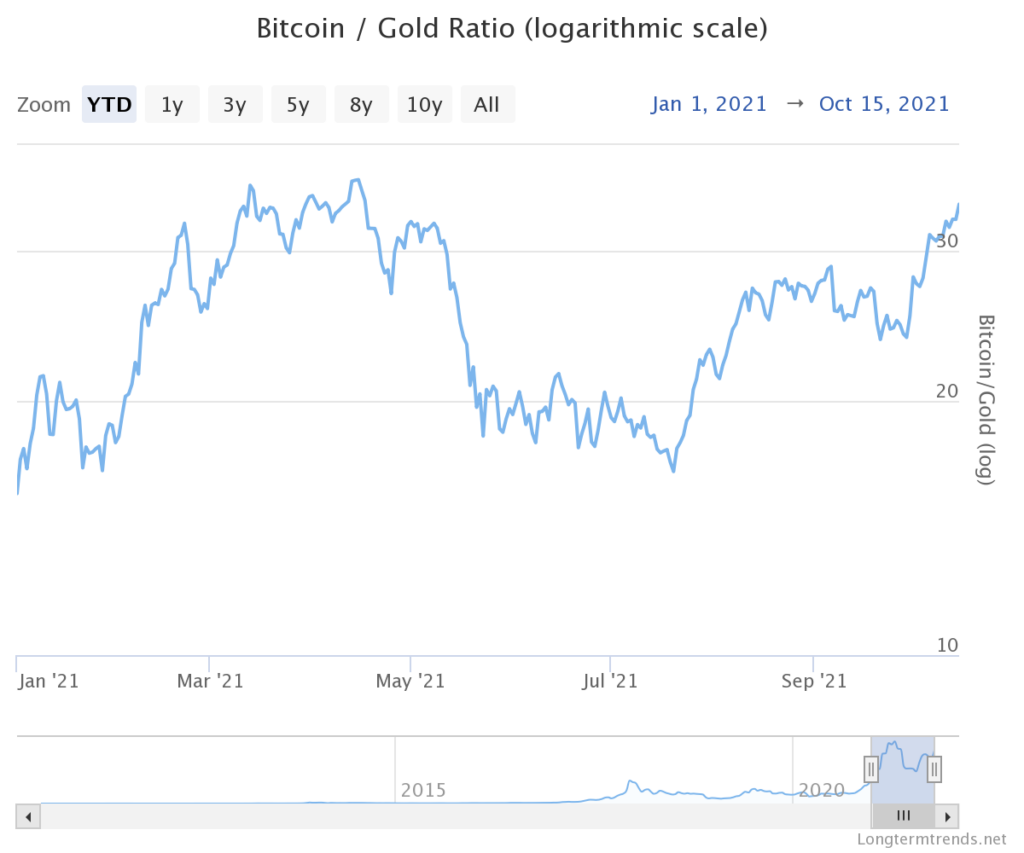

Looking at latest market trends with respect to the price of Bitcoin and Gold, the former seems to be outperforming as well.

He further added,

“Bitcoin was supposed to be smart contracts and, you know better savings accounts, better insurance, better credit scoring. And that’s happening through DeFi stuff that’s being built on Ethereum and Solana.”

This leaves a clear picture of where investor focus should be fixed. Crypto investor Adam Cochran had also stated earlier that how Ethereum and Solana are important components of the system. He said,

“Think of it like a computer, Ethereum is a CPU and Solana is a GPU. Both of them optimized towards different types of operations and states.”