Decentraland’s MANA rallies on back of whale activity

- The volume of whale transactions involving MANA has risen in the past few days.

- There is a steady inflow of liquidity into the MANA spot market.

MANA, the token that powers leading metaverse-based platform Decentraland, has witnessed a significant increase in whale transactions over the past few days.

#Decentraland | Whale activity is rising!

Not only are we seeing a spike in $MANA whale transaction count, but some of the biggest whales on the network recently purchased 25 million #MANA, worth over $10 million. pic.twitter.com/fJVgAU0jtZ

— Ali (@ali_charts) November 8, 2023

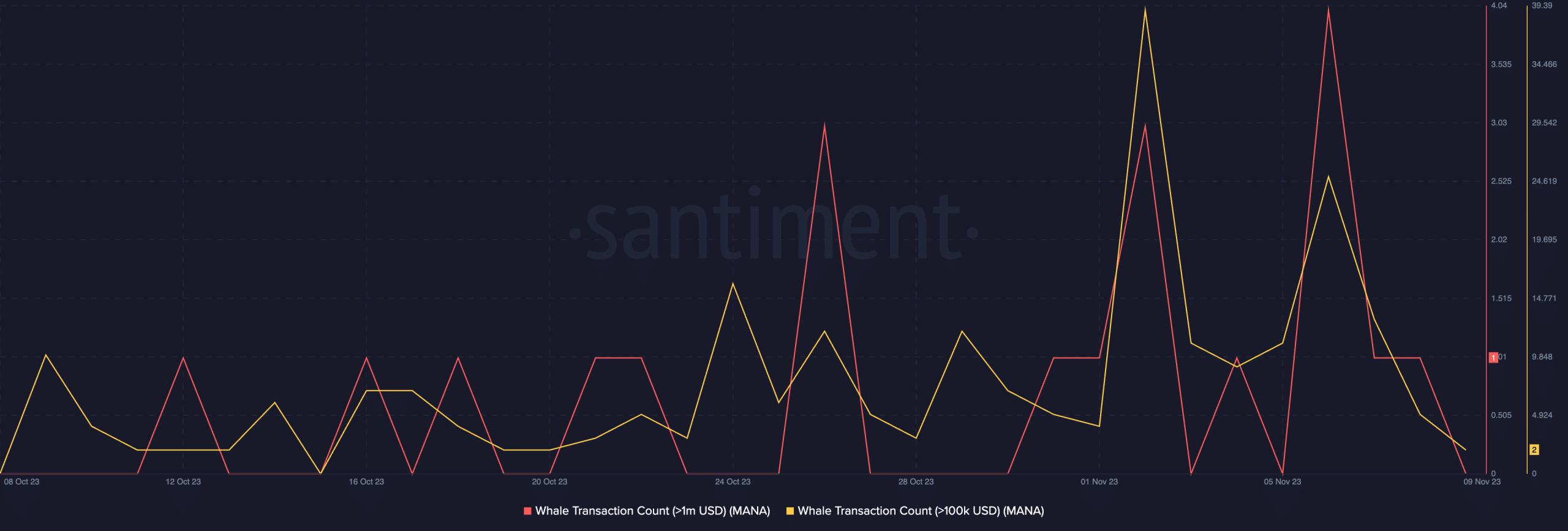

Information retrieved from on-chain data provider Santiment showed that the daily count of whale transactions exceeding $1 million reached a new high on 6th November.

This surge in whale activity follows a similar trend in whale transactions above $100,000, reaching a multi-month high a few days prior, data from the same source revealed.

MANA turns green

The surge in price is attributable to the general growth in the crypto market since October. In the last month, MANA’s price has rallied by over 45%, per data from CoinMarketCap.

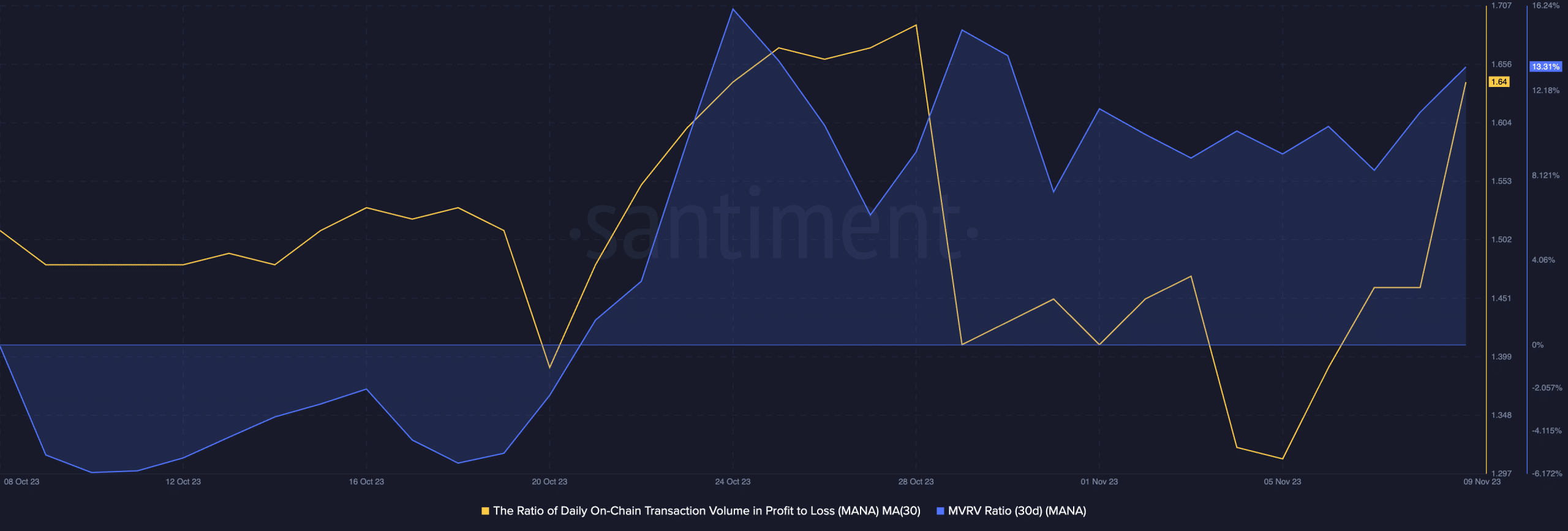

As the alt’s price climbed, its ratio of daily on-chain transaction volume in profit to loss began to increase.

The metric observed on a 30-day moving average was 1.64 at press time, showing that for every MANA transaction that ended in a loss in the last month, 1.64 transactions returned a profit.

Likewise, the asset’s Market Value to Realized Value (MVRV) ratio observed within the same time frame was 13.31%.

An asset’s MVRV ratio tracks the ratio between that asset’s current market price and the average price of every coin or token of that asset acquired.

At an MVRV ratio value above 1, if every MANA holder were to sell their tokens at the current market price, they would, on average, realize a profit of 13% on their initial investments.

The price hike and the profitable nature of MANA transactions caused investors to sell their holdings for profit at the beginning of the month, but this has slowed in the past few days.

An assessment of the token’s exchange activity showed a 2% decline in MANA’s supply on exchanges since 5th November. Within the same period, its supply outside exchanges has risen by 1%.

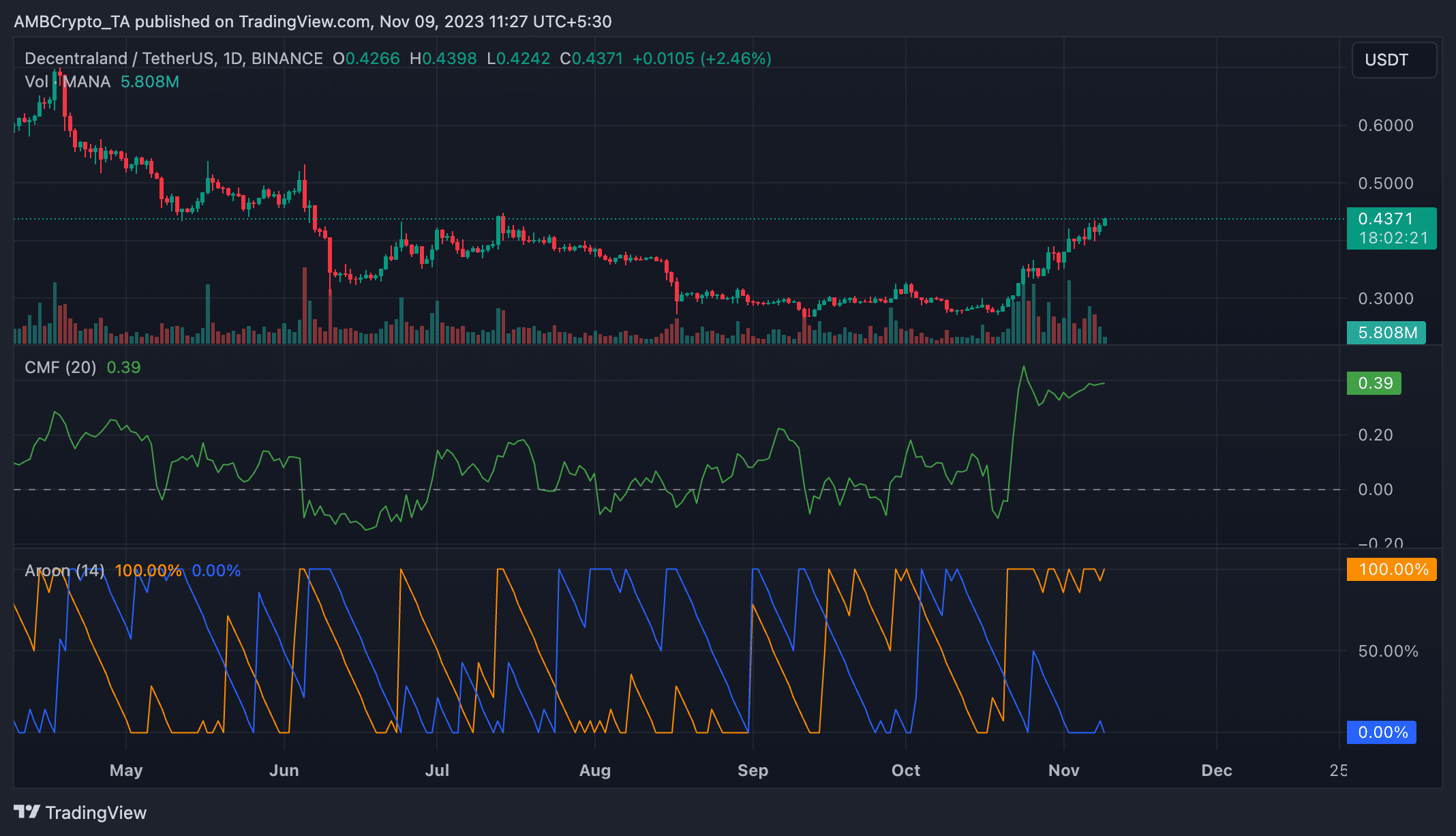

Further, MANA’s Aroon Indicator, considered on a 24-hour price chart, confirmed the strength of the current uptrend.

Is your portfolio green? Check out the MANA Profit Calculator

The Aroon up line (orange) was 100% at press time. When an asset’s Aroon Up line is close to 100, it indicates that the uptrend is strong. And that the most recent high was reached relatively recently.

Lastly, token’s Chaikin Money Flow (CMF) was spotted at 0.39 and in an uptrend, signaling the steady inflow of liquidity needed to sustain the uptrend.