Deciphering if Cardano buyers should consider buying this ‘dip’

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice.

- Cardano bears found renewed selling pressure and extended the coin’s descent.

- The crypto’s funding rates and the long/short ratio unveiled some hope for the buyers.

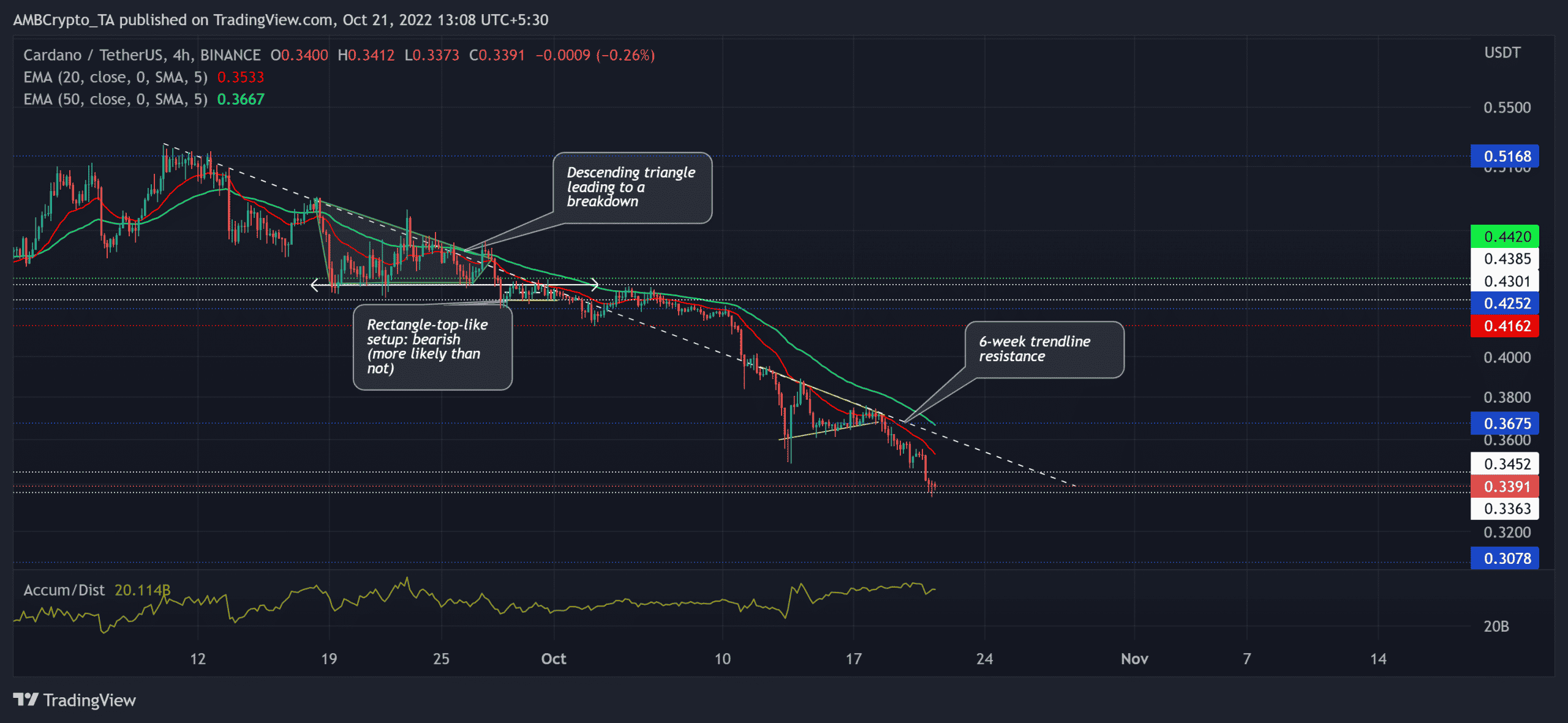

After reversing from the $0.51-resistance on 12 September, Cardano [ADA] expedited its southbound trajectory for over a month now. The entailing descent chalked out a trendline resistance (white, dashed) that has undermined the buying rallies for nearly six weeks.

Here’s AMBCrypto’s price prediction for Cardano [ADA] for 2023-24

With the price action struggling to snap the limitations of its 50 EMA (cyan), the broader trend continued to tilt toward the sellers. A reversal from its newly-found support could spur some buying pressure in the coming sessions.

At press time, ADA was trading at $0.3391, down by 4.34% in the last 24 hours.

Will bears continue finding fresher lows?

For over a month, the 20 EMA (red) and the 50 EMA kept the buying rallies under control by inducing reversals. Thus, the narrative refrained from exhibiting a buying edge for over a month.

After barely maintaining a position above its six-week trendline resistance, ADA fell back into the bearish track over the last two weeks.

The recent symmetrical triangle setup saw an expected breakdown while highlighting a continuation of the downtrend. This resulted in the bears flipping the $0.34 mark from support to immediate resistance.

Thus, a close below the $0.33-support could reignite solid bearish pressure and trigger a selling signal. The first major support level stood at the $0.3078-mark. The recent volatile break has put ADA in a relatively low liquidity zone. Hence, making its price more fragile to highly volatile moves.

Nonetheless, a likely reversal from its multi-monthly lows can aid the buyers in retesting the trendline resistance in the $0.36 zone. A sustained close above the $0.36 level could affirm a near-term bearish invalidation.

The Accumulation/ Distribution (A/D) marked a streak of higher troughs over the last week. This trajectory chalked out a bullish divergence with the price action.

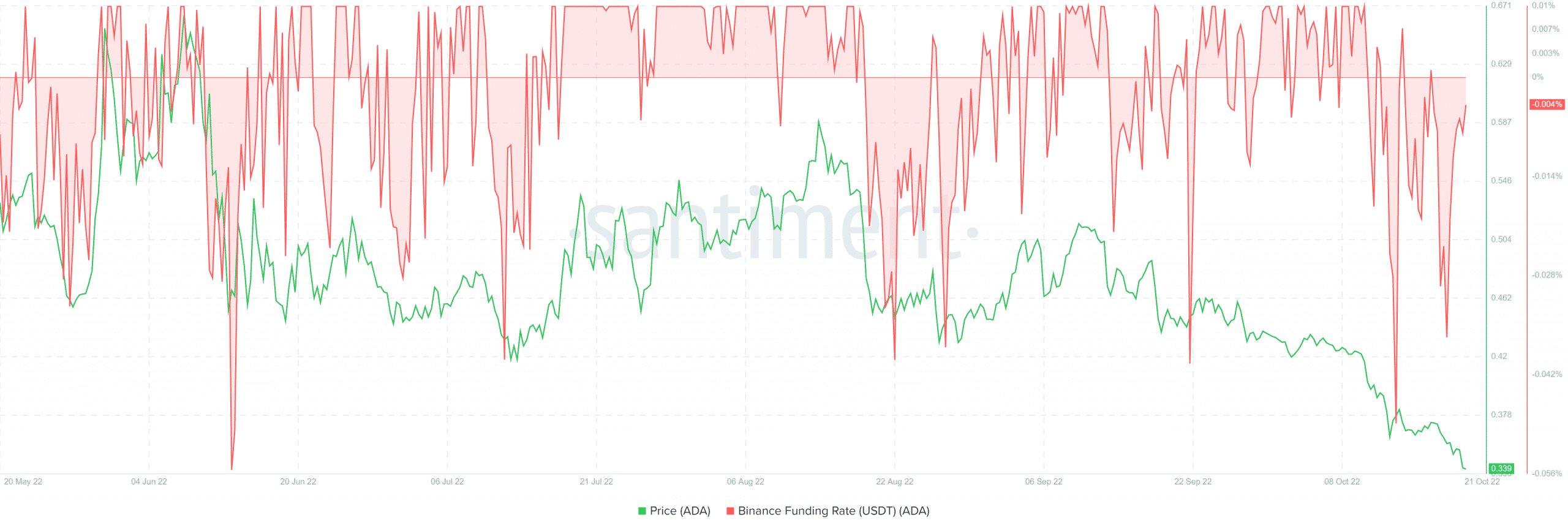

The funding rates witnessed gradual growth

Since mid-September, ADA exhibited weak price sensitivity with its funding rates on Binance. Over the past week, the gradual increase in these rates accompanied a price decline. Should the price action find a rebound from its oversold readings, the price action could potentially bounce back in the coming sessions.

Interestingly, ADA’s long/short ratio over the last four hours revealed a slight edge for the buyers. Finally, the buyers should factor in Bitcoin’s movement and its effects on the wider market to make a profitable move.