Decoding if 1INCH could fall to sell pressure as whale transfers into exchange

- A whale transferred two million 1INCH into Binance despite accumulating at a higher average price

- The token price declined with the technical outlook poised to fall further

On 12 February, a whale transferred $1.09 million worth of 1inch Network [1INCH] into Binance, Lookonchain revealed. Usually, a transfer of this magnitude infers an intent to sell. However, the on-chain smartmoney track mentioned that the last transfer the said whale had, was in August 2022.

A whale transferred 2M 1INCH($1.09M) to #Binance 20 mins ago.

The whale received 10M 1INCH in Dec 2021 and Jun 2022, the average receiving price is ~$0.83.

The last time he/she transferred 2M 1INCH to #Binance was on Aug 2, 2022, when the price was $0.75. pic.twitter.com/K3LgY2SI1b

— Lookonchain (@lookonchain) February 12, 2023

How much are 1,10,100 1INCH tokens worth today?

An evaluation of the sale implied that the whale selling the tokens would be a realized loss. This was because the average price of the 10 million 1INCH accumulated was $0.83 while the token exchanged hands at $0.53 as of this writing. So, has 1INCH suffered a significant loss in value as a result of this whale action?

Pressure on the bulls

Well, information from CoinGecko showed that the 1INCH exchange against Bitcoin [BTC], in the last 24 hours resulted in an 0.8% decline. However, the token’s ride against the U.S. Dollar was a different talk altogether.

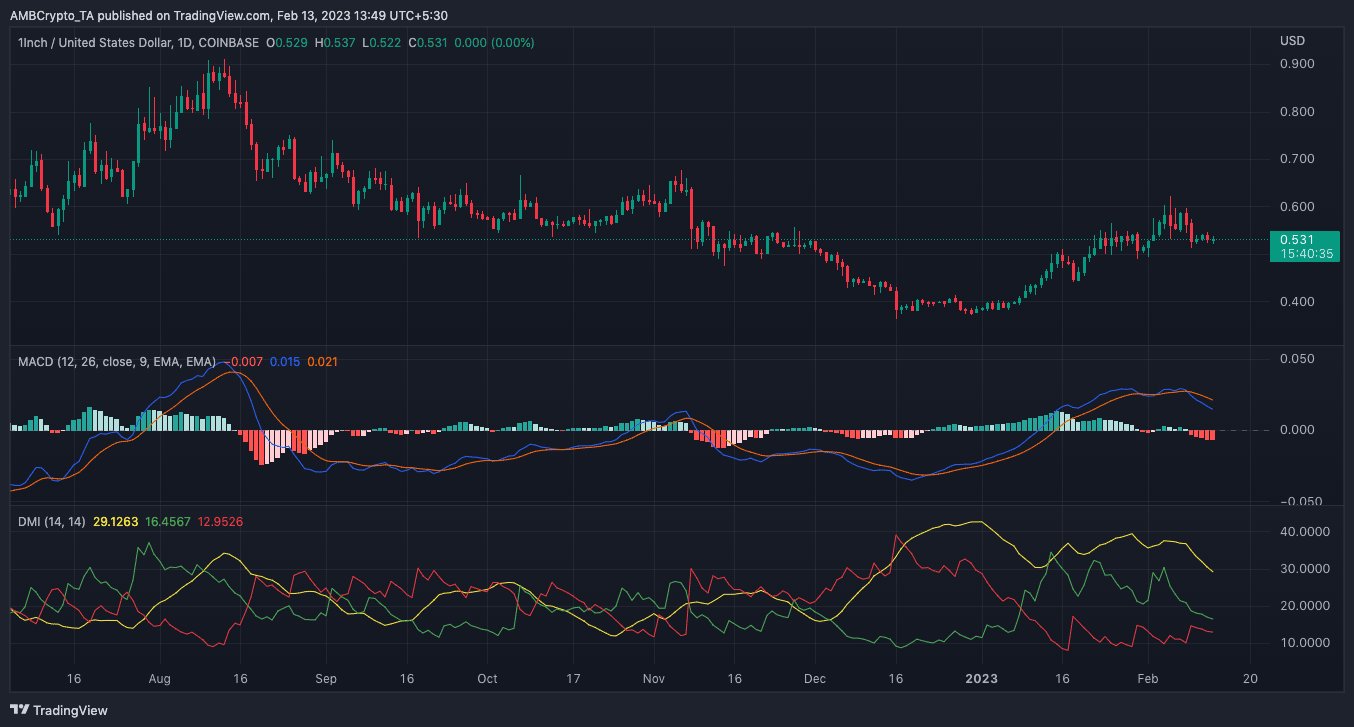

On the daily chart, the Moving Average Convergence Divergence (MACD) shifted momentum in bears’ favor. At the time of writing, the orange dynamic line was rated above the blue line. An explanation of this state points to sellers’ control.

However, both lines trended downwards meaning the selling pressure wasn’t extremely heightened for bulls. But on another note, 1INCH was likely to remain in a similar condition in the short term because the 12 to 26 EMA close remained below the equilibrium MACD point.

On the part of its trajectory, the Directional Movement Index (DMI) pointed to the red area. From the image above, the +DMI (green) was down to 16.45 while the -DMI (red) was positioned lower at 12.95. The Average Directional Index (ADX) also trended downwards with hardly any support for an uptick or downturn.

Miles ahead but still on the line

Despite the possibility of a fall, the 1INCH network recorded a milestone on 10 February with its Ethereum [ETH] swaps. On the said date, the blockchain distributed network announced hitting seven figures as per the activity.

Another 1M in the total number of swaps on the #Ethereum Network!

? After a long break, we continue to share our latest milestones.

Stay tuned ✌️

?️ https://t.co/iWL4B94GdZ#DeFi #crypto #1inch pic.twitter.com/I8Vd5Xcgn7

— 1inch Network (@1inch) February 10, 2023

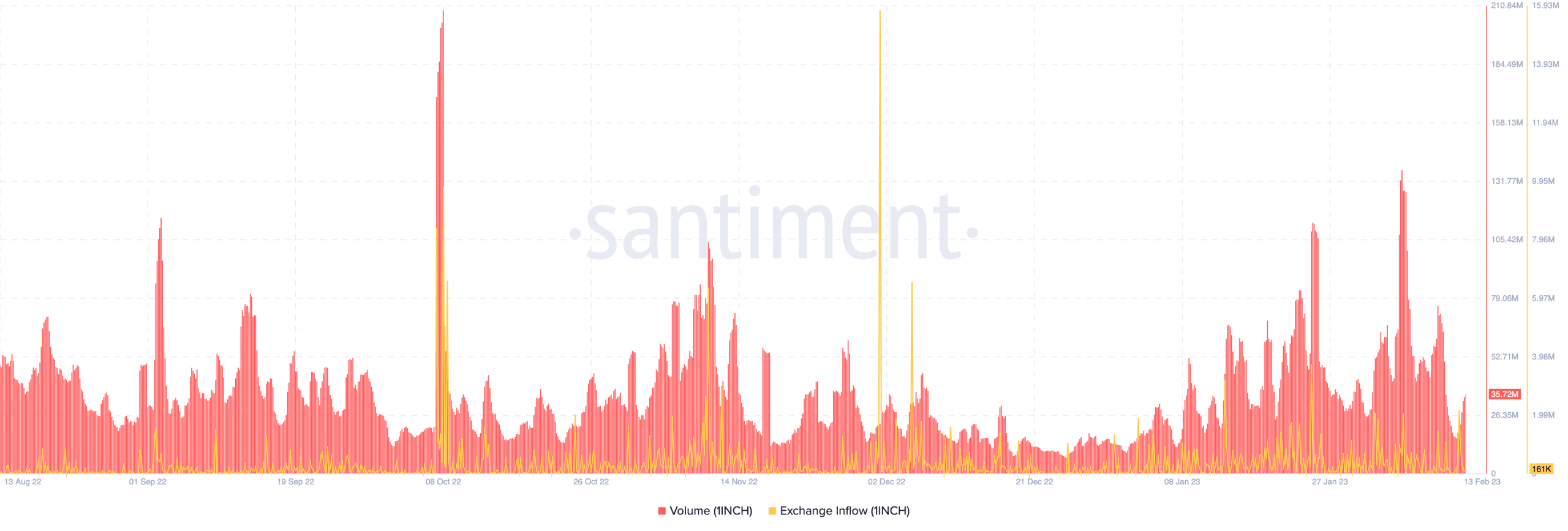

Concerning its volume, Santiment data showed that the metric spiked 123.79% in the last 24 hours. But the increase in transactions on the network does not mean tokens exchanging wallets ended up in profits, especially with the seven-day 1INCH performance.

Is your portfolio green? Check out the 1inch Network Profit Calculator

Besides, the exchange inflow also hit the highest in February the day the whale transferred. The exchange inflow describes the movement of assets into non-exchange wallets to CEXes. However, press time information from the on-chain platform showed that the inflow had reduced to 161,00. Hence, depicting resistance to selling more tokens.