Decoding Lido Finance’s [LDO] hurdles in growth despite continued upgrades

- LDO token holders’ revenue and TVL failed to show noticeable growth.

- Short-term selling wave pulled LDO down by 6% at the time of writing.

Three days after introducing major new features as part of the Lido V2 upgrade, Lido Finance [LDO] announced the mainnet update of its MEV Boost relay list.

Today the first mainnet update of the @LidoFinance MEV Boost relay list went live, which saw the addition of Ultra Sound Relay (@ultrasoundmoney), Agnostic Relay (@GnosisDAO) and Aestus Relay (@AestusRelay) to the relays which had already been vetted for use. More info below ?

— Izzy (@IsdrsP) February 10, 2023

Read Lido Finance’s [LDO] Price Prediction 2023-2024

As per the tweet, the upgrade saw the addition of some more lists, including UltraSound Relay, on top of the lists which were already approved for use.

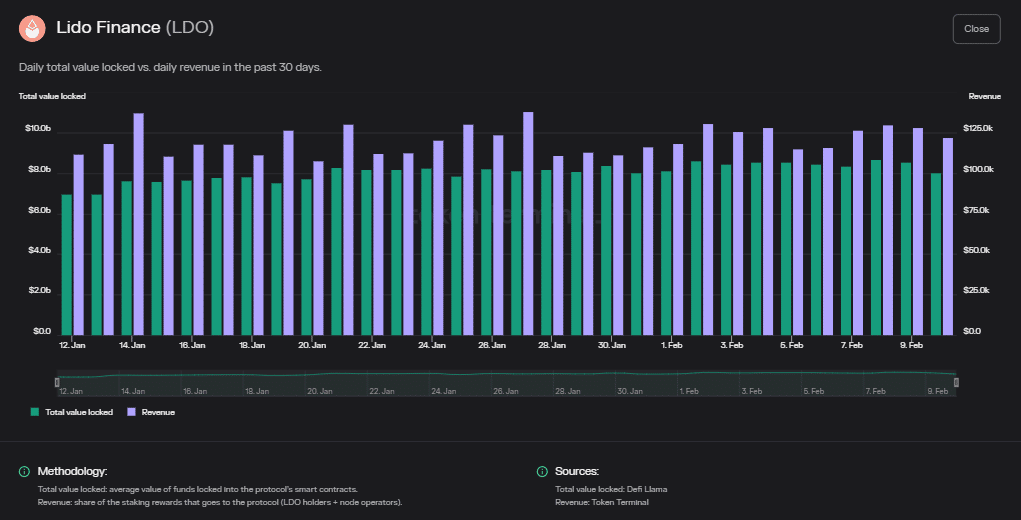

Lido’s revenue and TVL growth was uninspiring

However, despite the upgrades in technology, Lido was confronted with fundamental issues. As per data from Token Terminal. the revenue for LDO token holders didn’t reveal a significant increase. In fact, the metric has dipped over the last two days.

The total value locked (TVL), which is the most important measure of a DeFi protocol’s health, narrated the same story. The TVL of the largest DeFi protocol dropped below $8 billion as of 10 February.

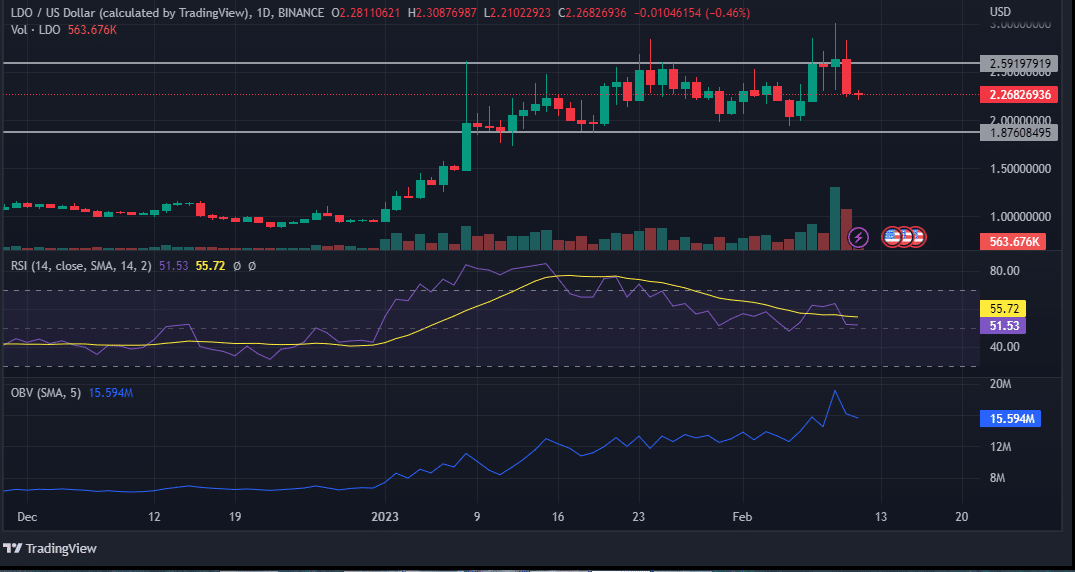

LDO’s price recorded wild swings in the last 24 hours. While it jumped on 9 February on the news of increased scrutiny of staking on centralized exchanges, it retreated by almost 6% at press time. What could be behind this pullback?

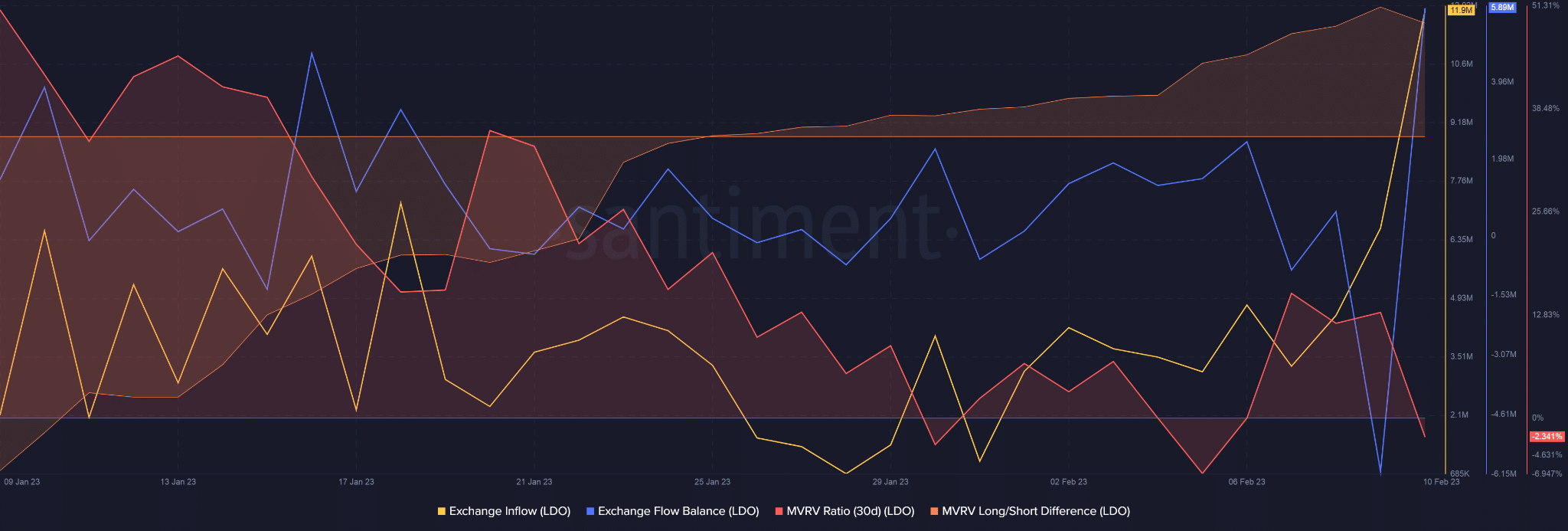

LDO long-term holders are filling their pockets

Data from Santiment showed that LDO’s exchange inflow and by extension the exchange balance increased dramatically on 10 February. This implied that investors started transferring their tokens to sell them off and earn profit.

The MVRV 30-Day Ratio also aligned with this deduction. The positive value pointed towards the profitability of the network and the increasing MVRV Long/Short Difference confirmed that the long-term holders would realize greater profits. Consequently, selling pressure followed the jump in price.

What’s next for LDO?

The price action of LDO signaled a short-term bearish sentiment. The surge and the consequent plunge in price were accompanied by high transaction volume, which was on expected lines.

The Relative Strength Index (RSI) dipped sharply but was still above the neutral 50 mark. The On Balance Volume (OBV) was also on the downward trend, which meant that the selling pressure was strong.

Realistic or not, here’s LDO’s market cap in BTC’s terms

However, it remained to be seen whether the wave of selling will subside or get intense. If LDO drops below the range lows, as indicated, it would give very strong bearish signs.

Having said that, LDO holders should remain optimistic about the token’s prospects, as SEC’s regulatory chokehold on centralized exchanges could be a big macroeconomic trigger for the growth of liquid staking protocols.

![Tron [TRX]](https://ambcrypto.com/wp-content/uploads/2025/08/Tron-TRX-400x240.webp)