Decoding TRON’s [TRX] price performance in spite of bearish conditions

- TRX’s performance on the price front remained better than many over the last week.

- Several developments and metrics might have played a role in TRX’s performance.

On 10 February, TRON [TRX] announced that the total amount of TRX burned had surpassed 15 billion. With this, the circulating supply of TRX had been reduced by 10.3 billion, which was worth $950, further establishing its deflationary nature.

The total amount of #TRX burned has surpassed 15 billion!?

?️The circulating supply of #TRX has been reduced by whopping 10.3 billion, $950 million $USD in worth. #TRX continues to be deflationary for 67 weeks!

?Data source: https://t.co/AnYpjDGVBP pic.twitter.com/AndCbr03Yh

— TRON DAO (@trondao) February 10, 2023

Interestingly, while cryptos struggled, registering massive price declines, TRON somehow minimized the damage. According to CoinMarketCap, TRX’s price declined only by 0.18% in the last seven days, and at the time of writing, it was trading at $0.06336 with a market capitalization of more than $5.8 billion.

Is your portfolio green? Check the TRON Profit Calculator

This is the scenario

TRON also posted its weekly report, highlighting the ecosystem’s major developments over the last seven days. The most notable one was the announcement of TRON’s plan to provide ChatGPT with a decentralized payment framework. The framework included the payment layer protocol, the underlying calling SDK, the chain’s smart contract system, and the AI payment gateway.

?Check out #TRON Highlights from this week (Feb 04, 2023 – Feb 10, 2023).

?We'll update you on the main news about #TRON and #TRON #Ecosystem. So stay tuned, #TRONICS! pic.twitter.com/zKli6tNSov

— TRON DAO (@trondao) February 11, 2023

Not only that, but Fireblocks, a digital asset and crypto infrastructure platform, announced that it has expanded non-EVM DeFi access with TRON. After this, users will be able to securely connect to TRON dApps through WalletConnect, starting with JustLend DAO and JustStables.

Another major development was recently revealed by Justin Sun. TRON launched a new $100 million AI development fund to facilitate the integration of AI and blockchain technologies. The blockchain has identified four areas of focus, including an AI service payment platform, AI infused oracles, and others.

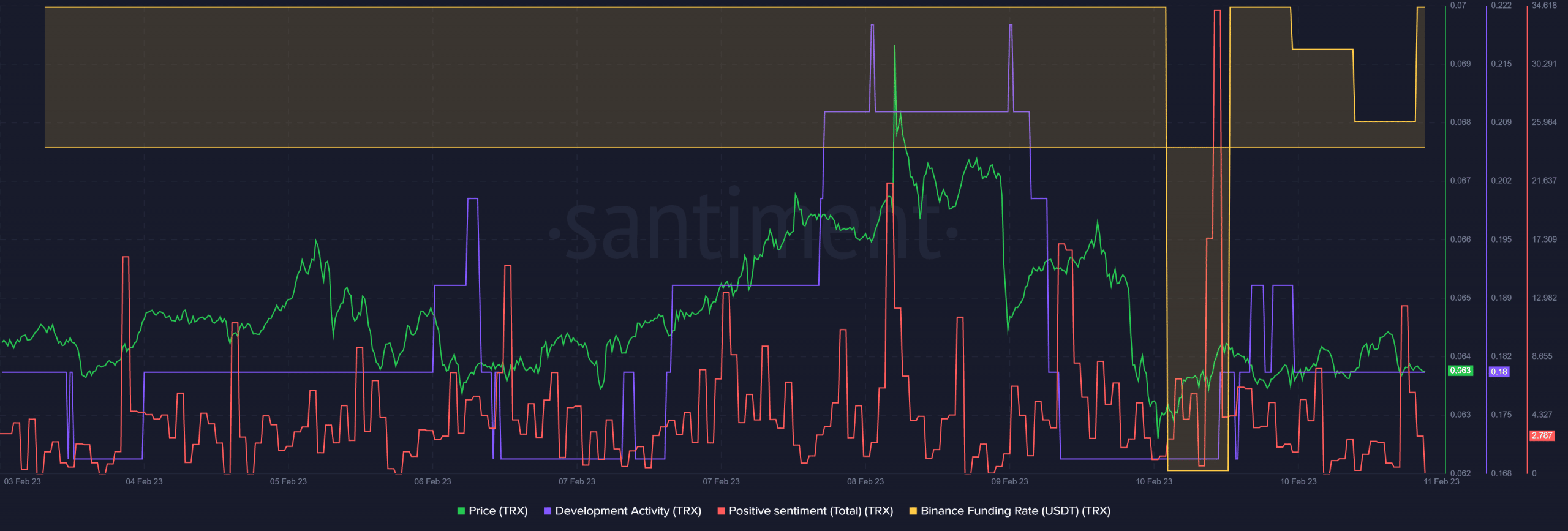

Santiment’s chart also pointed out quite a few metrics that were working in TRX’s favor, which might have helped TRX restrict a price decline. For instance, positive sentiments around TRX spiked in the last few days. Moreover, after a sharp drop, demand from the derivatives market increased again as TRX’s Binance funding rate went up. However, TRX’s development activity declined over the last few days, which was a negative signal.

Realistic or not, here’s TRX market cap in BTC’s terms

What to expect?

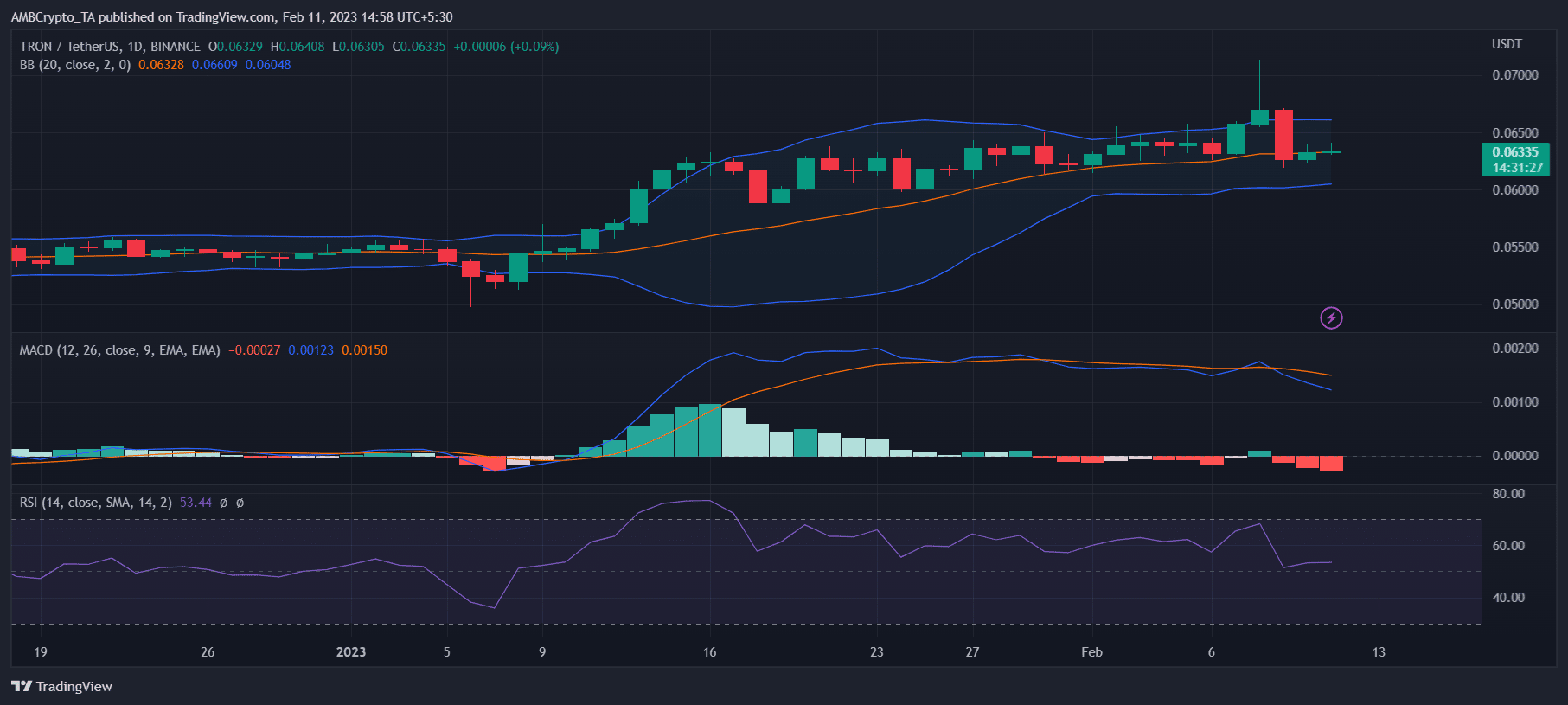

TRX’s daily chart remained neutral, as a few market indicators supported the bulls while the others suggested otherwise. The Bollinger Bands pointed out that TRX’s price was in a squeezed zone, which decreased the chances of a sudden breakout in either direction.

Moreover, the Relative Strength Index (RSI) followed a sideways path, indicating that the market could head in any direction. However, the MACD displayed a bearish crossover, which increased the chances of a downtrend in the coming days.